Real Estate waterfalls are a sophisticated and structured approach to distributing cash flow and profits among investors and sponsors in a real estate project. Just as water in a waterfall flows from one level to the next, in a real estate waterfall, cash available for distribution moves through a predefined series of calculations and priorities, ensuring each investor receives their share of profits in a hierarchical fashion.

Outlined in the operating agreement, waterfalls determine how cash flow distributions are made among different investors and sponsors involved in a project. It is designed to ensure that those who are entitled to a preferred return, such as certain investors, are repaid first, before any other distributions are made. This system not only motivates the deal sponsor by setting benchmarks that need to be met before they can earn their share but also aligns the interests of all parties involved over the duration of the project.

Key Components of Real Estate Waterfalls

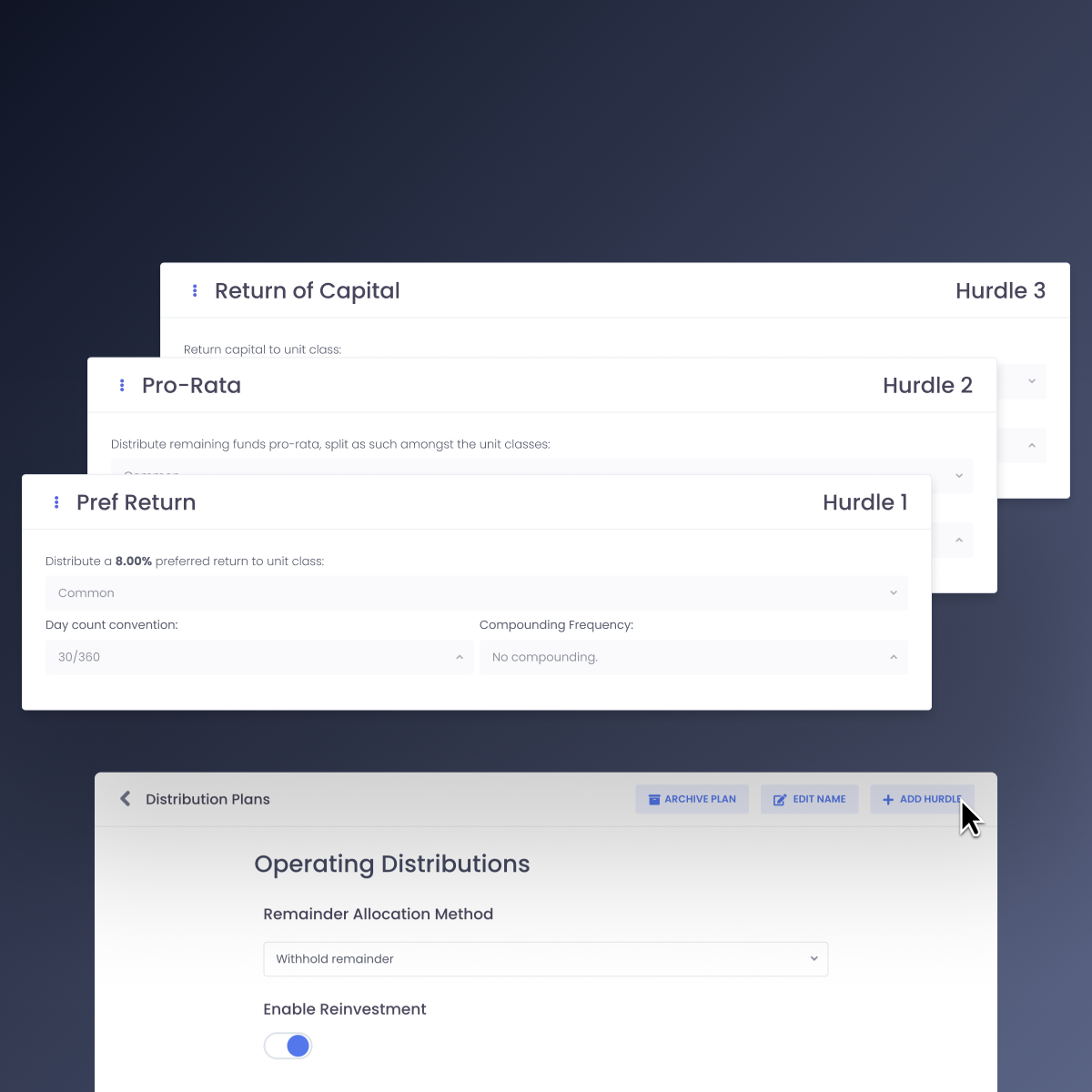

The structure of a real estate waterfall is underpinned by its detailed, tiered distribution system, where the flow of profits is meticulously governed by a series of hurdles which are defined in the partnership operating agreement. The operating agreement defines the allocation of revenue and profits among investors and sponsors to ensure an equitable and performance-based distribution. Common components of real estate waterfalls include:

Return of Capital (ROC)

A financial concept wherein an investor receives back a portion or all of their original investment. It represents the repayment of the initial funds invested, typically occurring through distributions, dividends, or other forms of disbursement from the investment. Unlike investment gains or returns, which result from the appreciation or profit generated by the investment, return of capital doesn’t necessarily reflect investment performance or profitability. Instead, it represents a partial or full recovery of the initial investment amount. ROC can occur in various investment vehicles, including stocks, bonds, mutual funds, real estate investment trusts (REITs) and real estate syndications. It’s crucial for investors to differentiate between return of capital and investment gains (return on capital) to accurately assess the performance and overall financial impact of their investments.

Preferred Return (pref)

The Preferred Return is akin to a minimum threshold return that limited partners are entitled to receive before the general partners (or sponsors) can participate in the distribution of profits. It is typically expressed as an annual percentage return on the invested capital. The preferred return prioritizes the investors’ returns, ensuring they receive a predefined yield on their investment before any catch-up or carried interest is allocated to the sponsors. This component underscores the investors’ preference in the distribution hierarchy, safeguarding their interests.

Internal Rate of Return (IRR)

The IRR is a critical financial metric used to evaluate the profitability of an investment. It represents the annualized rate of return that makes the net present value (NPV) of all cash flows (both positive and negative) from a particular investment equal to zero. In the context of real estate waterfalls, IRR hurdles are used to adjust the distribution of profits among the parties involved. Once the project achieves certain IRR thresholds, the split of subsequent profits may change, often providing a greater share to the sponsor as a reward for surpassing these performance milestones.

Pro-Rata

After the return of capital, distributions may occur on a pro-rata basis, where investors receive profits in proportion to their initial investment. This stage represents a more equitable sharing of profits, aligning with the amount each investor has contributed to the project.

Cash-on-Cash Return

This hurdle measures the cash income earned on the cash invested, providing investors with a clear picture of the yield from their invested capital. It’s a critical metric for assessing the ongoing performance of the investment.

Cumulative Return

Cumulative return hurdles account for the total return on investment over a period, including all cash flows and capital gains, relative to the initial investment. This comprehensive view ensures that investors see the full scope of their investment’s performance.

Total Return

Similar to cumulative return, the total return hurdle encompasses all the earnings from the investment, including both the income and the capital gains, providing a holistic assessment of the investment’s profitability.

Management Fee

This component accounts for the fees paid to the management team or the general partner for operating the investment. It’s crucial to factor in these costs before distributing profits to ensure that the operational expenses are adequately covered.

Catch-up

The catch-up mechanism is designed to rebalance the profit distribution between the general partner and the limited partners. After the limited partners have received their preferred returns, the catch-up allows the general partner to receive a larger share of subsequent profits until a specified balance is achieved.

By navigating these hurdles, real estate waterfalls orchestrate the distribution of profits, ensuring that each investor’s return reflects both their financial contribution and the investment’s performance. This structured approach not only aligns interests but also incentivizes all parties to strive for the success of the project.

The Purpose and Benefits of Waterfall Structures

Waterfall structures serve a dual purpose: they ensure that equity investors can appropriately reward the operating partner for surpassing return expectations through an extra share of returns, known as the promote, and they maintain a balance in profit sharing that adjusts with the performance of the project. This flexibility in the distribution of profits ensures that the operating partner is motivated to achieve and exceed expected returns, benefiting all parties involved.

Explore common waterfall structures in real estate.

Common Misconceptions and Complexities

Despite their widespread use, equity waterfall models in commercial real estate projects are among the most complex concepts in real estate finance. This complexity stems from the countless ways cash flow can be split among participants. However, by understanding waterfall components, structures and benefits, investors can better navigate the intricacies of real estate investments and their expected return.

Because of their complexity, it is critical for sponsors to provide waterfall transparency to investors in their deal rooms or offerings pages and in their operating agreements to align investor expectations with sponsor obligations. Over-complex operating agreements can result in misaligned expectations and a loss of investor satisfaction and trust.

Legal and Operational Framework

The operational and legal framework of a waterfall structure is critical for its execution and enforcement. The terms of the waterfall, including the distribution schedule, clawback provisions, and promote interests, must be clearly outlined in the operating agreement and other legal documents. This transparency ensures that all parties involved have a clear understanding of the distribution mechanism, fostering trust and alignment among investors and sponsors.

Conclusion: The Significance of Waterfalls in Real Estate Syndication

For Investors

Understanding the concept of waterfalls in real estate is pivotal for both new and seasoned investors. These structures not only dictate the flow of profits and losses in a project but also ensure that the interests of all parties are aligned towards the common goal of achieving and exceeding the project’s financial targets. By grasping the essence of real estate waterfalls, investors can make informed decisions, contributing to the success and sustainability of real estate syndications.

For Sponsors

Setting realistic hurdle rates is critical to motivate both sponsors and your investors. Emphasizing transparency and providing attainable returns to your investors are fundamental steps to prevent misaligned expectations and to generate investor satisfaction. Simplicity should be a guiding principle—complex waterfall structures, although potentially attractive for securing larger investments through varied investment classes and enticing splits, can be difficult to navigate for both sponsors and investors. Approach the creation of your first waterfall as though it were your tenth, avoiding the temptation to offer excessively high preferred returns or splits. These structures will create expectations to deliver the same level of returns on future projects. Remember, the diligence you’ve invested in acquiring and managing the asset warrants a fair share of the returns.

For those facing the challenge of intricate distribution plans, InvestNext simplifies the process. InvestNext provides a user-friendly, accurate, and efficient system for building complex distribution plans, automating calculations and streamlining payments. If you have an active portfolio of projects and investors, consider scheduling a demo with InvestNext to explore how we can streamline your distribution process.