Many lenders decide their interest rates by following the “index” rates. These rates are managed by national groups such as the US Federal Reserve and the US Department of Housing and Urban Development, also known as HUD. This means that commercial mortgage rates change every day, and because there’s more risk involved, the interest rates for commercial real estate loans are usually higher than those for loans backed by the government.

In this article, we’ll examine commercial mortgages in-depth and discuss the relevance of 30-year terms, types of rates, and FAQs to help broaden your understanding of the property investment world.

Understanding Commercial Mortgages

A commercial mortgage is a loan given to a business to buy property. They tend to have a lower loan-to-value ratio than residential mortgages and maintain shorter amortization periods. As a result, a bank may want a larger down payment as a percentage of the purchase price. Additionally, they will anticipate that you will repay the loan faster than a homeowner would.

Common Commercial Mortgage Loans

There are four primary types of commercial real estate loans accessible to businesses:

- Term Loans

- Small Business Administration (SBA) Loans

- Business Line of Credit

- Bridge Loans

These assorted loan types often come into play when quick funding is imperative or when bridge gaps in enduring financing arise. Nevertheless, each of these commercial real estate loans exhibits variance in terms of funding timelines and rates.

Therefore, evaluating your business’s specific needs to ascertain the most fitting loan type is crucial.

Term Loans

When people think of a business loan, they’re often picturing a term loan, the most common commercial real estate loan type. With a term loan, you’ll receive a large sum of money that you pay back in equal parts over a set amount of time.

These payment periods, called amortization periods, usually last between one to five years and sometimes even longer than the loan term. The interest rates and the amount you can borrow could change based on the property you want to finance, your own financial needs, and how much money you can put down upfront.

Commercial real estate lenders, online lenders, and conventional banks all provide term loans, with banks being the most difficult to qualify for. Online lenders may be more forgiving when it comes to things like credit ratings, business histories, down payment amounts, etc.

Small business Administration (SBA) loans

The government backs SBA loans. This means if things don’t go as planned, the government will pay part of the money you still owe. This setup makes the lender feel safer and lets you enjoy lower interest rates.

SBA loans are great for refinancing real estate and can be used to cover certain business expenses. This is because they come with longer terms and lower interest rates. However, real estate investors can’t get SBA loans.

To be eligible for an SBA loan, your business must meet these conditions:

- It has to be small enough to fit SBA size standards

- It should be a business that aims to make a profit

- It has to operate within the U.S.

- It must be in need of financial assistance

- The owners of the business must have invested their own money into it

Business Line of Credit

A business line of credit operates much like a business credit card, offering flexibility in obtaining a loan. Borrowers receive approval for a specific amount and can utilize the credit line whenever required, paying interest solely on the actively borrowed sum. Generally, funds can be accessed through a business checking account or a mobile application.

Differing from a conventional or fixed-term business loan that provides a one-time lump sum and requires repayment with interest, a business line of credit offers the advantage of renewability.

As the borrower makes payments, the available credit amount is replenished, much like making payments to reduce a credit card limit. Lenders usually approve business lines of credit for several months or even several years, depending on the specific terms.

Bridge loans

Bridge loans are a short-term financing choice that gives you an immediate cash boost while you’re in the process of securing a more permanent source of funding. These loans are often used by homeowners and businesses that need to buy a property but are still waiting on the sale of another property.

In other words, bridge loans can help fill any gaps in your cash flow that occur between when you need the money and when it becomes available. They’re usually used by businesses that need to pay off a loan but haven’t yet received a new, long-term loan transaction.

Bridge loans usually need to be paid back within a year or less. Plus, while you’re waiting for your new loan funds to come through, you can use a bridge loan to speed up the refinancing process.

Commercial Mortgage Rates

Commercial mortgage rates refer to the interest rates charged on loans used to finance commercial real estate properties such as office buildings, retail spaces, industrial facilities, and multifamily complexes. Unlike residential mortgages, which are primarily used for homes, commercial mortgages are specifically designed for business purposes.

Read more on commercial mortgage rates here.

How are Commercial Mortgage Rates utilized?

Commercial banks tend to charge higher rates and fees for commercial mortgages than residential ones, mainly because there’s a higher risk when lending large sums of money for investments(as stated in the introduction).

The commercial real estate loan amount at risk can lead to a complex loan structure and possible recourse against the borrower’s personal assets, not just the property. This may require borrowers to provide more security measures.

As stated in the intro, commercial mortgage rates frequently change because government entities manage the rates. Additional proponents that affect rates also include::

- Market Conditions: Overall economic conditions, such as inflation, employment rates, and the strength of the real estate market, can impact commercial mortgage rates.

- Risk Assessment: Lenders assess the risk associated with the loan, considering factors like the borrower’s creditworthiness, property location, property type, and cash flow projections. Higher-risk loans may result in higher interest rates.

- Loan-to-Value (LTV) Ratio: The loan amount relative to the property’s appraised value or purchase price affects the interest rate. A lower LTV ratio (a larger down payment) generally results in more favorable rates.

- Term and Amortization: The length of the loan term and the amortization period (the time it takes to repay the loan fully) can impact rates. Longer-term loans may have slightly higher rates due to increased risk exposure for the lender.

- Loan Size: Larger loan amounts might attract more competitive rates compared to smaller loans.

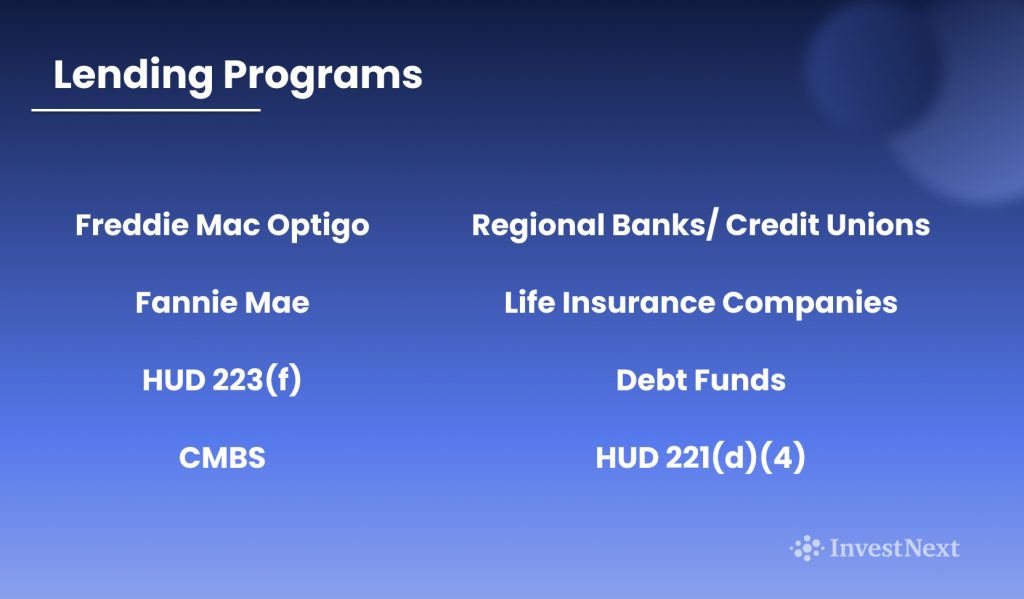

Lending programs

There are eight primary types of business lending programs, each offering a range of interest rates. Real estate investors will use the most current commercial mortgage rate to determine their cost of capital and decide if an investment is worth it.

- Freddie Mac Optigo

- Fannie Mae

- HUD 223(f)

- CMBS

- Regional Banks/Credit Unions

- Life Insurance Companies

- Debt Funds

- HUD 221(d)(4)

30-Year Commercial Mortgage Rates

A 30-year commercial mortgage is a long-term loan that provides businesses with the convenience of lower monthly payments and a fixed repayment schedule. This type of mortgage offers stability and predictability, making it an attractive choice for businesses looking to spread out their real estate financing obligations over an extended period. However, it’s important to consider both the advantages and drawbacks of a 30-year term before making a decision.

When it comes to real estate loan rates, borrowers have the option of choosing between fixed rates and variable rates. Fixed rates remain constant throughout the loan term, providing businesses with a predictable repayment structure. On the other hand, variable rates fluctuate based on market conditions, potentially offering lower initial rates but subject to change over time.

Benefits of 30-Year Fixed Commercial Mortgages

Choosing a 30-year fixed commercial mortgage might be your business’s best decision. Wondering why? Let’s break down the benefits into simple terms.

Enjoy Stability with Financial Predictability

Think of your mortgage as a marathon, not a sprint. With a 30-year fixed commercial mortgage, your business gets to know exactly how much needs to be paid each month for the next three decades. Imagine having no surprises on your monthly mortgage payments; it’s like having a roadmap for your financial journey. This predictability helps your business plan ahead, making budgeting easier and financial management stress-free.

Lower Monthly Payments: Keep More Money in Your Pocket

Here’s the thing about longer loans – they stretch out your payments over a more extended period. This stretching results in smaller, more manageable monthly payments. This means your business gets to keep more money each month, which can be used for other ventures or unexpected costs.

An Invisible Shield Against Inflation

Inflation, although predictable, gradually erodes the value of the dollar over time. This long-term impact can be substantial, spanning across a 30-year period. However, with a fixed-rate mortgage, you secure the cost of your loan. It’s akin to having an agreement that guarantees your favorite pizza will remain at the same price for the next three decades, regardless of external factors.

As inflation rises, the real cost of your mortgage effectively decreases. It acts as an invisible shield that safeguards your business from the stealthy threat of inflation.

Opting for a 30-year fixed commercial mortgage is more than just a means to purchase or renovate property; it grants your business the invaluable gift of financial stability, flexibility, and protection. It represents a long-term investment that can significantly impact your business’s financial bottom line.

Choosing the Right Lender

Selecting the right lender is crucial when seeking a 30-year fixed commercial mortgage. Here are some key factors to consider:

Evaluate Financial Stability

Before committing to a lender, it is important to assess their financial health. A financially stable lender with a strong track record indicates that they can support your loan throughout its term. This ensures that you can rely on them for ongoing assistance and reduces the risk of encountering problems down the line.

Clarity is Key: Look for Transparency

Transparency is essential in any financial relationship. When evaluating lenders, look for those who are upfront about their terms and conditions, interest rates, fees, and any potential penalties. Transparent communication fosters trust and helps you make well-informed decisions about your mortgage.

Flexibility Matters: Seek Adjustable Terms

Flexibility in terms of prepayment options and loan modifications can significantly affect how the mortgage aligns with your long-term financial plans. Look for lenders offering options that allow you to adjust your payment schedule or make extra payments without substantial penalties. This flexibility allows businesses to adapt to changing circumstances or take advantage of opportunities for growth.

How to Secure a 30-Year Fixed Commercial Mortgage:

Securing approval for a 30-year fixed commercial mortgage requires careful preparation and attention to detail. Here are some steps to follow:

Review Your Credit Score

A higher credit score generally leads to more favorable loan terms. Before applying for the mortgage, ensure that your business has a solid credit history. Review and address any potential issues, such as outstanding debts or inaccuracies in your credit report, to improve your chances of obtaining better loan terms.

Understand Property Value

Appraisers evaluate the value of the property to determine whether it can adequately cover the loan amount in case of default. Clearly understand the property’s market value to set realistic expectations. Conduct thorough research and consider obtaining a professional appraisal to ensure the property’s value aligns with your financing needs.

Prepare Financial Statements

Lenders will carefully examine your financial statements to assess your ability to repay the loan. Make sure your records are up-to-date, accurate, and clearly represent your business’s financial standing. Prepare necessary documentation such as income statements, balance sheets, and cash flow statements to demonstrate your business’s financial stability and capacity to fulfill the mortgage obligations.

FAQS

What is the typical down payment amount for a commercial mortgage?

Down payments for commercial real estate loans generally range between 20% and 50%, varying depending on the specific loan situation. The down payment, also referred to as the equity requirement for the investment, is determined by factors such as location, asset type, borrower experience, and investment risk profile.

What minimum down payment is typically required for a commercial real estate loan?

Typically, the minimum down payment for commercial real estate loans is around 20% of the purchase price.

What are the closing costs associated with a commercial real estate loan?

Closing costs for commercial real estate loans encompass various expenses, some of which are regulated by law. These costs may include appraisal fees, credit reports, fees for real estate attorneys, title insurance, and recording charges. Commercial mortgage borrowers are also typically responsible for the lender’s real estate attorney fees. It’s important to be aware of negotiating minor details in loan documents that may not warrant revision.

What are the usual fees associated with a commercial mortgage?

Usual fees associated with a commercial mortgage include application fees, extension fees, and potential exit fees. The loan’s Term Sheet will provide a comprehensive schedule of these fees. Commercial property investors may also be responsible for settlement agent or broker’s commissions, as well as lender origination points.

What is the Commercial Mortgage Debt Service Coverage Ratio?

The Commercial Mortgage Debt Service Coverage Ratio (DSCR) measures the net income generated by commercial properties compared to the loan payment. Lenders typically require a minimum DSCR of 1.2, meaning the property’s income should be at least 1.2 times the monthly loan payments.

Investment Management Software Solutions

As a sponsor, it is crucial to possess an extensive understanding of the real estate industry and the capital raise process. Additionally, utilizing a robust asset administration tool can facilitate the efficient and effective management of your fundraising efforts and increase the chances of success for your next raise.

InvestNext is a full-service investment management platform that allows you to efficiently oversee all aspects of your capital raise in one place. From same-day ACH transactions to waterfall calculations, impress your investors through an intuitive investor portal coupled with stylish deal room functionalities to captivate, attract and retain investors.

Schedule a demo today to see how our team can help you to welcome the next level of raising capital.

InvestNext’s content insights are dedicated to providing educational and informational content only and should not be construed as investment, tax, financial planning, legal, or real estate advice. InvestNext is not acting as an advisor or agent to you. Please seek advice from your own experts in these areas. While InvestNext strives to provide accurate information, we make no representations or warranties about the accuracy or completeness of the information contained in this article.

Additional Resources:

To read more on commercial real estate loans, click here.

To read more about commercial mortgage rates, click here.