Syndication has emerged as a popular method for pooling resources and maximizing returns. As a form of alternative investment, real estate syndication investment fits within the broader category of non-traditional investment opportunities, offering higher potential returns and diversification benefits.

This collaborative approach, known as commercial real estate syndication, allows multiple investors to collectively purchase and manage properties, including larger assets such as apartment buildings, that would otherwise be out of reach. However, traditional syndication can be fraught with challenges. Enter real estate syndication software—transforming the industry by simplifying management and enhancing investor satisfaction.

The Challenges of Traditional Real Estate Syndication

Time-Consuming Paperwork

One of the most daunting aspects of traditional syndication is the sheer volume of paperwork involved. The process can be overwhelming and prone to errors, from initial agreements to ongoing management documents. Manual documentation consumes significant time and increases the risk of mismanagement and non-compliance.

Complex Financial Management

One of the most daunting aspects of traditional syndication is the sheer volume of paperwork involved. The process can be overwhelming and prone to errors, from initial agreements to ongoing management documents. Manual documentation consumes significant time and increases the risk of mismanagement and non-compliance.

Complex Financial Management

Managing a syndicate’s finances is no small feat. It involves meticulous tracking of contributions, distributions, expenses, and returns. Without the aid of sophisticated tools, these tasks become complex and error-prone, leading to potential financial discrepancies and investor dissatisfaction.

Key Benefits of Real Estate Syndication Software

Enhanced Communication and Transparency

Effective communication is crucial in maintaining investor confidence and satisfaction. Syndication software facilitates this by providing centralized communication platforms and real-time updates. It also ensures the distribution of important documents like the private placement memorandum, ensuring that all investors have access to critical information.

InvestNext excels in this area with its robust communication tools that inform investors about their investments through regular updates and transparent reporting. This fosters trust and builds stronger relationships between syndicators and investors.

Improved Investor Relations

Building and maintaining strong investor relationships is key to the success of any syndication. An investor portal provides instant access to critical investment data and metrics, thereby improving investor relations. Software tools enable personalized dashboards, regular updates, and easy access to investment details, making it easier for syndicators to manage investor relations.

InvestNext’s platform offers features that personalize the investor experience. It provides detailed insights and updates that keep investors engaged and satisfied. This personal touch goes a long way toward retaining investors and attracting new ones.

Increased Efficiency and Scalability

Automation reduces the manual tasks associated with syndication, saving time and resources. The software also streamlines property management tasks, allowing syndicators to efficiently oversee and maintain their assets. A flexible business model that integrates secondary market features can enhance scalability and attract more investors. This increased efficiency allows syndicators to manage more deals and investors, scaling their operations without a proportional increase in workload.

InvestNext enables syndicators and investors to handle multiple deals efficiently, supporting growth and scalability. Its user-friendly interface and powerful features streamline operations, allowing syndicators to focus on strategic growth rather than administrative tasks.

Versatility for Various Real Estate Investment Structures

One of the standout features of real estate syndication software is its versatility. Beyond syndications, the software is also highly beneficial for managing other real estate investment structures such as funds, joint ventures, and Real Estate Investment Trusts (REITs). This flexibility allows real estate professionals to use a single platform for a variety of investment strategies, streamlining management and enhancing operational efficiency across different types of deals.

InvestNext’s platform is designed to accommodate these various structures, providing tools and features that support each’s unique requirements. Whether you’re managing a fund, a joint venture, or a REIT, the software offers tailored solutions that enhance efficiency, improve transparency, and maximize investor satisfaction.

How to Choose the Right Real Estate Syndication Software

Selecting the right syndication software is crucial for managing the complexities of real estate investments, particularly in a real estate syndication deal, and maximizing its benefits. Here are some key considerations:

Ease of Use

The software should have an intuitive interface that is easy to navigate. Complex software can deter users and reduce productivity.

Features

Look for features that align with your specific needs, such as real-time reporting, document management, and communication tools. The software should also support the management of real estate syndication deals, ensuring you can effectively handle minimum investment requirements and personal investment goals.

A real estate investment management platform offers these features and more, providing functionalities like customizable investment management and tax implications handling. InvestNext offers a comprehensive suite of features for real estate syndication management:

- Raising Capital: Promote new offerings and capture investment intent efficiently.

- Investor Portal: User-friendly, white-label portal for document sharing and updates.

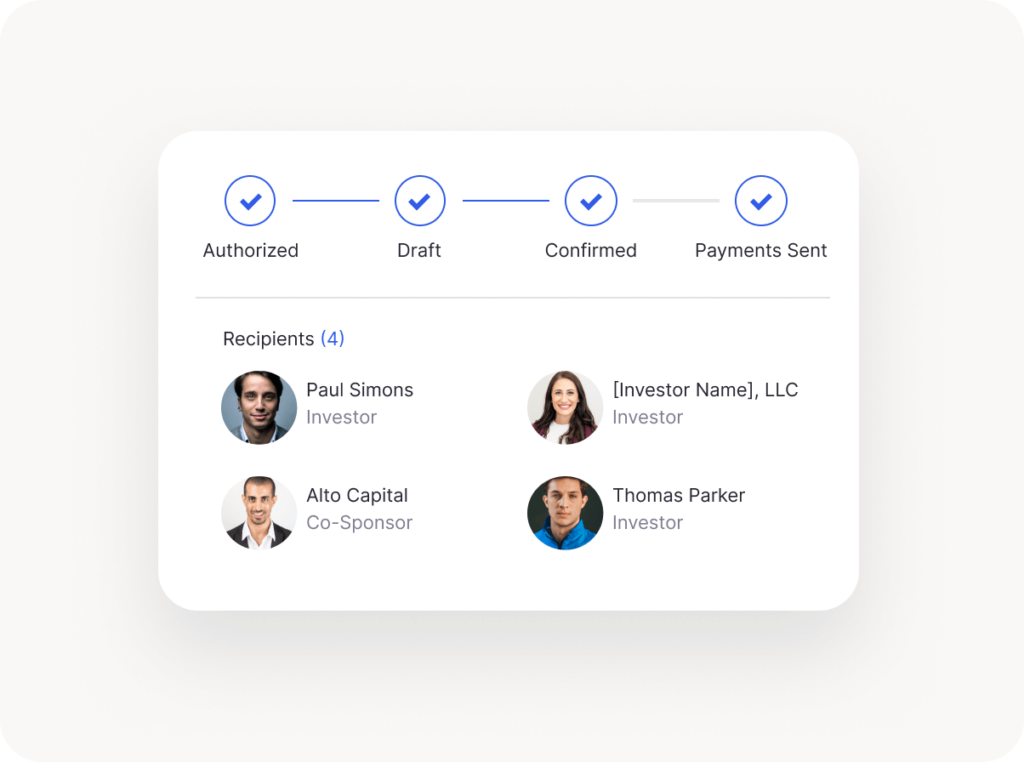

- Distributions & Payments: Automate complex distribution calculations and payments.

- CRM: Manage investor relations seamlessly.

- Investor Accreditation: Integrated accreditation verification.

- KYC/AML: Ensure compliance with investor onboarding.

- Security: Industry-leading data protection.

- Cap Table Management: Automated financial management for distributions and reporting.

- Document Management: Organize and access documents easily.

- ACH Payments: Fast and secure payment processing.

Scalability

Ensure the software can grow with your business. It should be able to support an increasing number of deals and investors without compromising performance.

Customer Support

Reliable customer support is essential for addressing any issues or questions that may arise. InvestNext provides exceptional customer support to help users maximize the platform’s capabilities.

Pricing

Consider the cost relative to the features and benefits offered. InvestNext provides a competitive pricing model that delivers value for money. InvestNext’s platform meets all these criteria, making it a top choice for syndicators looking to streamline their operations and enhance investor satisfaction.

Case Studies: Success Stories Using Syndication Software

InvestNext has helped numerous syndicators achieve remarkable success. One of the standout success stories is Open Door Capital, which significantly improved its syndication management and investor relations using InvestNext.

The platform enabled Open Door Capital to automate time-consuming processes, streamline communication, and enhance investor satisfaction across multiple deals. The success achieved by Open Door Capital highlights the transformative power of InvestNext’s software in managing large-scale real estate syndications.

Check out the full case study here for a deeper look into how Open Door Capital utilized InvestNext to scale its operations and maximize efficiency.

Level Up Your Real Estate Syndication with InvestNext

InvestNext stands out in the competitive landscape of real estate syndication software due to its comprehensive and innovative features. By choosing InvestNext, you can transform your syndication management process, enhancing efficiency, transparency, and investor satisfaction.

Exceptional Customer Support

InvestNext offers exceptional customer support, ensuring users can access assistance whenever needed. The dedicated support team can help with any issues or questions, providing reliable guidance and solutions to maximize the platform’s capabilities.

Continuous Innovation

InvestNext is committed to continuous innovation, regularly updating its software to incorporate new features and improvements. Recent updates have enhanced functionality and user experience, ensuring that the platform remains at the forefront of industry advancements.

Protect Your Investor Data

Data protection is a priority at InvestNext. The platform employs advanced security protocols to safeguard investor data, ensuring that all information is secure and compliant with industry standards. This focus on data security helps build and maintain investor trust.

Send Rich & Detailed Investor Updates

Effective communication with investors is facilitated through InvestNext’s software, which allows for sending rich and detailed updates. The software ensures compliance with regulations set by the Securities and Exchange Commission, providing investors with accurate and legally compliant updates.

Regular, transparent updates on market trends help keep investors informed and engaged, fostering stronger relationships and greater satisfaction.

Conclusion: The Future of Real Estate Syndication Software

The landscape of real estate syndication is rapidly evolving, and advanced software solutions are becoming essential. Features like real-time data analysis, customizable reports, automated calculations, and robust security are critical for effective investment management. As technology continues to advance, these tools will only get better, offering even greater efficiency and accuracy.

Discover How InvestNext Can Elevate Your Investment Strategy

Curious about how InvestNext can enhance your investment distribution process? Explore our real estate investment platform or schedule a demo to see our solutions in action. You can also sign up for a free trial to experience firsthand how InvestNext can transform your investment management.

Real Estate Syndication Software: Frequently Asked Questions (FAQ)

How does real estate syndication software benefit different investment structures?

Real estate syndication software is versatile and can be used to manage various investment structures, including syndications, funds, joint ventures, and REITs. The software provides tailored features for each structure, such as automated reporting, document management, and performance tracking, ensuring that your specific investment needs are met efficiently.

Can InvestNext be used for managing funds and joint ventures?

Yes, InvestNext is designed to support a wide range of real estate investment structures, including funds and joint ventures. The platform offers tools that simplify the management of these investments, such as centralized communication, customizable dashboards, and automated financial tracking.

What makes InvestNext suitable for REIT management?

InvestNext’s robust feature set, including real-time reporting, document management, and compliance tools, makes it an excellent choice for managing Real Estate Investment Trusts (REITs). The platform’s scalability and flexibility allow REIT managers to handle complex portfolios while maintaining transparency and efficiency.

How does InvestNext enhance investor communication and transparency?

InvestNext provides centralized communication platforms and real-time updates, ensuring that all investors have access to critical information and updates about their investments. This transparency builds trust and fosters stronger relationships between syndicators and investors.

What support does InvestNext offer for scaling real estate syndication businesses?

InvestNext’s platform is designed to grow with your business. Its automation features reduce manual tasks, allowing syndicators to manage more deals and investors efficiently. The platform’s scalability supports the expansion of your syndication business without compromising performance or investor satisfaction.