Commercial real estate investors need to do their due diligence when deciding on the best rental property investments. Fortunately, there are a lot of “rules” in real estate that can help guide you to good decisions. One of the most important guiding criteria for investing in real estate is the 1% Rule. Let’s take a look at how to leverage this rule to help with your decision-making.

Definition of the 1% Rule

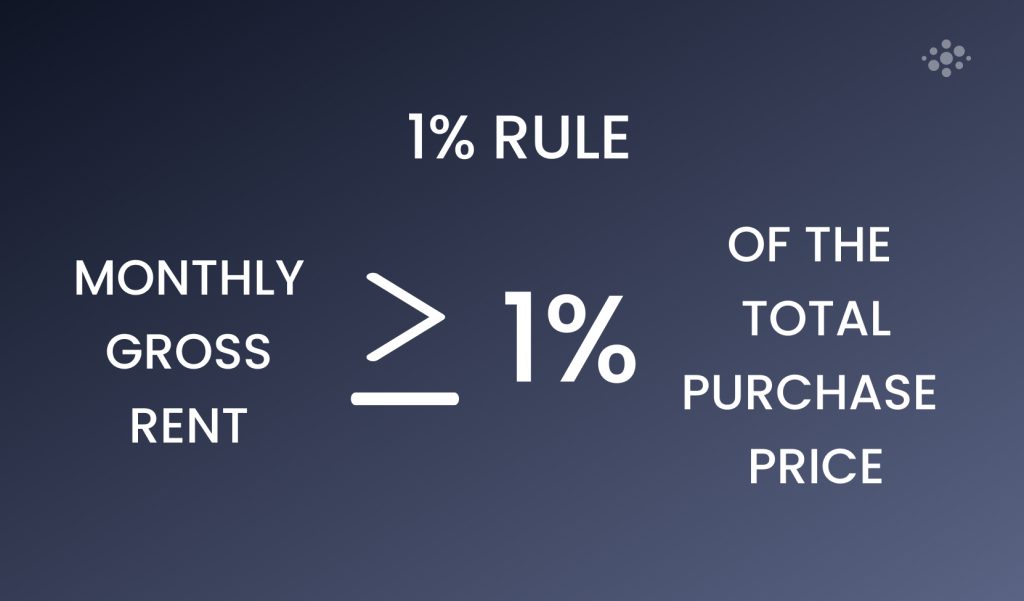

The definition of the 1% Rule is quite simple. The rule states that an investment property’s gross monthly rent income should equal or surpass 1% of the purchase price. This rule helps predict whether a commercial real estate property will provide positive cash flow.

The calculation is pretty straightforward. Multiply the property’s purchase price by 1% or move the decimal point two places to the left. The resulting number represents the minimum monthly rent required to achieve positive cash flow.

Additionally, the purchase price should include any necessary repairs before applying the 1% rule to determine the minimum rental income needed to generate profits.

How It Helps Determine if a Property Has Positive Cash Flow

Commercial real estate success heavily depends on positive cash flow. The 1% rule is helpful in determining whether a property can generate profits. If the rental income is at least 1% of the purchase price, it indicates profitability, meaning the property generates more revenue than expenses.

However, other factors, such as expenses and potential appreciation, should also be considered to make an informed investment decision. For instance, if an investor considers a $300,000 property, a monthly rental income of $3,000 or more would meet the 1% rule and indicate a cash surplus. If the rental income is lower, the investor should evaluate other factors before making a decision.

Illustrations of Applying the 1% Rule in Real Estate Investing

Example 1: Single-Family Home

Suppose you’re considering a single-family home with a purchase price of $170,000. By applying the 1% rule, you should find a mortgage with a monthly payment of $1,700 or less and charge tenants a minimum monthly rent of $1,700. However, suppose the property requires $12,000 in repairs. In that case, you should add the cost of repairs to the home’s purchase price for a total of $182,000, then multiply that by 1% to get a minimum monthly payment of $1,820.

Example 2: Investment Property that Passes the 1% Rule

Suppose you’re interested in an investment property listed for $250,000 that historically charges $2,500 for monthly rent. According to the 1% rule, the monthly rent should equal or greater than $2,500 x 1% = $2,500 per month. This property charges $2,500 per month, so it passes the 1% rule.

Example 3: Investment Property that Fails the 1% Rule

Suppose you’re evaluating an investment property listed for $200,000 with a history of charging $1,800 for monthly rent. This property does not pass the 1% rule as the monthly rent is less than $2,000 (or 1% of the purchase price). In this scenario, you could continue your search for a more profitable rental property or make an offer of no more than $180,000 to purchase the home.

Real Estate Investment Rules: Exploring the 1% Rule and Beyond

While the 1% rule is popular among investors, other investment rules are also used in real estate to determine the best opportunities for purchasing rental properties. These include the gross rent multiplier, the 70% rule, and the 2% rule.

Gross Rent Multiplier

The gross rent multiplier (GRM) calculates how long it will take to pay off the investment by dividing the purchase price by the gross annual rent. The lower the GRM, the more lucrative the property may be. For instance, if you buy a property for $250,000 and the annual rent is $30,000, the GRM is 8.33. You can compare different properties by using the GRM, but keep in mind other expenses such as repair costs, maintenance, operating costs, and vacancy rates.

70% Rule

The 70% rule is used for flipping houses and suggests paying no more than 70% of the property’s estimated after-repair value (ARV) minus any repair costs. To apply the 70% rule, multiply the estimated ARV by 0.7 and then subtract the estimated repair costs. For example, if the ARV of a home is $180,000 and the estimated repair cost is $25,000, the maximum amount you should pay for the property is $109,000.

2% Rule

Similar to the 1% rule, the 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. For example, if a property is purchased for $200,000, the monthly rent should be at least $4,000. Although it’s more extreme than the 1% rule, it can be used in specific markets or to provide a financial safety net in case of vacancies or major repairs.

How the 1% Rule Helps Investors Find Properties with Positive Cash Flow

The rule is an excellent tool for filtering through a long list of potential real estate assets. You will typically begin with a broad range of properties during your due diligence. By applying the 1% rule, you can quickly eliminate unsuitable assets and rank the potential profitability of the remaining properties.

Importance of Positive Cash Flow for Investment Properties

When it comes to rental properties, positive cash flow is one of the most important predictors of success. Positive cash flow indicates that your liquid assets are increasing, so when dealing with commercial real estate, a positive cash flow at a minimum of $100-200 a month is desirable to make a property a good investment.

How Real Estate Investors Use the 1% Rule to Make Better Investment Decisions

The 1% rule is a valuable tool for real estate investors to quickly assess the level of risk involved in an investment property. Calculating it can help you get a general sense of the level of risk involved in an investment property, a higher percentage yields less risk, while a value less than 1% yields significantly more risk.

Additionally, applying the 1% rule can help you in the following ways with investment decisions:

- Prioritizing which properties to pursue

- Ranking potential properties based on their potential positive cash flow

- Eliminating properties that are unlikely to generate profits from consideration

- Deciding whether to negotiate on the purchase price

Limitations of the 1% Rule

While the 1% rule is a useful tool for commercial real estate investors, it is not without limitations and there are certainly other factors to consider.

Situations Where the 1% Rule May Not Be Applicable

There are situations where the 1% rule may not be applicable. One of these is in the event of a housing bubble. If real estate prices are highly inflated, it is possible that almost no properties would meet the criteria. Thus, opting for other considerations of evaluation is important.

Additionally, the 1% rule does not account for upcoming changes to locations affected by the workforce. Consider an area where a factory has been announced to open in a few years, bringing a few thousand jobs. In this situation, demand for housing will likely increase significantly. Thus, a property below the 1% rule may be far above in a few years. Conversely, if an area has a trend of negative population growth, a property above the 1% rule may not be a good investment a few years later.

Other Factors to Consider When Evaluating Investment Properties

In addition to the 1% rule, you should consider a wide variety of factors when considering commercial real estate investment properties, including the following:

- Property location & area trends.

- Your individual investment goals.

- Needed maintenance and renovations.

- Interest rates if buying through financing.

- Overall real estate market.

Importance of Conducting Through Due Diligence

Above all else, the most important thing for real estate investors is to conduct thorough due diligence. Commercial real estate is a lucrative long-term income strategy. However, it requires strong decision-making. The time spent analyzing the potential for a property can payoff significantly over the years. Meanwhile, making a decision without conducting due diligence could spell disaster. When it comes to real estate, data is your biggest asset.

Conclusion: Using the 1% Rule

Ultimately, real estate’s 1% rule states that the gross monthly rent should equal or exceed 1% of the purchase price of a property. If this condition is met, you can expect that the property is likely to yield a positive cash flow.

While it is important to understand that the 1% rule has limitations and due diligence should always be practiced, it is a very easy-to-use tool for evaluating properties to determine their potential for positive cash flow, helping narrow your decision-making process.

Investment Management Software Solutions

As a sponsor, it is crucial to possess an extensive understanding of the real estate industry and the capital raise process. Additionally, utilizing a robust asset administration tool can facilitate the efficient and effective management of your fundraising efforts and increase the chances of success for your next raise.

InvestNext is a full-service investment management platform that allows you to efficiently oversee all aspects of your capital raise in one place. From same-day ACH transactions to waterfall calculations, impress your investors through an intuitive investor portal coupled with stylish deal room functionalities to captivate, attract and retain investors.

Schedule a demo today to see how our team can help you to welcome the next level of raising capital.