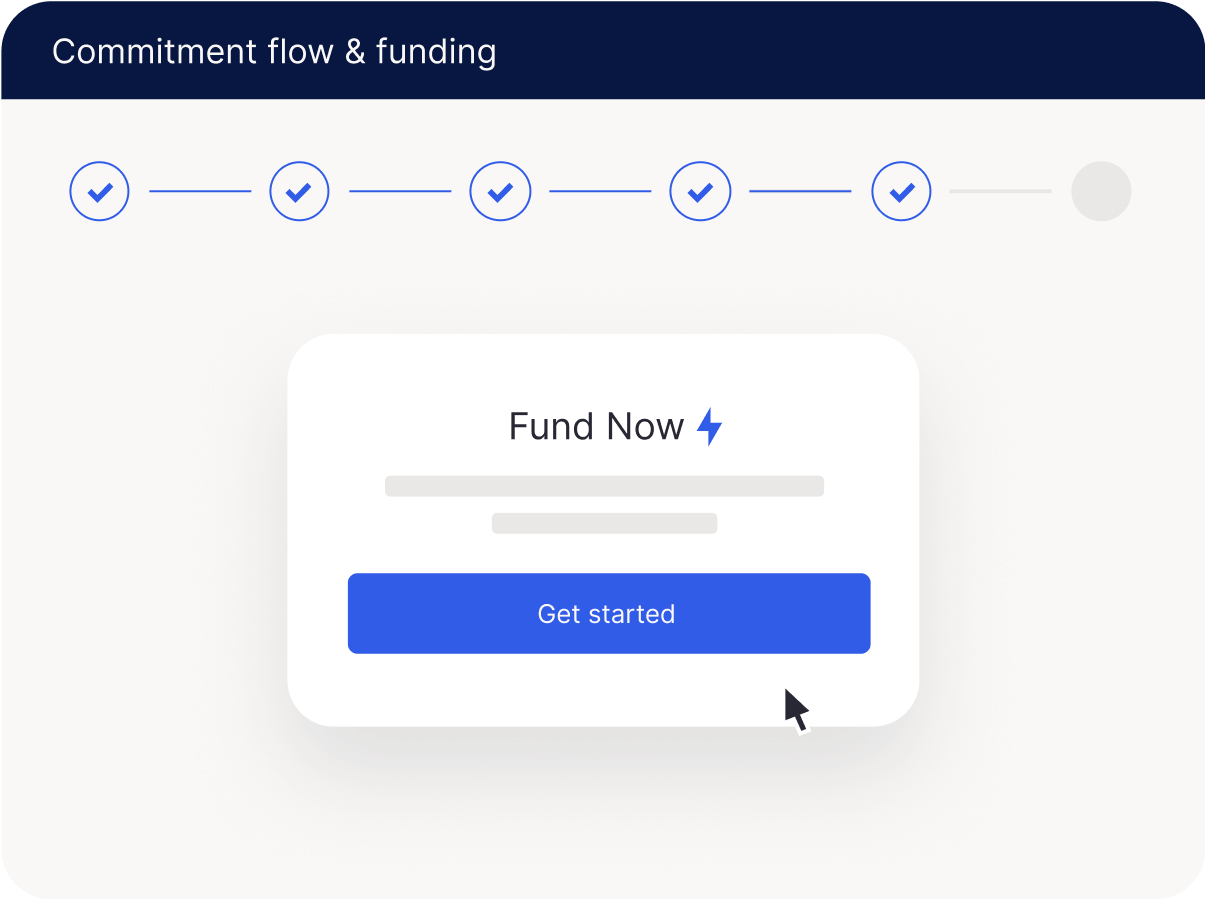

Investor Onboarding

1 of every 4 of abandoned digital purchases are attributed to cumbersome account creation processes. Don’t miss out on securing investments because of complicated investor onboarding.

If your platform requires you to send investors outside of your portal to complete onboarding requirements…

You could be creating friction and frustration for investors – and losing out on investments.

With InvestNext, you’ll offer a straightforward onboarding and subscription process that keeps LPs coming back to invest with you again and again.

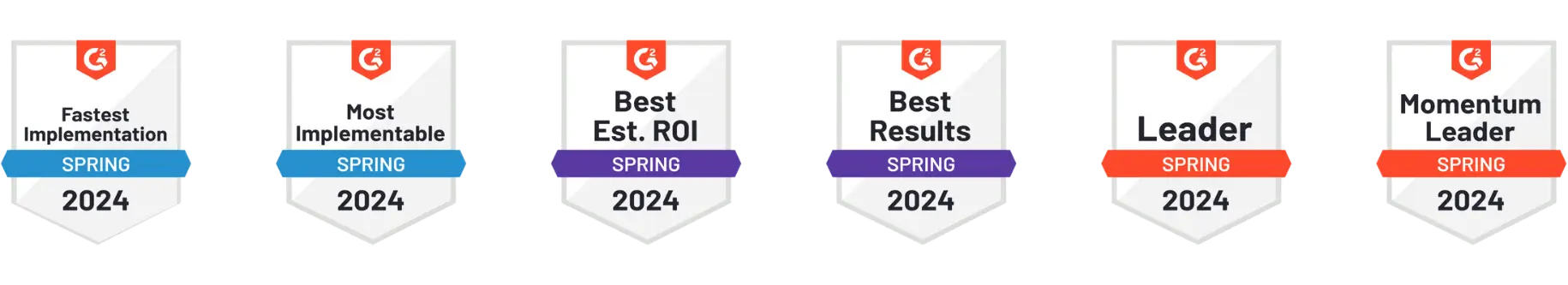

Smart E-Signatures

Tired of catching missed signatures at the last minute? With smart E-signatures, you’ll ensure accuracy across all of your required documents, allowing investors to progress through their commitment only once all required signatures have been completed.

Flexible Accreditation

Are you spending time manually tracking investor accreditation status?

Verify accreditation status and empower investors to get accreditation letters – seamlessly integrated into your investor portal and commitment flow. Maintain compliance for 506(c) offerings while delivering an investor-friendly, effortless workflow. Investors can:

- Obtain new accreditation letters within 12 hours directly in their investor portal via Accredd

- Upload their existing accreditation letters directly in their investor portal

- Attest to their accreditation status in the commitment flow if they already have an investing relationship with you

Integrated KYC/AML Verification

Is your current KYC process highly manual – costing you time and resources?

InvestNext’s KYC/AML ensures rapid and secure investor onboarding. Protect your firm, expand your investor network, and stay compliant with SEC regulations through fully integrated KYC/AML verification.

- Investors can complete a secure, compliant KYC check directly in the commitment flow in < 1 minute

- Over 90% of investors are approved on their first attempt

- 14,000+ global ID types are accepted

Secure ACH Funding

Are you lacking visibility and connectivity in your inbound funding solution? With InvestNext, investors can link their bank accounts within minutes and fund directly from the commitment flow via secure ACH, up to $1M per single transaction.

With InvestNext’s financial institution grade security, you’ll leverage the highest grade encryption and authentication standards to keep payments secure and investors’ data safe.

Scalable Plans.

Simple Pricing.

For Syndicators, General Partners, and Investor Relations.

Plans suitable for any investment size, from initial deals to billion-dollar funds.

Vincent Celeste | DeRosa Group

- What our clients say