When a promising commercial real estate deal is at stake, fast access to capital is essential. While an investor portal on its own won’t guarantee more commitments, leveraging these platforms to build investor confidence, sustain deal momentum, and nurture LP relationships at scale can be the difference between a fully funded project and a lost opportunity.

Your growing portfolio of real estate investments needs sophisticated tools that simplify operations, turn manual processes into automated workflows, and deliver the transparency modern investors expect. Commercial real estate investor portals now include powerful reporting capabilities, document management systems, and capital raise tools that simplify traditionally complex processes. The leading platforms even offer configurable dashboards for a truly customized experience, integrated communication systems with actionable LP insights, and bank-level security protocols to transform your operational standards into a competitive advantage.

This article will help you evaluate the five key components of a best-in-class real estate investor portal, showing how each supports credibility, investor confidence, and operational scale, and outlining which essential features to look for in each category.

Investor Experience

Real-Time Portfolio Dashboard & Reporting

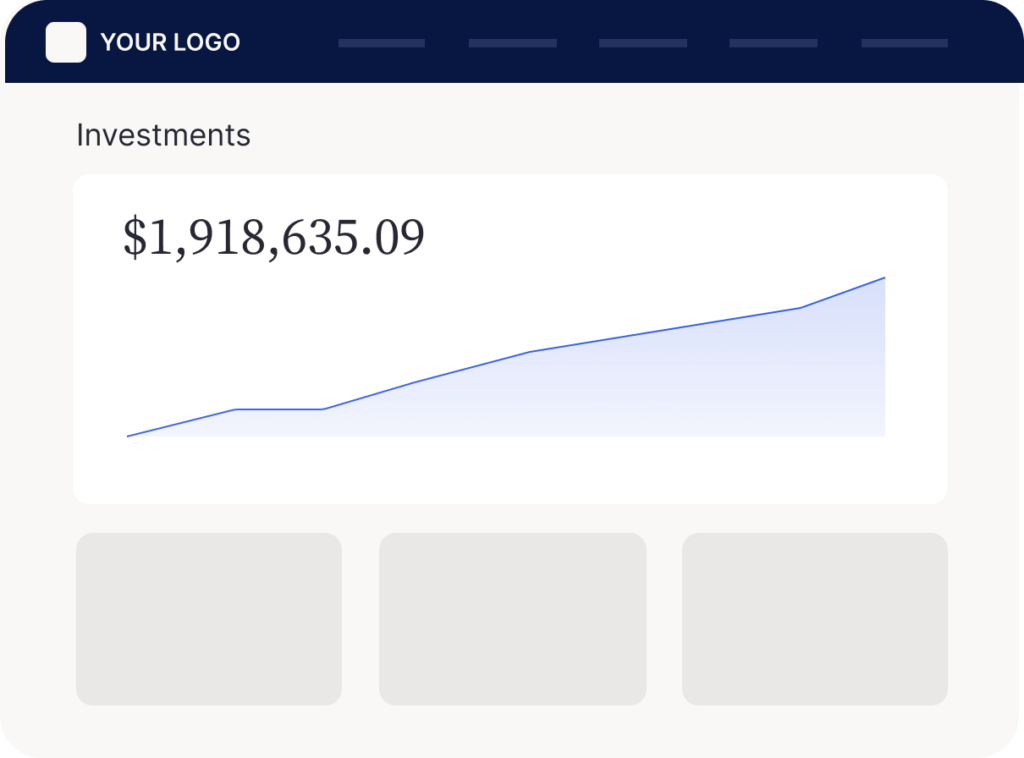

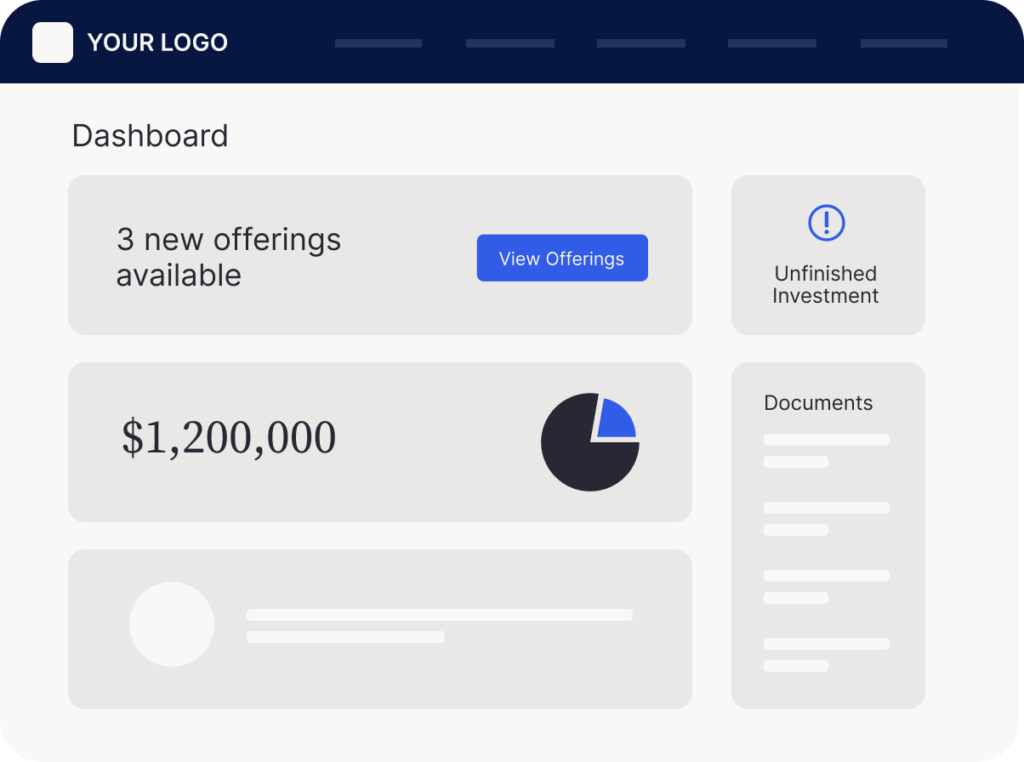

One of the biggest frustrations investors face is digging through static PDFs or email attachments to find the information they care about most. Every investor has different priorities: some want to track cash flow distributions, others want detailed performance metrics, and others simply want a high-level portfolio view. For GPs, the challenge is delivering this information in a way that is timely, transparent, and tailored to each investor without creating a massive administrative burden.

Best-in-class real estate investor portals solve this through customizable dashboards and reporting tools. Investors can log in and immediately see the data most relevant to them, including property-level performance to portfolio summaries, upcoming distributions, tax documents, and capital account balances. Reports can be filtered, exported, and even white-labeled, ensuring both flexibility for investors and professionalism for the GP.

The best dashboards show key performance indicators through easy-to-understand visual elements:

· Investment-level details including ownership percentage and contribution amounts

· Fund-level performance with IRR calculations and equity multiples

· Historical distribution data with upcoming payment schedules

How InvestNext Delivers: InvestNext elevates the reporting experience with a visually appealing and easy-to-navigate investor dashboard designed to impress LPs and strengthen relationships. Investors gain secure, on-demand access to performance data, investment reports, and customizable statements. Tailor your investor portal to your LPs preference by selecting the reports and metrics that matter to them most.

White-Label Portals & Customizable Branding

First impressions matter. When investors log into a portal that feels disconnected from a firm’s brand — with generic colors, clunky design, or third-party logos — it can undermine confidence and make the experience feel transactional rather than relationship-driven. For GPs, the challenge is maintaining brand consistency and professionalism across every investor touchpoint, especially when technology platforms often default to their own branding.

Best-in-class investor portals offer white-label functionality and fully customizable branding. This allows GPs to apply their own logos, color palettes, typography, and even domain names, creating a seamless extension of their firm’s identity. From the login page to dashboards, reports, statements, and email notifications, every interaction reinforces the firm’s professionalism and brand promise.

For GPs, this feature strengthens credibility, fosters investor trust, and elevates the overall experience, turning the portal into a branded investor hub rather than a third-party software tool. The result is a more polished and cohesive investor journey that reflects the quality of the investments themselves.

How InvestNext Delivers: InvestNext enables firms to create a fully branded experience with customizable deal rooms, logos, and brand colors that extend a professional digital presence to every investor interaction. From the first login to ongoing engagement, the portal is designed to reinforce the firm’s identity and credibility, while providing investors with intuitive navigation and secure access to their investment entities. By blending modern design with seamless branding, InvestNext transforms the portal into a true extension of the GP’s firm, elevating the investor experience and strengthening long-term relationships.

Mobile-friendly investor experience

Today’s investors expect the same ease of use from their investment platforms as they do from their banking or shopping apps. Yet many legacy portals fall short. Some portals offer clunky interfaces that only work well on desktop or require investors to pinch, zoom, and scroll endlessly on their phones. This creates friction, frustration, and in some cases delays in commitments or missed opportunities to engage.

Best-in-class investor portals provide a mobile-optimized experience that allows investors to access their accounts seamlessly from any device. Dashboards, reports, deal rooms, and even funding workflows are designed responsively, ensuring clear readability, intuitive navigation, and secure functionality whether on a laptop, tablet, or smartphone.

For GPs, a mobile-friendly portal reduces investor support inquiries, accelerates capital raising by making it easier for investors to commit on the go, and ensures that every interaction reflects the firm’s professionalism. It’s not just a convenience, but a competitive necessity for winning and retaining modern investors.

How InvestNext Delivers: InvestNext creates a modern, white-glove experience through its clean, intuitive interface and responsive design. Investors enjoy anytime, anywhere access to their portfolios and performance data on any device, whether desktop or mobile. By pairing a sleek user experience with mobile-friendly accessibility, InvestNext ensures LPs can stay connected and engaged without friction, helping GPs build stronger relationships and exceed investor expectations.

Integrated Capital Raise Tools

Modern capital raising needs sophisticated tools that simplify investment processes. The best real estate investor portal solutions blend capital raising features that cut down friction, boost compliance, and speed up funding timelines.

Professional Deal Rooms

Showcasing an offering is one of the most important opportunities GPs have to capture investor interest and build confidence. But too often, deal materials are scattered across emails, PDFs, or static websites, leaving investors with an incomplete or disjointed view of the opportunity. This not only reduces engagement but can also delay commitments and weaken the overall investor experience.

Best-in-class investor portals solve this with professional deal rooms that centralize all offering materials in a clean, organized, and engaging digital environment. Investors can access key documents, financials, offering memorandums, images, and videos in one place, often paired with interactive performance metrics and seamless links to the subscription process.

For GPs, professional deal rooms streamline communication, reduce repetitive investor inquiries, and ensure that every investor receives consistent, accurate information. By transforming offerings into polished, interactive experiences, GPs can create urgency, drive faster commitments, and differentiate their firm in a competitive capital-raising environment.

How InvestNext Delivers: InvestNext empowers firms to promote upcoming and active deals through intuitive, fully customizable deal rooms. GPs can showcase images, videos, and key offering details alongside metrics that create excitement and drive investor action. Deal rooms can also be promoted and accessed individually via link, ensuring seamless integration with investor marketing tools. When combined with frictionless commitment flows, investors can move from interest to funding in minutes. This functionality reduces acquisition costs while elevating the overall investor experience.

Integrated NDA Protection

Protecting sensitive deal information is essential in commercial real estate. When financial projections, property details, or strategies circulate without controls, sponsors face compliance risk and lose credibility. For Regulation D offerings like 506(b), even a single unauthorized disclosure can create serious vulnerability.

Traditional approaches leave gaps: open access risks leaks, locked deal rooms create friction, and manual NDAs slow momentum. None balance protection with efficiency.

Best-in-class investor portals address this with integrated NDA functionality. Investors are prompted to sign a legally binding NDA before entering deal rooms, gaining instant access once complete. This protects sensitive information while keeping the process fast and professional.

For investment managers, built-in NDAs reduce administrative work, provide a clear audit trail, and signal institutional-grade security. By protecting proprietary strategies and maintaining compliance, GPs build investor trust and preserve their competitive edge.

How InvestNext Delivers: InvestNext can integrate one-sided NDAs directly into any deal room. Using DocuSign, every agreement is enforceable and automatically stored with investor profiles. Investors can sign instantly and enter deal rooms without delay, ensuring investment managers can access capital with both speed and confidence while protecting their advantage and credibility in the market.

Responsive LP Communication

Raising capital depends on more than presenting a deal. It requires timely, targeted follow-up that keeps momentum alive. Sponsors often lose this advantage when communication is spread across separate email tools and CRMs, making it difficult to know which investors are engaged and when to reach out.

Best-in-class investor portals solve this by unifying communication and providing actionable insights. With a clear view of investor engagement, sponsors can identify interest early, follow up at the right time, and keep capital raising efforts on track.

For sponsors, integrated communication reduces missed opportunities, strengthens investor relationships, and accelerates commitments. By aligning tools and insights, sponsors can build trust while sustaining deal momentum.

How InvestNext Delivers: InvestNext centralizes communication with universal email integration that connects directly to our CRM. Every message is tracked, giving sponsors a complete picture of LP interactions. Deal room views reveal which investors are engaging with each opportunity, equipping sponsors to conduct responsive follow-up and capture momentum. This functionality ensures communication drives action, helping sponsors raise capital with greater insight and efficiency.

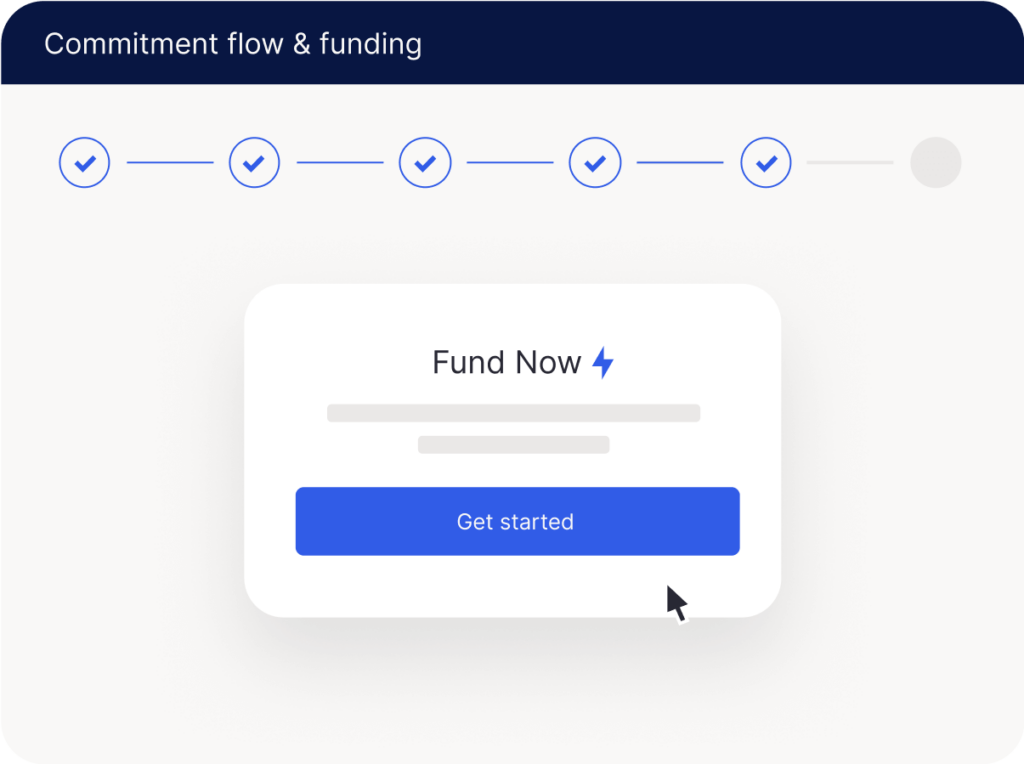

Digital subscription workflows

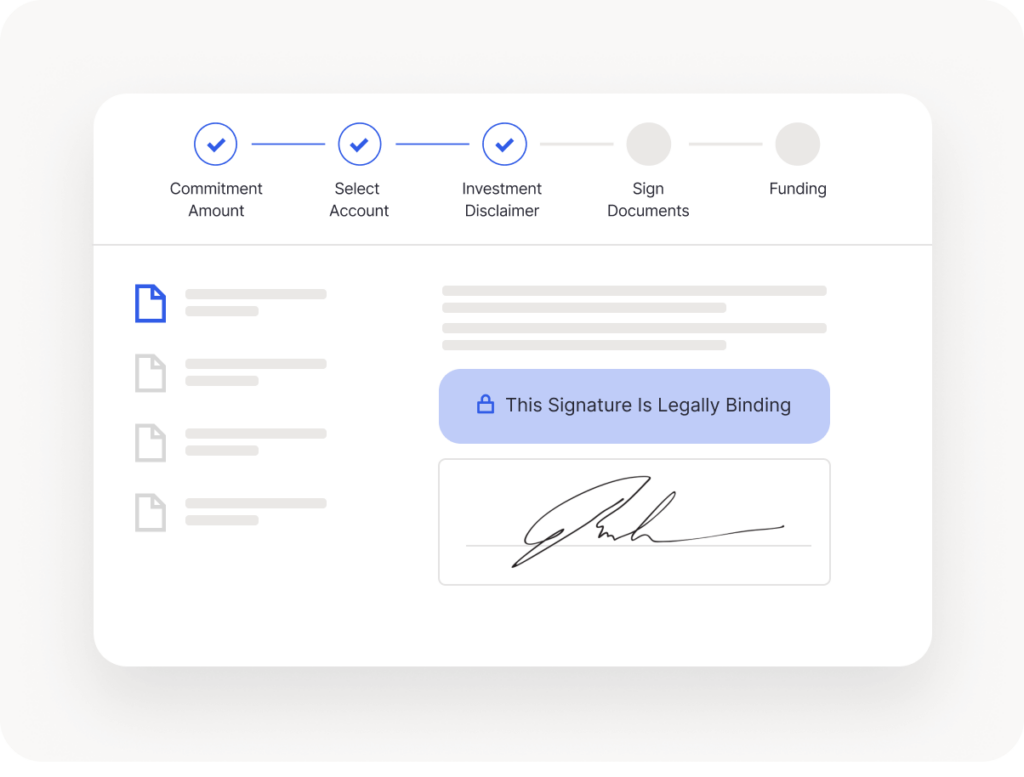

One of the most common friction points in capital raising is the subscription process. Paper-based or PDF subscription agreements often require investors to print, sign, scan, and email documents back. This tedious process leads to errors, delays, and in some cases, lost commitments. For GPs, manually tracking these documents and reconciling them into cap tables is equally time-consuming and error-prone.

Best-in-class investor portals replace this with fully digital subscription workflows that streamline and secure the process from end to end while delivering a digital experience similar to ecommerce checkout. InvestNext’s frictionless subscriptions enable investors to go from interest to funding in minutes:

- Guided digital subscription forms that validate inputs in real time, reducing errors and incomplete submissions.

- Integrated e-signature functionality to eliminate printing, scanning, and emailing documents.

- Intelligent document display, where the platform dynamically determines which documents to present based on investor responses, ensuring compliance without overwhelming the investor.

- Integrated accreditation verification that intuitively guides investors through securely uploading letters, requesting them directly through the portal, or self-attesting to accreditation status.

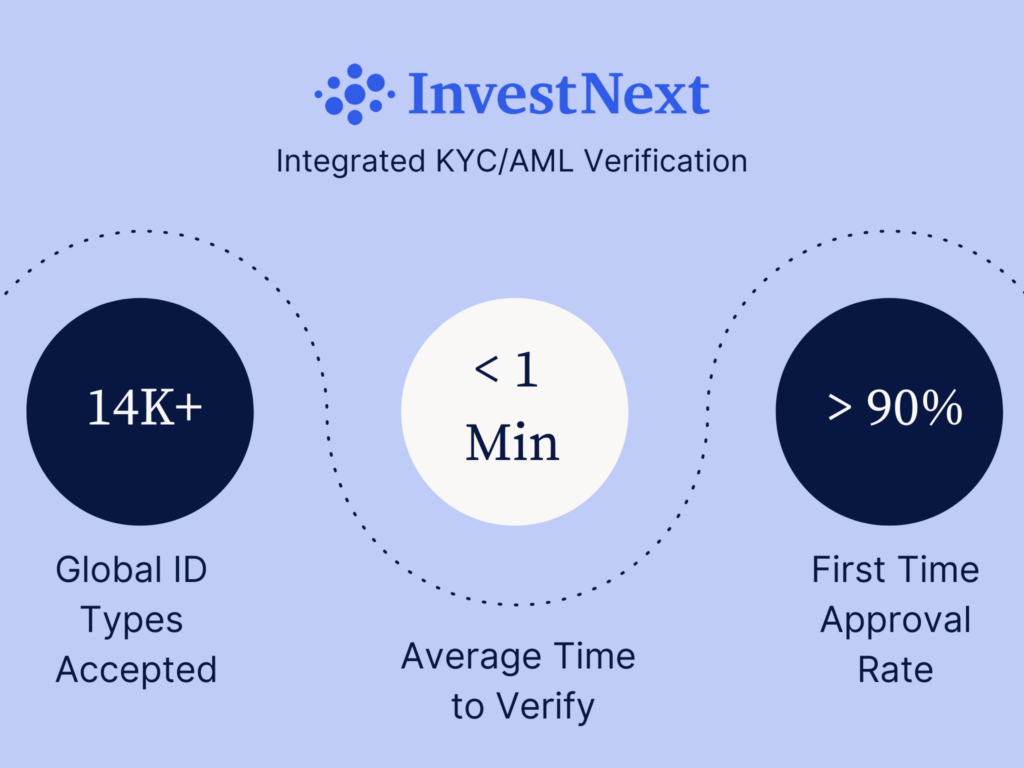

- Investor verification (KYC/AML) conducted securely within the platform, either integrated into the commitment flow or triggered as a standalone process, reducing risk for both GPs and investors.

- Inbound funding via ACH, enabling investors to link bank accounts and transfer funds directly, moving from interest to fully funded commitments in a matter of minutes.

For GPs, these capabilities accelerate fundraising, improve data accuracy, and reduce administrative overhead, while giving investors a smooth, professional experience that builds confidence and drives faster commitments.

Accreditation Verification & KYC/AML

Investor compliance is one of the most important, and often most time-consuming, aspects of raising private capital. GPs must confirm that investors meet regulatory requirements, whether that’s accreditation status for certain offerings or identity verification to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Historically, these checks have been handled manually through emails, physical documents, and third-party services, creating friction for investors and administrative burden for GPs.

Best-in-class investor portals streamline compliance by embedding these processes directly into the subscription workflow:

- Accreditation verification: Investors are guided through intuitive questionnaires to establish the fastest path to verifying their status. Then, they can securely upload accreditation letters, request verification directly through the portal, or self-attest as permitted by regulations. This ensures GPs collect accurate documentation quickly and consistently.

- Investor verification (KYC/AML): Investors can complete KYC/AML checks seamlessly within the platform, with secure integrations that authenticate identity and screen for compliance risks. GPs can trigger verification as part of the commitment process or request it independently, protecting both the firm and its investors.

For GPs, these capabilities reduce risk, ensure compliance with securities laws, and save significant administrative time. For investors, it means a smoother onboarding process with greater transparency and security.

Inbound Funding

One of the biggest hurdles in closing commitments quickly is the funding process. Traditional methods often require investors to initiate wire transfers through their banks, manually enter routing and account information, and wait days for confirmation. This not only creates delays and administrative headaches but also increases the risk of errors or even fraud.

Best-in-class investor portals address this with integrated inbound funding capabilities. Investors can securely link their bank accounts within minutes and transfer funds directly through the portal. With ACH payments embedded in the commitment workflow, investors can move from signing documents to funding their commitments seamlessly, without leaving the platform.

For GPs, this functionality accelerates capital raising, reduces reconciliation errors, and provides clear visibility into the status of investor payments. It also enhances security by keeping sensitive bank details within a trusted, encrypted environment rather than scattered across emails or spreadsheets.

The result is a faster, safer, and more professional process that removes friction for investors while giving GPs confidence and control over inbound capital flows.

How InvestNext Delivers: InvestNext enables firms to take investors from awareness to fully funded in minutes. The platform unifies e-signatures, accreditation verification, KYC compliance, and direct inbound funding into a single seamless flow. Investors can link bank accounts and send secure ACH transfers, wires, or even check payments. This workflow eliminates delays and reduces friction, while giving GPs confidence in a faster, more secure funding process.

Tracking Investor Commitments

As capital is raised, keeping track of who has expressed interest, how much they’ve committed, and what’s been funded can quickly become overwhelming when managed through spreadsheets or email threads. Without a centralized system, GPs risk miscommunication, delays in funding, and inaccuracies in reporting to both investors and internal teams.

Best-in-class investor portals offer real-time tracking of investor commitments, giving GPs and LPs complete visibility into the status of each investment. Investors can see their commitments, funded amounts, and outstanding balances directly within the portal, while GPs gain a live dashboard of capital raised, pending commitments, and funding progress against targets.

For GPs, this feature reduces manual reconciliation, improves accuracy in cap table management, and ensures smoother communication with investors. For LPs, it provides transparency and confidence that their commitments are being accurately recorded and tracked.

The result is a more efficient fundraising process, fewer administrative errors, and a higher level of trust between GPs and their investors.

Automated Document Management

Effectively managing sensitive investor documents is a cornerstone of professional investor relations. A disorganized or unsecured process not only frustrates investors but can also expose GPs to unnecessary compliance and reputational risk. Best-in-class investor portals streamline this with secure, centralized, and transparent document workflows.

Secure file sharing and storage

Email attachments and physical mail create unnecessary risks like data breaches and misplaced or outdated files. Investors expect the same level of security with their investment documents as they do with online banking. Modern portals provide encrypted file sharing and storage, allowing GPs to safely distribute subscription agreements, statements, reports, and other sensitive materials. With documents stored in a centralized repository, investors have a reliable, always-available source of truth, reducing support requests and manual follow-ups.

Investor access to K-1s and tax forms

Tax season has traditionally been a pain point for both investors and GPs. Manually connecting K-1s to investors at scale is resource intensive and can result in investors receiving the wrong tax documents. Best-in-class portals simplify this by giving investors direct access to their K-1s and tax forms within the portal, while automatically matching K-1s to the right investors. Investors can log in, securely download the documents they need, and stay confident that they’re receiving the correct and most current information. For GPs, this automation saves countless hours and reduces the risk of costly errors in tax form distribution.

InvestNext automates this process through:

- Bulk upload, match, and distribute K-1s to investors in minutes, not days

- Industry leading OCR technology that matches K-1s to the right investor every time

- Tailored document delivery to each investor’s secure portal

- Email alerts when new tax documents are ready

- Year-round access to historical tax documents

The system handles K-1s and other tax documents like Schedule D forms, 1099s, and investment summaries. This integrated approach gives investors all the information they need for tax returns.

Version control and audit trails

Miscommunication around document versions can erode trust quickly. When multiple drafts of agreements or reports circulate via email, it’s easy for investors to rely on outdated or inaccurate information. Leading investor portals solve this through version control and audit trails. Investors always see the most recent version of a document, while GPs benefit from a detailed log of document activity, including who accessed what and when. This creates transparency, strengthens compliance, and provides an added layer of accountability.

Investor Subscription Management

Self-service investor onboarding

An accessible self-service tool makes the investor experience simpler. The right real estate investor portal software features let investors complete most onboarding steps independently. This cuts administrative overhead and speeds up the investment process.

Effective self-service features typically include:

- Guided step-by-step subscription processes

- Smart forms that adapt based on investor inputs

- Automatic data validation to prevent submission errors

- Clear progress indicators showing completion status

These tools transform traditional paper-based manual processes into a single, cohesive digital experience. Investors see your organization’s dedication to technological efficiency through this streamlined approach.

Integrated E-Signatures

The traditional subscription and agreement process has long been bogged down by inefficiencies. When investors are printing, signing, scanning, and emailing documents back to GPs, this often leads to missing pages, errors, or delays. For firms raising millions in commitments, this outdated workflow creates unnecessary friction for investors and an administrative burden for staff.

Best-in-class investor portals solve this with integrated e-signature functionality. Investors can review, sign, and submit subscription documents, operating agreements, and other critical paperwork entirely within the portal. These signatures are legally compliant and securely stored, eliminating the need for paper-based processes.

For GPs, integrated e-signatures accelerate the fundraising timeline, reduce errors, and provide a centralized digital record for compliance. For investors, the experience is simple, secure, and convenient, transforming what was once a tedious step into a seamless part of the commitment flow.

How InvestNext Delivers: InvestNext supports investor-friendly commitment flows with fully integrated e-signatures. Investors can electronically sign legal documents directly within the platform, ensuring that critical agreements are completed quickly, accurately, and without friction. This streamlined approach saves time for GPs while delivering a modern, professional experience for LPs.

Compliance checks and document collection

Regulatory compliance remains crucial in real estate investing. Advanced investor portals use sophisticated compliance verification tools that protect sponsors and simplify the investor experience.

Notable compliance features include:

- Automated accreditation verification workflows

- KYC/AML checks integrated into the subscription process

- Tax document collection including W-9 and W-8BEN forms

- Suitability assessment tools that assess investment appropriateness

These integrated compliance tools lower regulatory risk and create an audit trail showing due diligence. Sponsors managing multiple offerings can ensure consistent compliance standards across all investment opportunities.

Premium solutions stand apart from simple alternatives in the U.S. real estate investor portal software market through their subscription management capabilities. Efficient onboarding, status tracking, and compliance tools reduce operational costs and boost investor satisfaction.

Security and Compliance Features

Security is crucial when selecting an investor portal. The platform must have strong safeguards that ensure regulatory compliance and build investor trust. Modern platforms go beyond simple password protection. They use multi-layered security systems that protect financial data while keeping it accessible to users.

SOC 2 Type II compliance in InvestNext

InvestNext sets itself apart with its SOC 2 Type II certification, which stands as the gold standard for organizations that handle sensitive information. This certification goes beyond simple compliance measures.

This certification changes how users see platform security. It moves past marketing claims to actual verified protection. SOC 2 compliance shows a major investment in security that smaller platforms usually can’t match.

Data encryption and secure hosting

Complete data protection needs both safe transmission and storage. InvestNext uses bank-grade encryption standards that include:

- 256-bit SSL encryption for all data transmission

- At-rest encryption for stored documents and financial information

- Regular security testing by independent firms

- Backup systems spread across different locations

These security measures bring practical benefits. Investors can access their information safely from any network. Sponsors can show they meet regulations. Both groups stay protected from sophisticated cyber threats.

Investment managers should not treat security as an extra feature when evaluating platforms. A resilient security system forms the foundation for all portal features, and allows them to market their operational standards as a competitive differentiator from other investment managers. Without it, even the most innovative tools lose value when data becomes vulnerable.

Conclusion

The investor portal has evolved from a simple document repository into a powerful tool for capital access, investor management, and brand building. For GPs, the right platform isn’t just about convenience. It’s about creating a foundation of trust, transparency, and efficiency at every stage of the investor journey.

The five categories outlined here, including features like customizable dashboards, mobile-friendly access, secure document management, integrated funding flows, and professional deal rooms, address the very challenges that slow down fundraising and strain investor relationships. When executed well, these capabilities free GPs from administrative burdens, reduce compliance risks, and elevate the investor experience to a standard that today’s LPs expect.

At the same time, investors benefit from seamless access to the information and tools they value most: transparency into performance, confidence in secure processes, and the ability to engage with opportunities anytime, anywhere.

The result is a win-win: stronger investor relationships, faster capital raising, and a competitive edge in a crowded market.

If you want to upgrade your investor portal and foster a community of investment-ready LPs, don’t wait until the right deal is already in flight. Book a demo with InvestNext now to ensure the capital you need is always just a few clicks away.

FAQs

The essential features include customizable dashboards, automated document management, integrated capital raise tools, investor communication capabilities, performance reporting, subscription management, CRM functionality, robust security measures, mobile accessibility, and scalability options.

An investor portal enhances communication through scheduled email campaigns, automated performance updates, and customizable templates. It allows for targeted messaging, real-time notifications, and centralized document sharing, keeping investors informed and engaged.

A robust investor portal should have SOC 2 Type II compliance, role-based access control, data encryption for both transmission and storage, secure hosting, and regular security audits to protect sensitive financial information and maintain investor confidence.

An effective portal offers self-service investor onboarding, real-time subscription status tracking, and integrated compliance checks. This simplifies the process for investors, reduces administrative work, and ensures regulatory requirements are met efficiently.

Mobile accessibility is crucial because it allows investors to access their portfolio information anytime, anywhere. Features like responsive design, push notifications, and dedicated mobile apps enhance user experience and keep investors connected to their investments on-the-go.