Raising Capital

Go from awareness to funded in minutes with engaging deal rooms, frictionless commitment flows, and secure inbound funding. Create seamless experiences that build lifetime investor relationships.

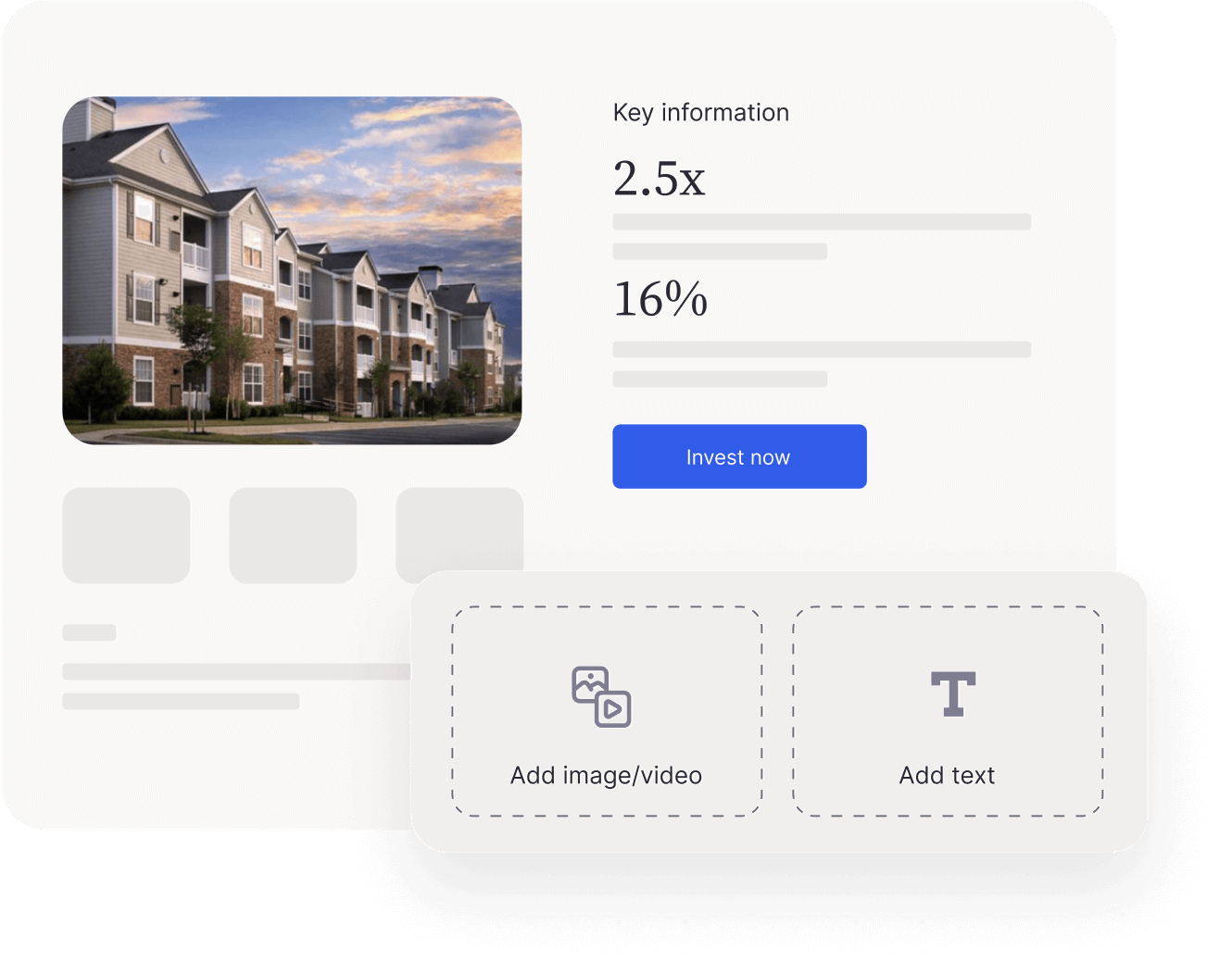

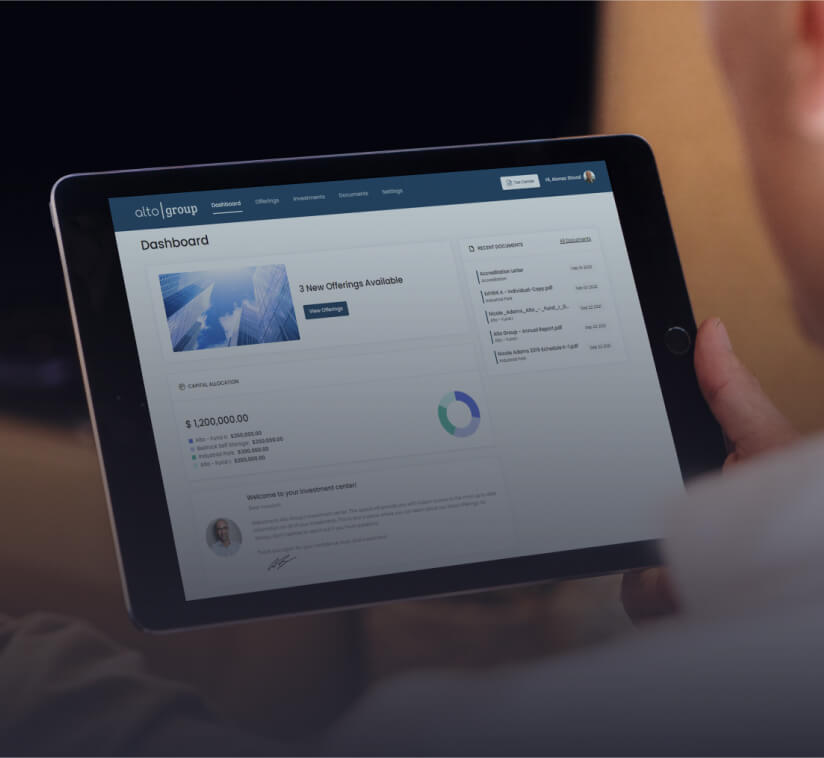

Showcase offerings to new and existing investors with engaging deal rooms in a white label investor portal.

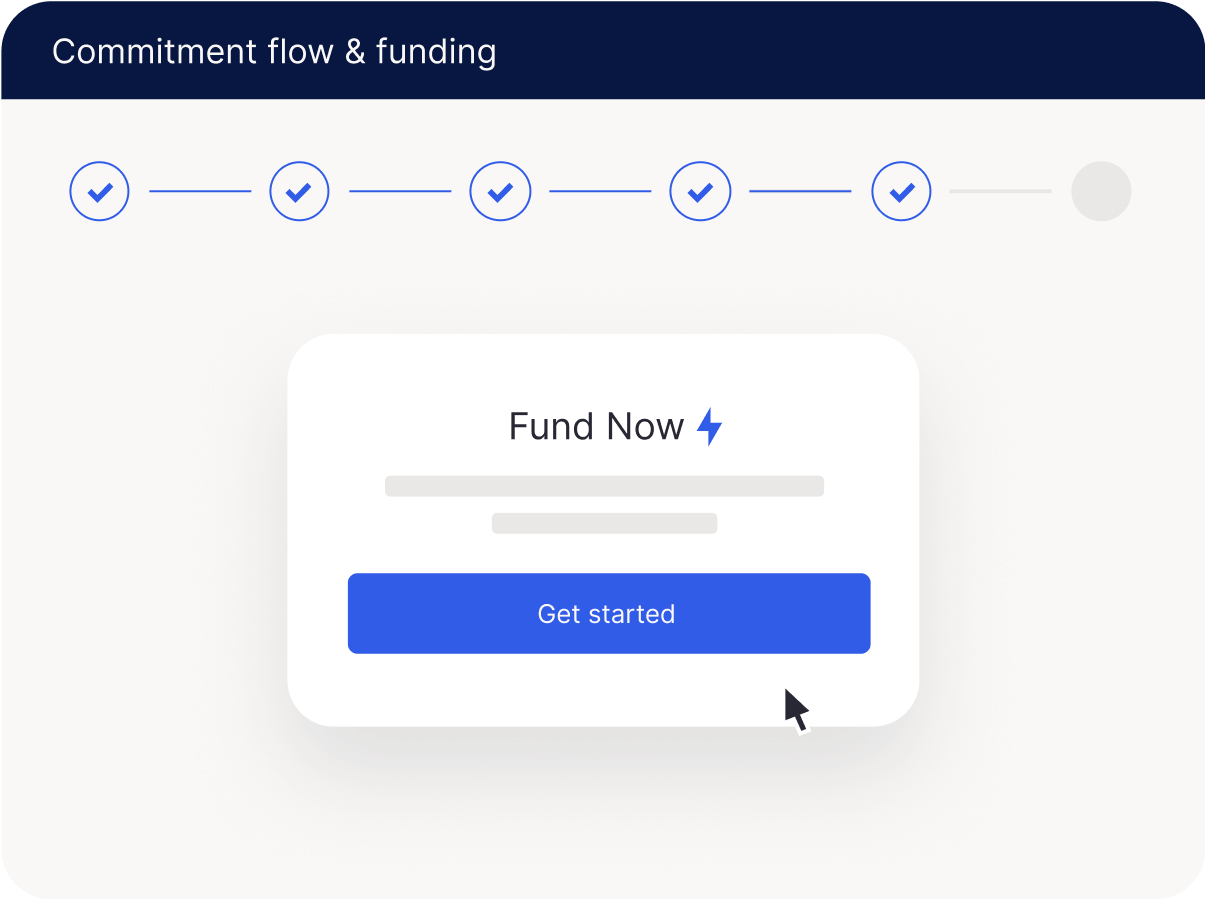

Offer frictionless commitment flows and empower investors to securely fund investments in minutes - not days.

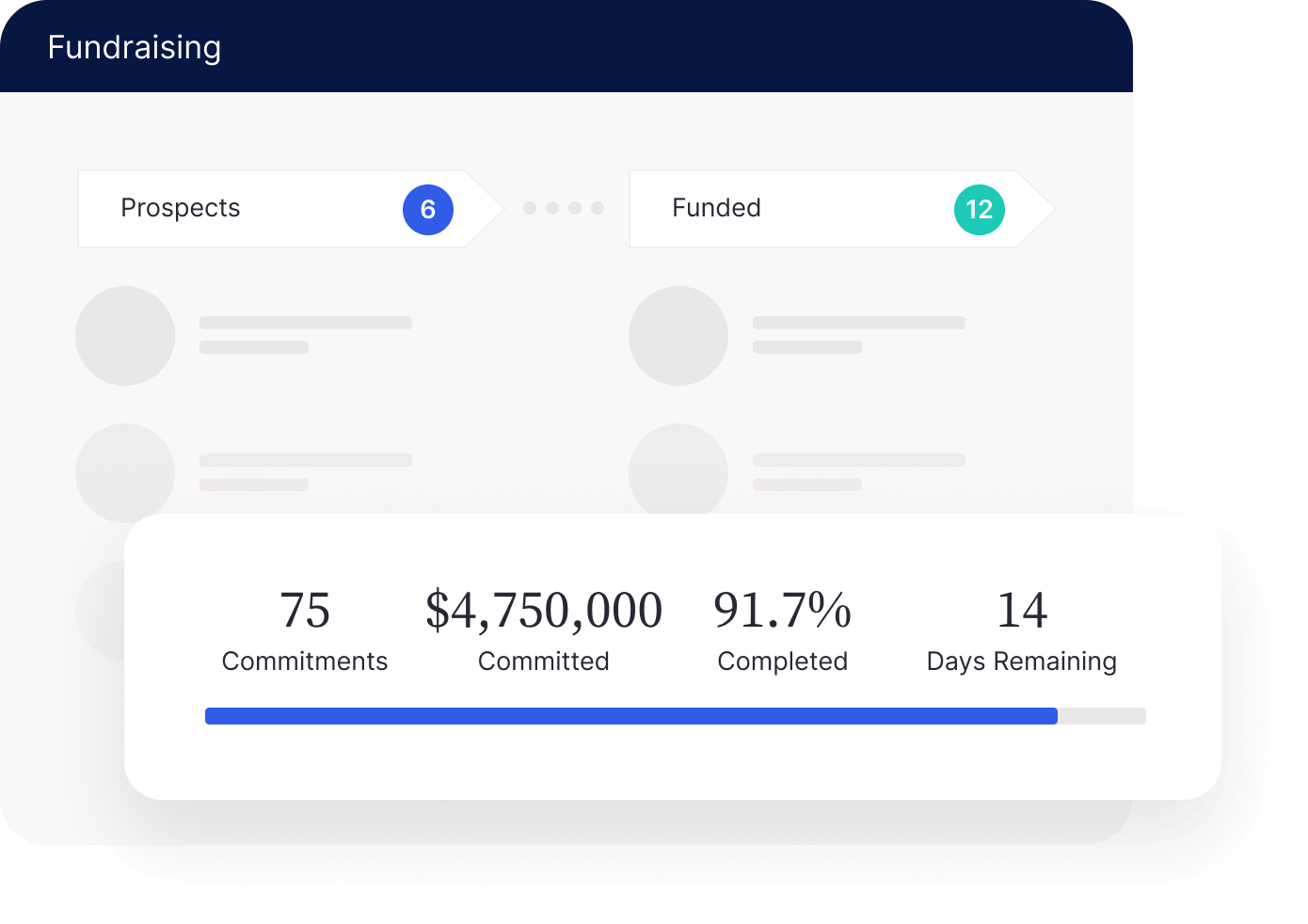

Access one end-to-end CRM solution and back-office to save time on administrative tasks and focus on your next opportunity.

Caley Acevez, Director of Investor Relations | Cedar Creek Capital

Promote Offerings

Promote upcoming and active deals to new and existing investors with customizable and user friendly deal rooms. Fund directly from frictionless commitment flows with secure ACH inbound funding and capture soft commitments to build pipeline for upcoming deals. Support multiple equity classes and debt in the same project, enabling investors to choose the investment structure that best meets their needs.

Capture Commitments

Go from awareness to funding in minutes. Offer seamlessly integrated disclaimer and document e-signatures, automated accreditation verification, KYC compliance, and direct inbound funding in one commitment flow. Investors can connect bank accounts and send secure ACH transfers, wires, or check payments.

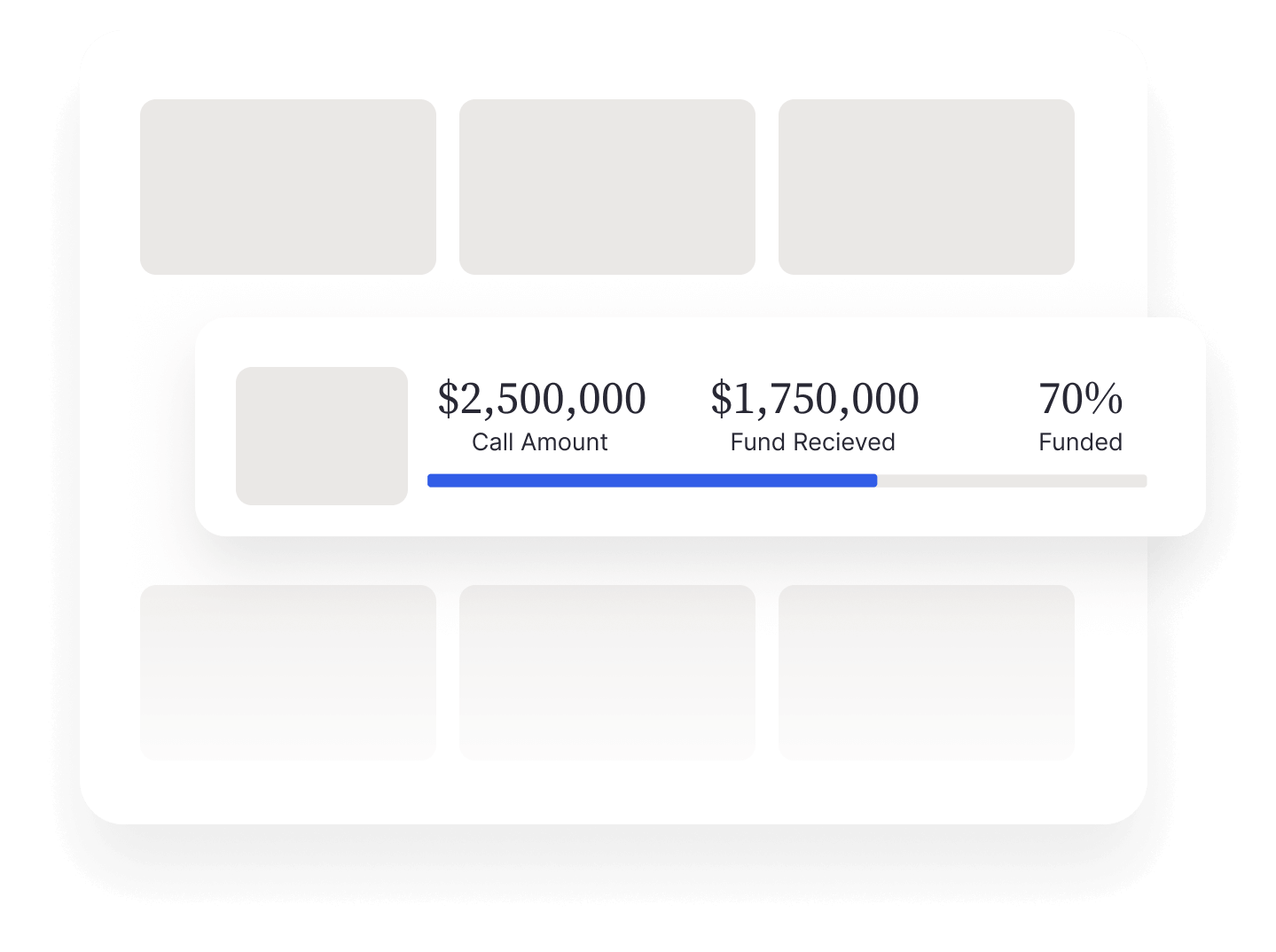

Raise capital on your timeline. Automatically calculate call amounts with precision, notify your investors, and send follow up reminders with just a few clicks.

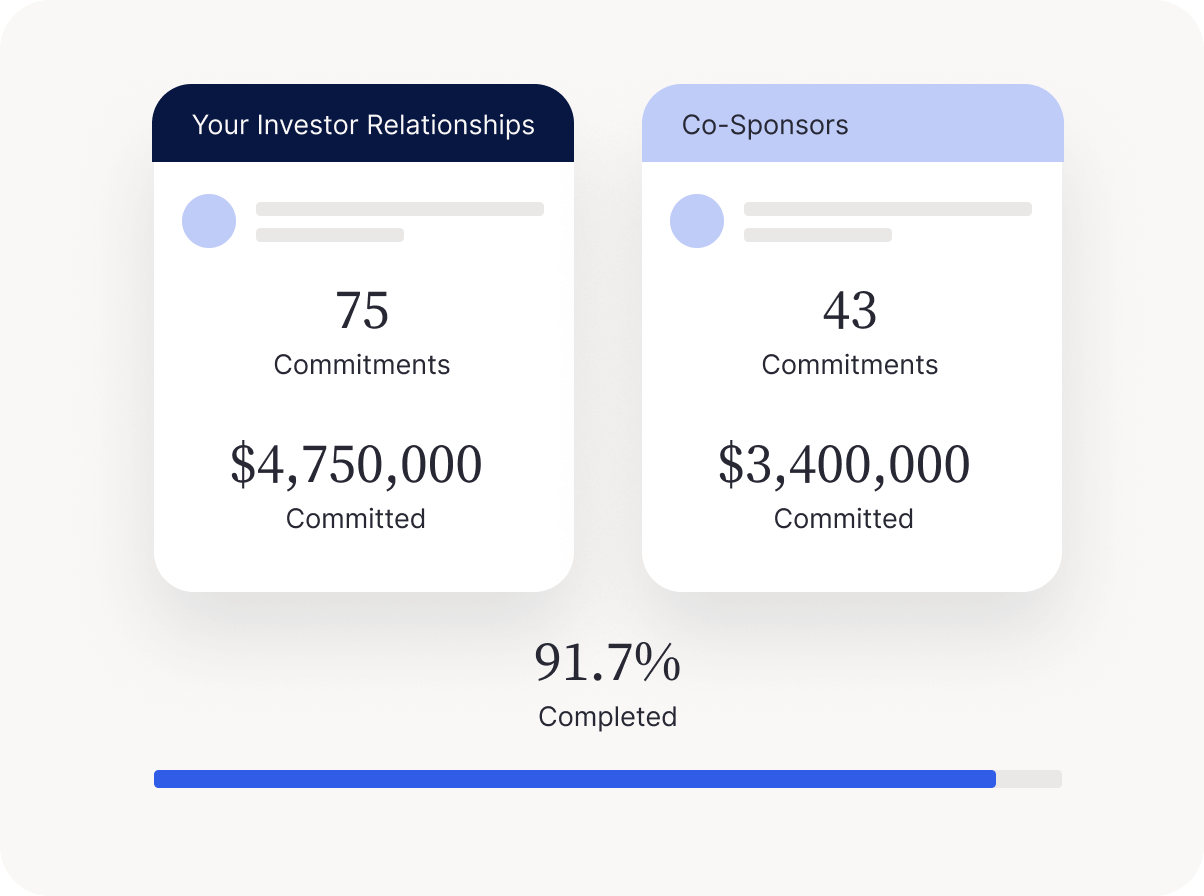

Retain control of your investor relationships when you work with co-sponsors. Collaborate with co-sponsors to raise capital and deliver the same modern investor experience, all without sacrificing your data integrity.

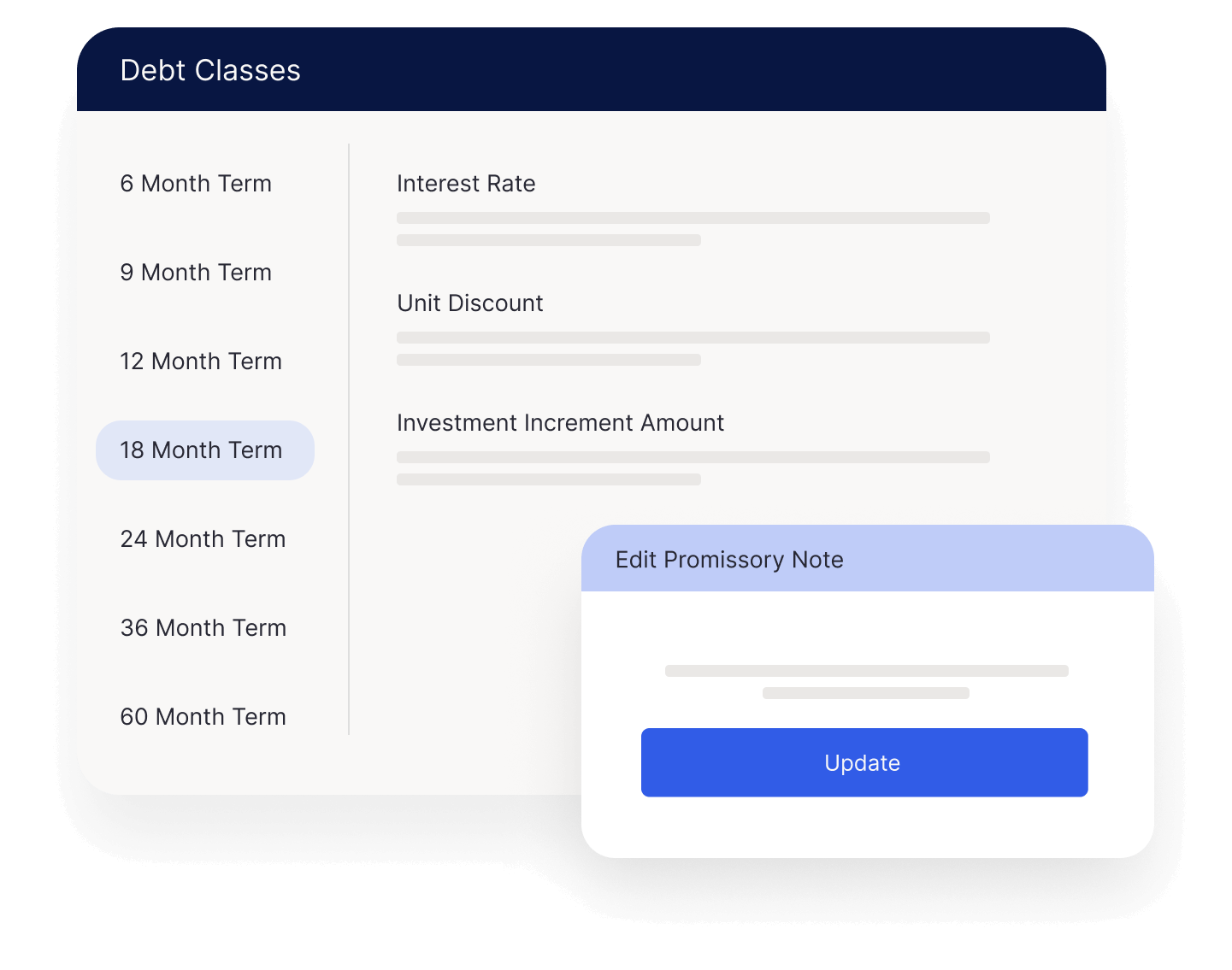

Your investment management tool shouldn’t limit your fundraising options. Raise your way with flexible debt funds. Create promissory note offerings with multiple terms, maturity dates, interest rates, and more.

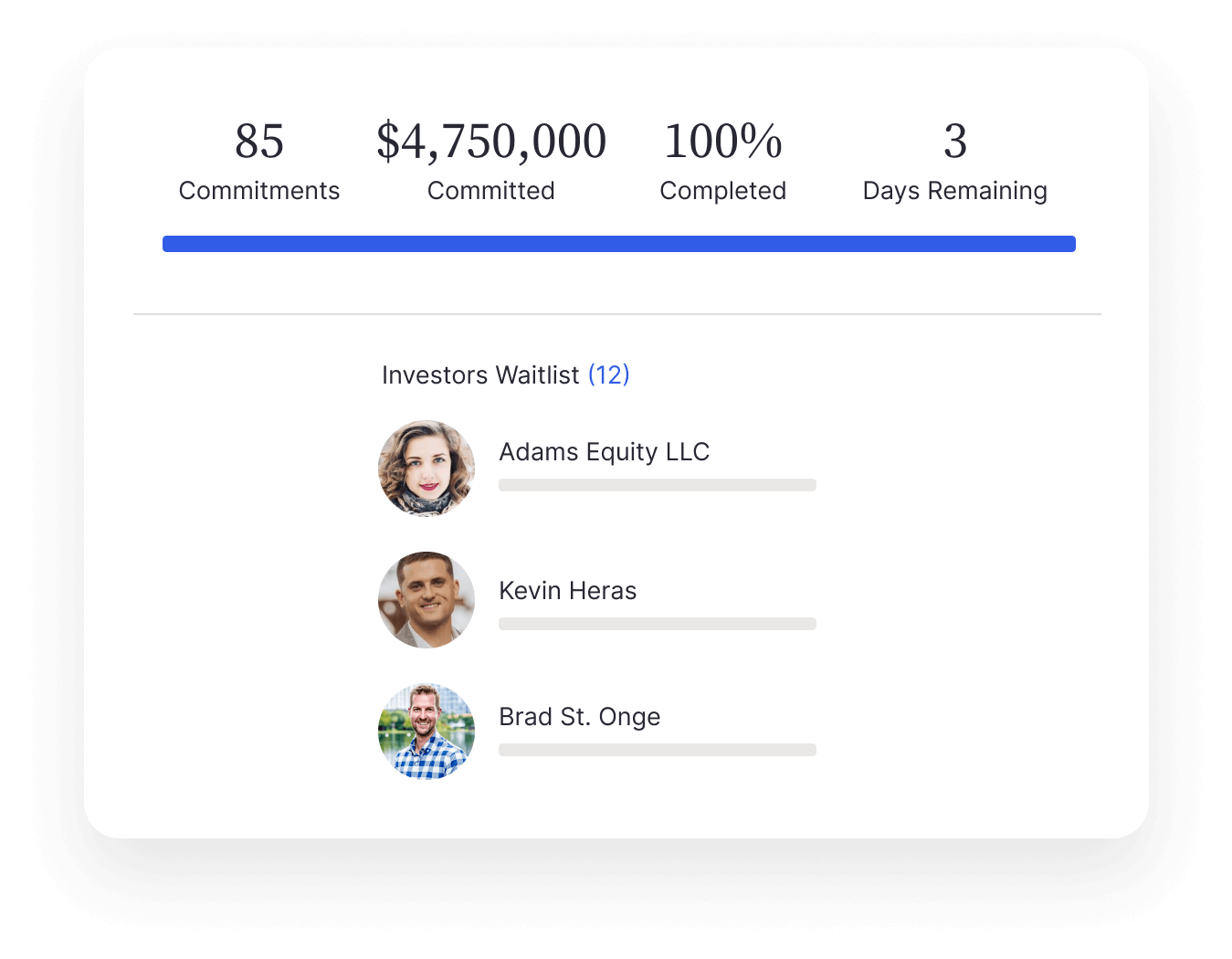

Never miss your next commitment – even when deals are fully subscribed. Capture investor interest, trigger communication, and direct available investor capital to other active or upcoming projects.

One platform to support the entire lifecycle of your fundraising process. Streamline your workflows across inbound lead management and pipeline development, all the way to cap table and position management. Every action is tracked and stored in the CRM and funded positions are automatically added to your cap table. Empower your team to focus on actions that drive results from beginning to end, not administrative work.

Create complex distribution waterfalls, automatically calculate distributions and send secure payments to your investors with a few clicks.

Build credibility and impress your investors with a modern, user-friendly experience. Share documents, send updates, and capture investment intent in a centralized hub.

Cultivate trusted relationships, build credibility and enhance investor satisfaction - all while saving time through automated workflows.

Connect with our product experts to get a personalized view of InvestNext