Supporting a specific fund structure is a start, but it’s not enough. As your firm grows, your investment management platform should power your next deal, next structure, and next strategy. The firms that scale don’t settle for limitations. They choose flexibility.

To help you make the best decision for your firm, this page compares InvestNext against Avestor based on publicly available information.

Modern infrastructure for modern firms

Go beyond single-strategy platforms. Support deal-by-deal syndications with multiple equity classes, customizable, open-ended, closed-end, and debt funds with a single plan. InvestNext adapts to your strategy, not the other way around.

Automate complex distributions with ease

Whether your deal includes equity splits, preferred returns, or hybrid structures, InvestNext lets you model and automate distributions with just a few clicks.

Faster onboarding, real support

Get up and running 2x faster with hands-on onboarding and a dedicated migration team. No matter your firm size, you’ll have dedicated support at every step.

Flexible

Whether you’re running traditional syndications, blended fund models, or hybrid capital stacks, InvestNext handles it all without forcing you into one structure.

Secure

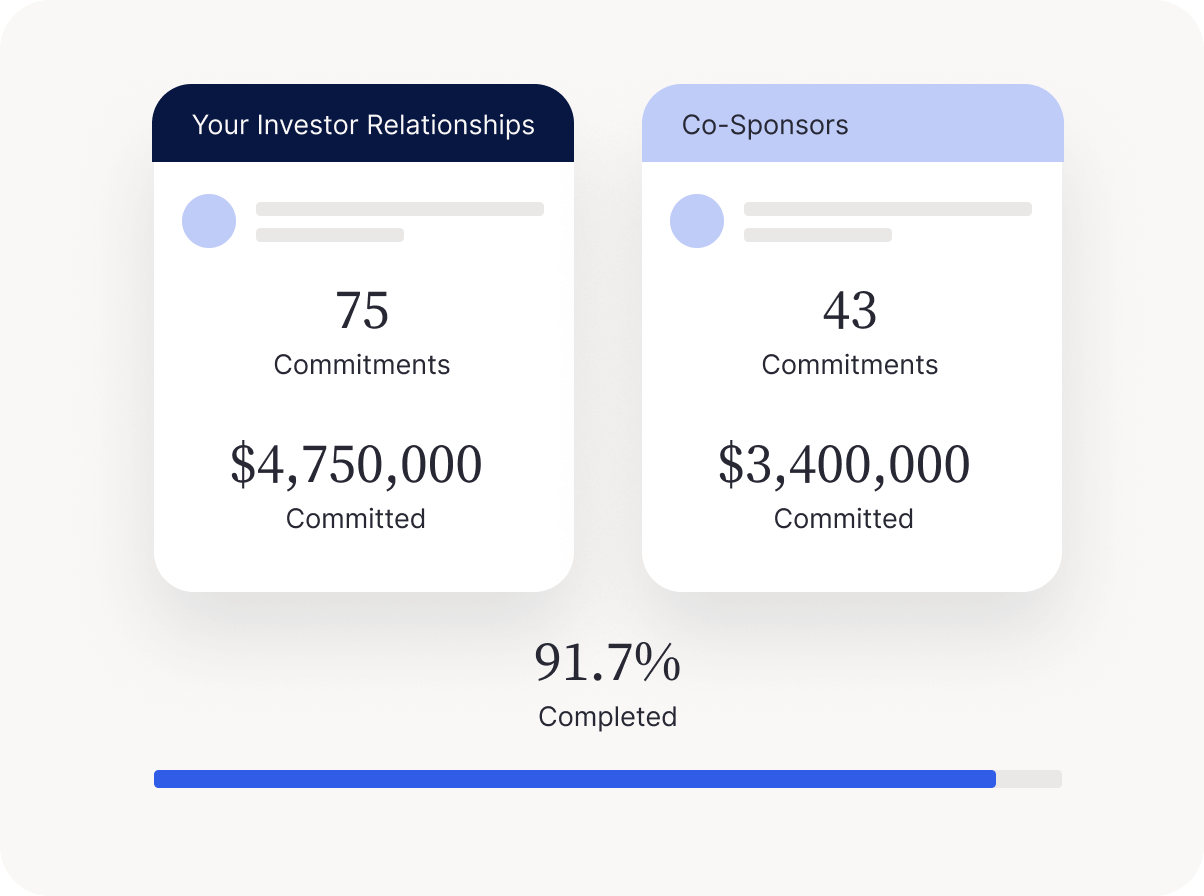

Co-sponsor deals with confidence. Maintain full control over your investor base while offering a shared investment experience across partners.

Streamlined

Integrated ACH, seamless subscription flows, automated document collection: everything investors need to commit in minutes, not days.

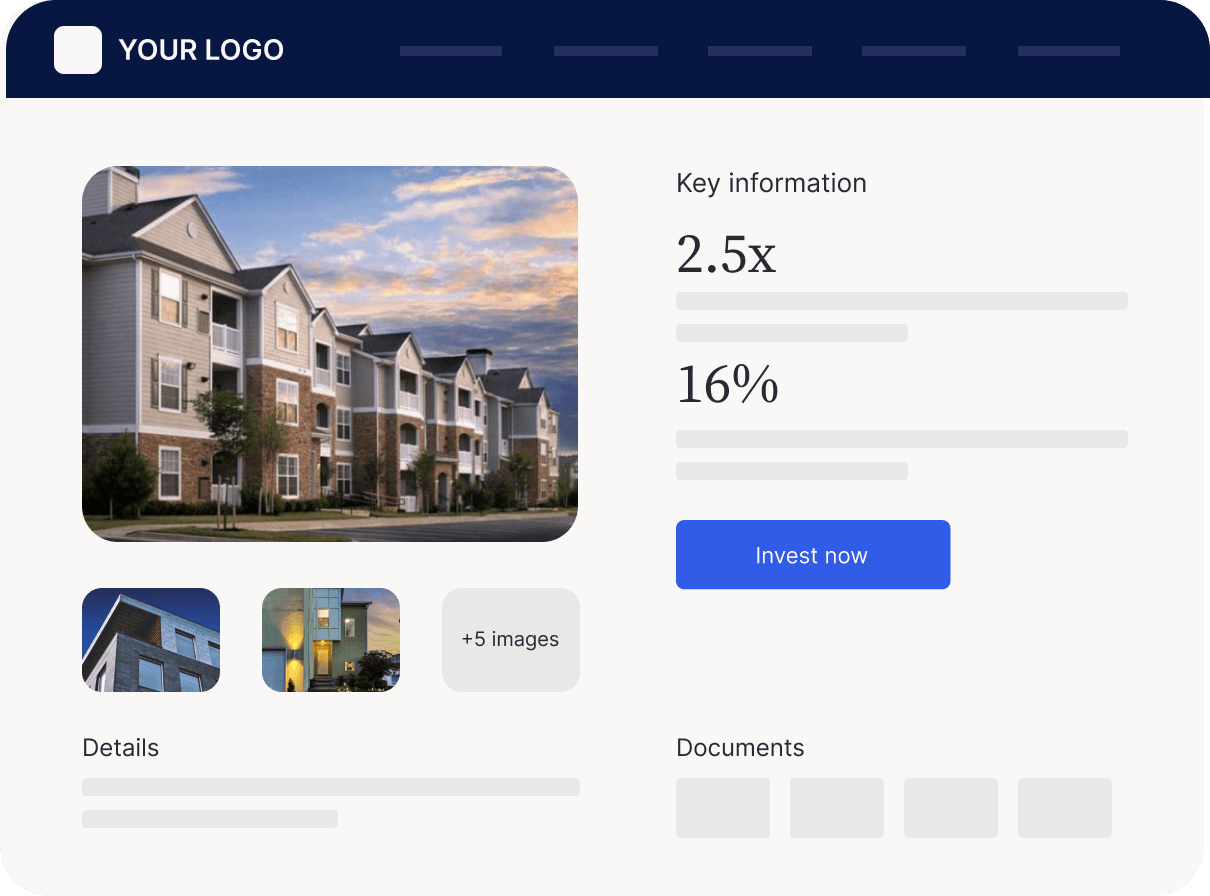

Raise Capital Without Limits

Raise Capital Together

Raise Capital Faster

Support multiple equity classes, debt tranches, and promissory notes in a single offering.

Transparent pricing starting at $499/Mo

Complex Distributions

InvestNext

- Build distribution waterfalls for any deal or fund. Automate calculations and send ACH payments with a few clicks.

AVESTOR*

- Distribution models are tied to fund templates with less flexibility for creative structures.

Equity Classes & Debt Funds

InvestNext

- Support multiple equity classes, debt tranches, and promissory notes in a single offering.

AVESTOR*

- Limited support for complex capital stacks or multiple equity classes.

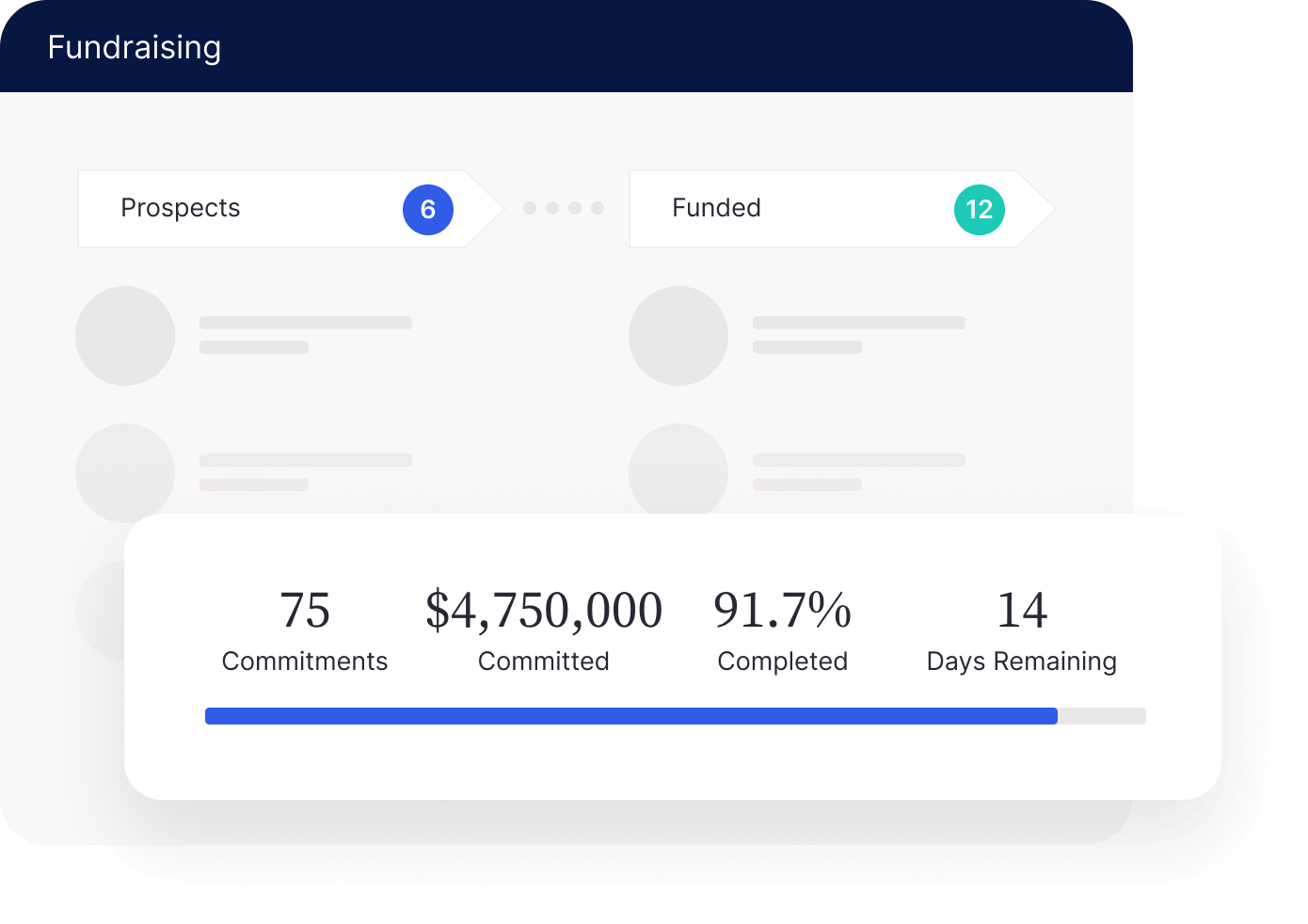

Capital Raising

InvestNext

- Raise for syndications or funds. Offer multiple classes in one deal room. Investors can commit and fund directly with integrated ACH.

AVESTOR*

- Designed around rolling funds. One equity class per offering; ACH limits of $100K per transaction.

Inbound & Outbound Payments

InvestNext

- ACH payments in and out up to $1M in a single transaction. Investors link their bank account once and fund instantly.

AVESTOR*

- ACH limits of $100K per transaction.

Onboarding & Support

InvestNext

- Go live in under two weeks with dedicated onboarding and 7-day data migration. Responsive support for firms of all sizes.

AVESTOR*

- Onboarding process varies by fund setup. Support limited by team size and scope.

Capital Calls

InvestNext

- Built-in capital call tools for both upfront and progressive funding strategies.

AVESTOR*

- Requires working with Avestor’s fund admin team to execute capital calls, often at additional cost.

Co-Sponsors

InvestNext

- Raise alongside co-sponsors without compromising investor privacy. White-labeled portals and segmented contact control included.

AVESTOR*

- Co-sponsors must be added as admins, giving them full visibility into your investor data.

User Satisfaction

Price

InvestNext

- Transparent pricing starting at $499/Mo

AVESTOR*

- Complex pricing starts at $700/month, with added costs for admin services and fund complexity. Limit of 5 syndications.

Mike Williams

Open Door Capital

“The introduction of InvestNext reshaped our approach. It came at a critical juncture, providing the scalability we needed to surpass our expectations of $50 million in Capital Under Management, reaching $400 million in Capital Under Management within just four years."

Victor Pasaran

Pasago Investment Management

“InvestNext wasn’t just a tool for me. It was a game-changer in how I managed my portfolio, allowing me to see the bigger picture, analyze data, and diversify investments across various markets, thanks to its versatility."

Vincent Celeste

DeRosa Group

“The decision to integrate InvestNext was a game-changer. The platform’s features, especially the automated payments and visually appealing investor dashboard, have been instrumental in streamlining our operations.”

Raise Capital Faster

With industry-leading functionality. Deliver an elevated investor experience with modern deal rooms, frictionless capital raising, direct inbound funding, co-sponsor support, and capital calls.

Industry Leading Onboarding & Support

InvestNext customers go-live 2x faster and get access to quality support, regardless of size.

Distribution Automation

Create complex distribution waterfalls for any operating agreement, automatically calculate distributions and send secure payments to your investors with a few clicks.