Up-Front Costs

Ever wish you didn’t have to spend so much up-front to build out a great office in the commercial real estate sector? This month we’re highlighting an InvestNext customer, Solid Space, a startup that helps office tenants turn out-of-pocket build-out costs into easy monthly payments – just like paying for software. This new firm was created with one goal in mind: empower office operators in the commercial real estate industry to unleash the potential of physical workspace – thereby facilitating human happiness, creativity, and productivity. They achieve this by advancing companies in the commercial real estate sector the capital needed to build an exceptional office. This allows business owners in the commercial real estate industry to instead reinvest in their business and people and smooth out this immense cash outlay over the term of their office lease.

What makes Solid Space different:

- Solid Space financing is largely unsecured. This means that the funds can be incorporated in an office build without running afoul of other creditor agreements. It’s like subscribing to your office the same way you would subscribe to InvestNext or another SaaS tool.

- Solid Space works alongside a landlord-provided Tenant Improvement Allowance (TIA) that may be a part of the lease negotiation. But, it can also cover items often left out of the landlord TIA like furniture, fixtures, and equipment.

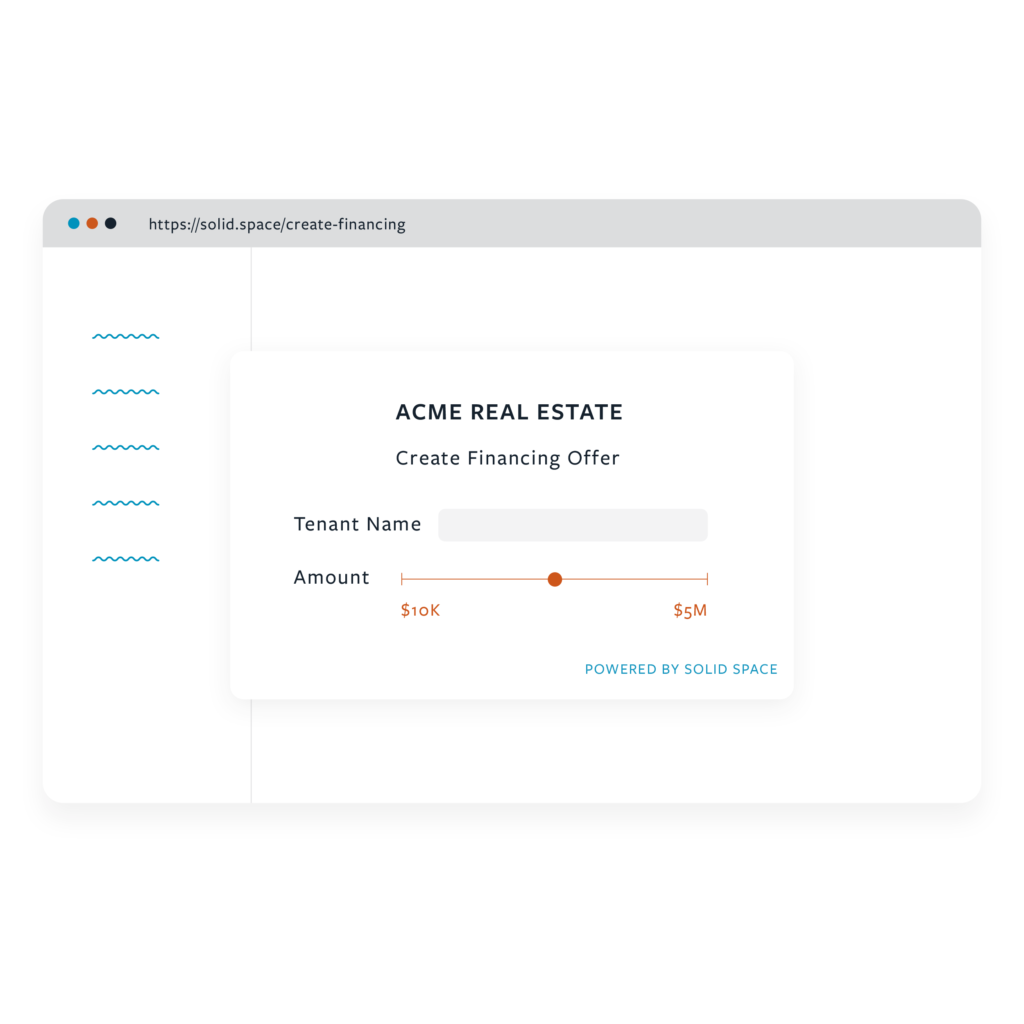

- Solid Space is a digitally native platform allowing for underwriting and fund dispersal to happen in a matter of days. Rather than the months-long process that is common with banks.

Build-out costs are on the rise and Tenant Improvement Allowances are not keeping pace. This means tenants are increasingly coming out of pocket to create a work environment that keeps employees happy and productive and attracts the best new talent. Solid Space protects businesses’ liquidity, this ensures the business has an opportunity to invest cash in more impactful projects and initiatives.

Relationships & Liabilities

- The landlord has no guarantee or liability. The Transaction is between Solid Space and tenant only.

- Build-out costs are provided via a hybrid financing agreement that takes only a partial security interest for a low-friction process.

- Once funded, the financed amount is repaid by the tenant. Over the course of the lease, these payments are made directly to Solid Space (maximum term of 60 months).

- Standard asset ownership delineation. The landlord owns improvements that become part of the building (walls, flooring, glass). The tenant owns furniture, fixtures, and equipment.

–To get started or learn more, Solid Space can be found online here.