Tax season can be a challenging period for many, especially for general/limited partners involved in real estate investments. One critical concept that often causes confusion is how taxable activity of the investment is allocated to each individual member (also known as partners or investors). The K1, or Schedule K-1, is an essential document for anyone involved in partnerships or limited liability companies (LLCs), as it reports income, losses, and other tax information from the partnership to the individual members.

What is a K1?

Schedule K-1 is a component of Form 1065, which is the Return of Partnership Income. Real estate syndications are typically structured as Limited Liability Companies (LLCs), which elect to be taxed as a partnership. This is referred to as “flow through” taxation, meaning the income and losses are passed through to individual partners or members, who then report this information on their personal tax returns. Schedule K-1 is a component of the partnership return, which is used to report each member’s allocated share of the partnership’s income, losses, and deductions.

Challenges of K1 Distribution

Preparing the partnership tax return, including the creation of the member’s K1s can be a challenging task, especially for funds and real estate syndicates that encompass numerous investors and complex transactions.

The process of preparing and distributing these forms is not only time-consuming but also demands a high level of accuracy in the entity’s accounting and administrative records. Each K1 form must precisely reflect an investor’s share taxable activity, which may differ based on terms in the Operating Agreement, IRS tax code and other items specific to each investor, such as date of investment and class of shares invested in.

The complexity inherent in partnership taxation regularly necessitates seeking professional assistance from external CPAs. This requirement can lead to significant costs, particularly when handling multiple investors and properties. Each form demands individual attention and verification, which can escalate expenses rapidly. Moreover, the extensive amount of data and the intricate nature of these forms pose a substantial risk of errors. Any mistakes in the K1 forms can have serious repercussions, including IRS audits, disputes with investors, and potential legal issues, all of which can be costly and harm the reputation of the fund.

Furthermore, the aspect of investor relations cannot be overlooked. Delays or inaccuracies in the dissemination of the K1scan strain the relationship with investors. Timely and accurate distribution of these forms is essential for maintaining investor trust and satisfaction. Investors rely on these documents for their personal tax filings, and any discrepancies can lead to dissatisfaction and potential conflicts. Therefore, ensuring the precision and promptness of K1 form distribution is crucial for sustaining healthy investor relations and the overall integrity of the fund.

Importance for Funds and Real Estate Syndicates

For real estate funds and syndications, the K1 form is particularly important. These entities often involve multiple investors and complex ownership structures. Accurate and timely K1 dissemination ensures that each investor receives the correct information about their share of income, losses, and deductions. This is crucial for maintaining transparency and trust among investors, as well as for ensuring compliance with tax laws. Inaccurate or delayed K1 forms can lead to investor dissatisfaction, potential legal issues, and financial penalties.

The Significance of Timely and Accurate K1 Dissemination

The dissemination of K1 forms is a process that requires precision and timeliness. The Internal Revenue Service (IRS) mandates that partnerships and LLCs distribute K1 forms to their partners or members by March 15th each year or by September 15th, if a proper extension is filed.

Meeting the deadline for K1 form distribution is crucial, as failure to do so can lead to hefty financial penalties for both the partnership and the individual investors involved.

Consequences of Late or Incorrect K1 Forms

Several problems can arise from late or incorrect K1 forms:

- Penalties and Fines: Failing to distribute K1 forms on time can result in substantial fines.

- Tax Liabilities: Incorrect or late K1 forms can cause miscalculations in tax liabilities, potentially leading to underpaid taxes and further penalties.

- IRS Audits: Inaccurate K1 documentation can trigger IRS audits, which are not only time-consuming but also costly.

- Investor Relations: Delays or inaccuracies in K1 dissemination can damage the relationship with investors, who depend on these documents for their personal tax filings.

Timely and accurate distribution of K1 forms is essential, not only for compliance but also for maintaining trust and good standing with investors. The implications of failing to distribute K1 forms promptly extend beyond the partnership, significantly impacting the investors. If investors are forced to delay their tax filings due to late receipt of K1 forms, they may miss their filing deadlines or tax payments, leading to fines, interest, and penalties. This situation can affect their financial standing and strain the relationship with the partnership.

How InvestNext Can Assist in Streamlining K1 Dissemination

InvestNext provides a user-friendly platform that significantly reduces the time and effort required for K1 distribution. Here’s how it can transform your K1 management process:

- Export Reports to Your CPA: Easily export necessary reports, facilitating efficient collaboration with your CPA for accurate K1 preparation.

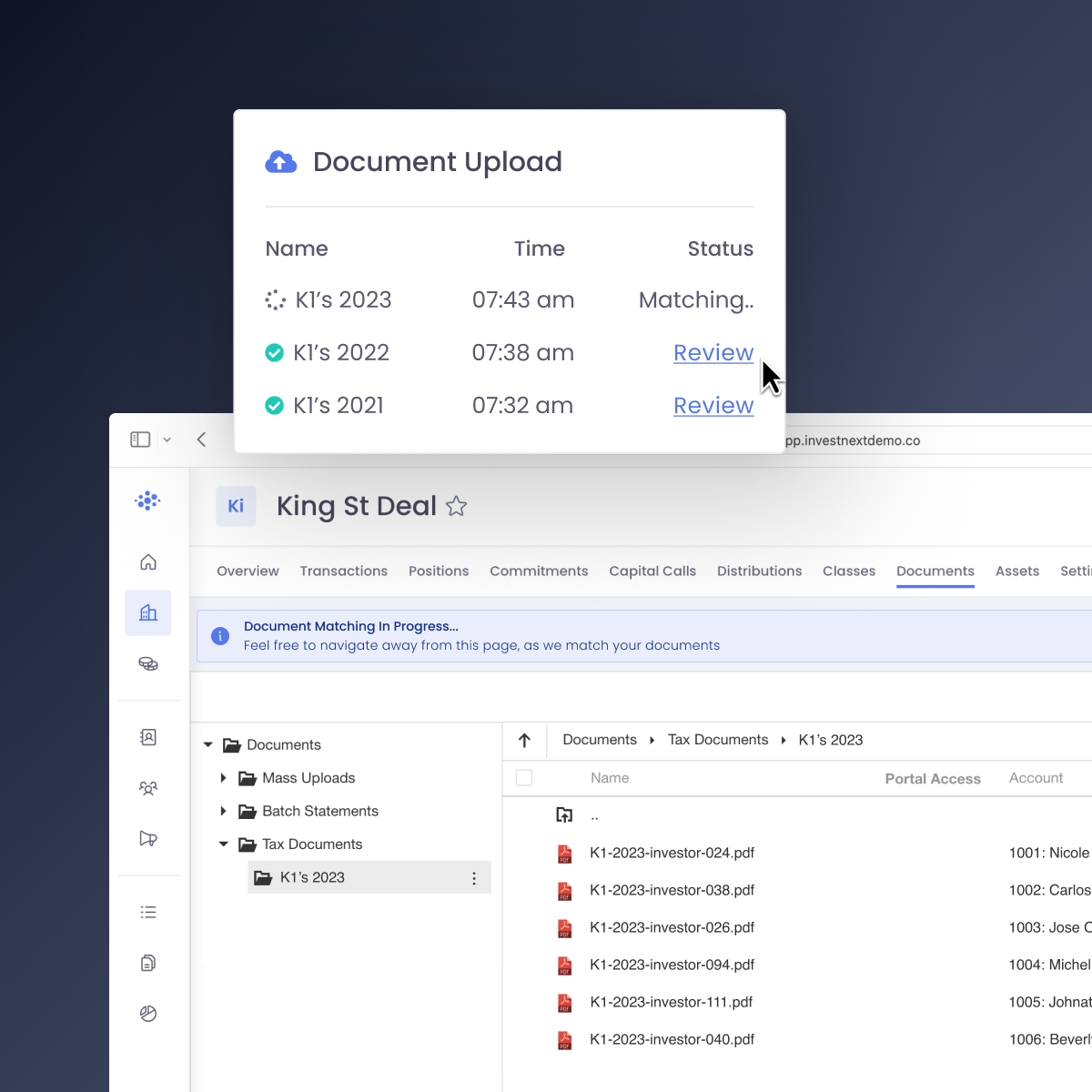

- Bulk Upload Tax Documents: InvestNext allows for the bulk uploading of tax documents in any format, making the process faster and more efficient.

- One-Click K1 Addition to Investor Portal: With a single click, add K1 forms to the investor portal, ensuring that investors have immediate access to their documents.

- Automated Notification to Investors: Once K1s are uploaded, InvestNext sends out notifications to investors, keeping them informed and engaged.

- Automatic Identification and Assignment: The platform’s document management system automatically identifies and assigns K1s to the correct investor, eliminating the need for manual assignment and extensive quality assurance processes.

Final Thoughts

Navigating the complexities of partnership taxation in real estate requires accuracy, attention to detail and typically involves working with a trusted CPA . Real estate funds and syndications must prioritize the timely and correct filing of tax forms and distribution of K1s to avoid penalties and maintain healthy investor relations. Utilizing software solutions like InvestNext can greatly aid in this process, ensuring compliance and efficiency during the taxing tax season. By leveraging its advanced features, you can ensure accuracy, save time, and enhance investor relations, all of which are crucial for successful real estate investment management.

InvestNext offers a compelling solution for real estate professionals looking to optimize their K1 management process. By leveraging its advanced features, you can ensure accuracy, save time, and enhance investor relations, all of which are crucial for successful real estate investment management.

Consider booking a demo with InvestNext to explore how it can revolutionize your K1 dissemination process.