Capture inbound funds and initiate payments to your investors in minutes – not days.

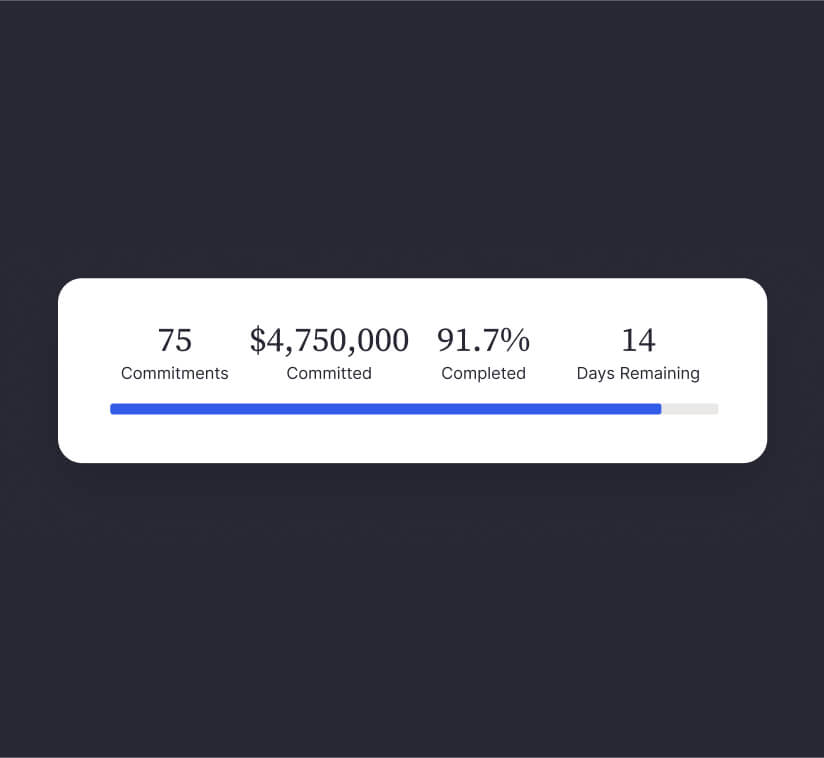

Accelerate capital raising with secure inbound payments up to $1M per transaction.

Streamline payment processes and increase investor satisfaction.

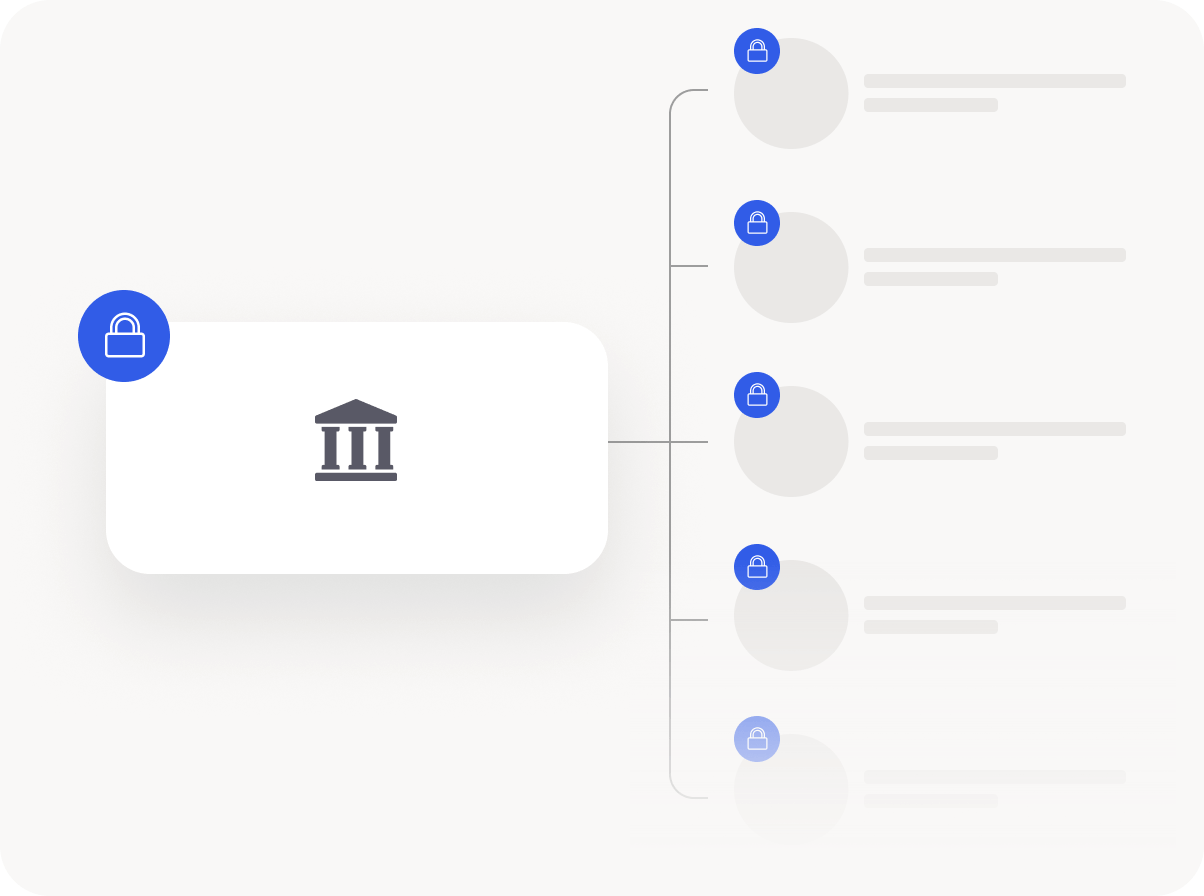

Prevent fraudulent activity with InvestNext’s financial institution grade security.

“The turning point in our decision-making process was InvestNext’s Automated Payments. This feature not only meant significant time savings but also fit seamlessly into our long-term plans.”

Patrick Keltner, Director of Innovation | Griffin Partners

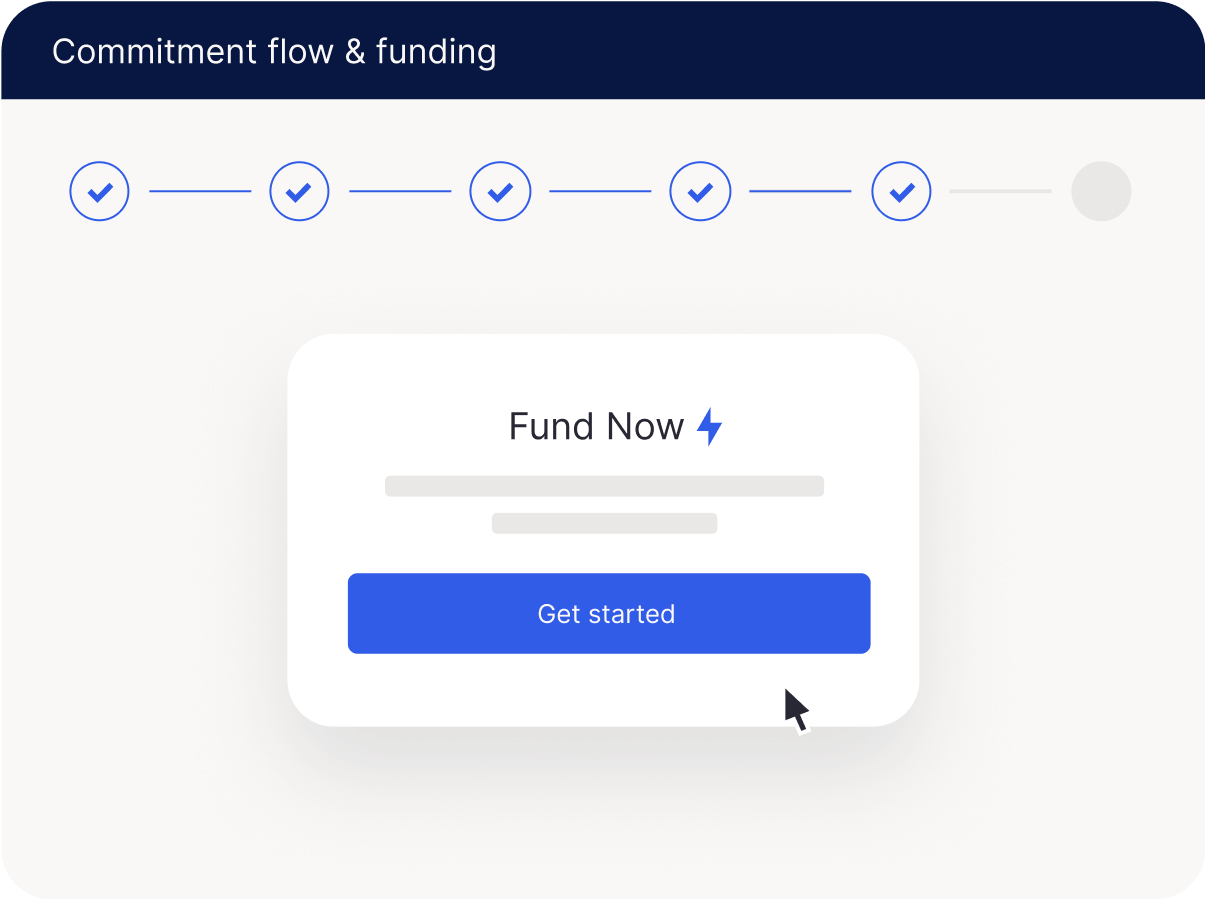

Accelerate capital raising with secure inbound payments up to $1M per transaction. Investors link their bank accounts within minutes and fund directly from the commitment flow. Investor entities are automatically added as positions to your cap table, eliminating manual administrative work for your raise.

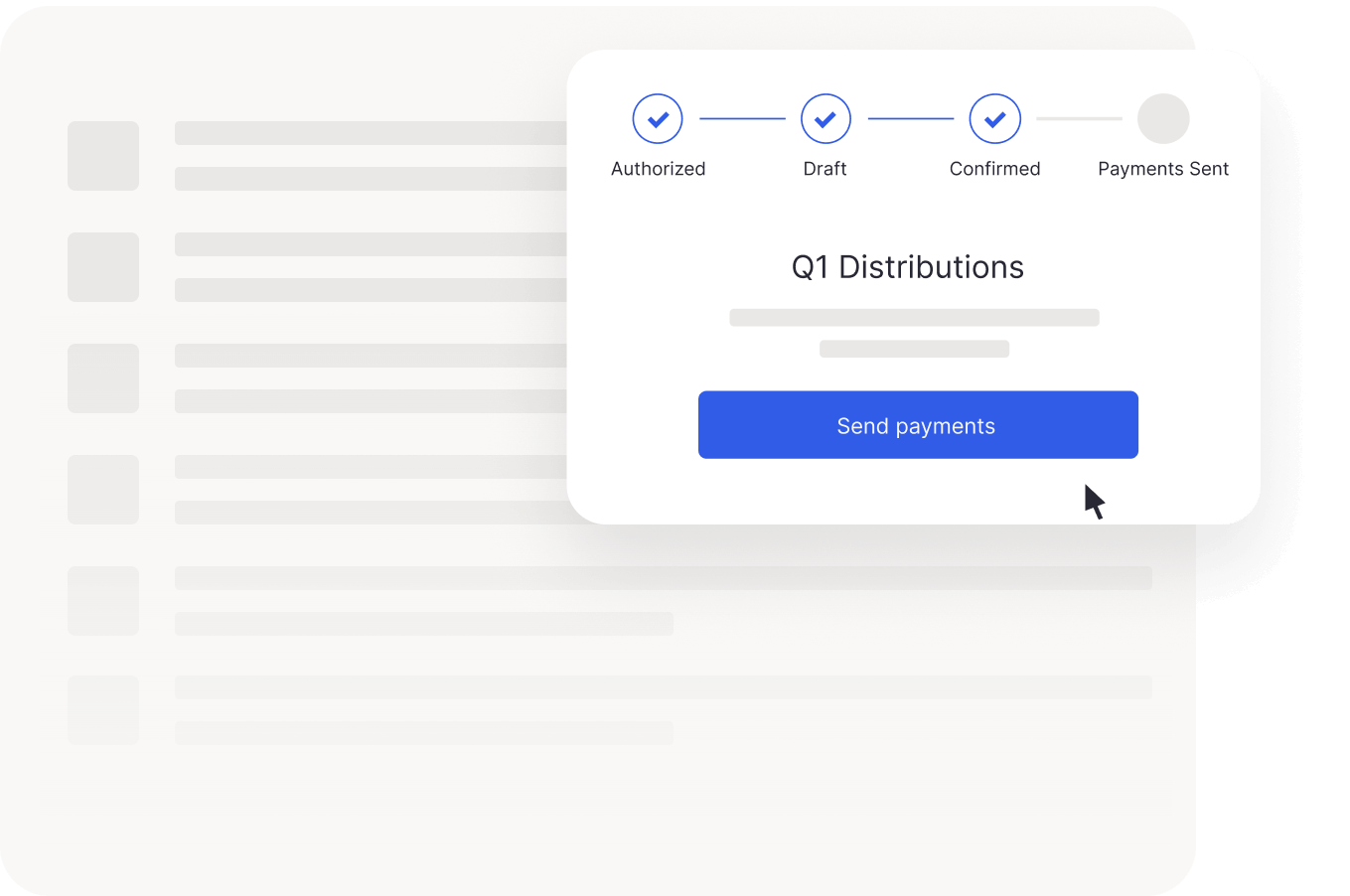

Streamline your payment process to increase investor satisfaction. Send payments to investors in a few clicks. They are automatically notified when transfers are initiated, and when funds land in their accounts – keeping them informed at every stage.

Prevent fraudulent activity with InvestNext’s financial institution grade security, leveraging the highest grade encryption and authentication standards to keep payments secure and investors’ data safe.

Create complex distribution waterfalls, automatically calculate distributions and send secure payments to your investors with a few clicks.

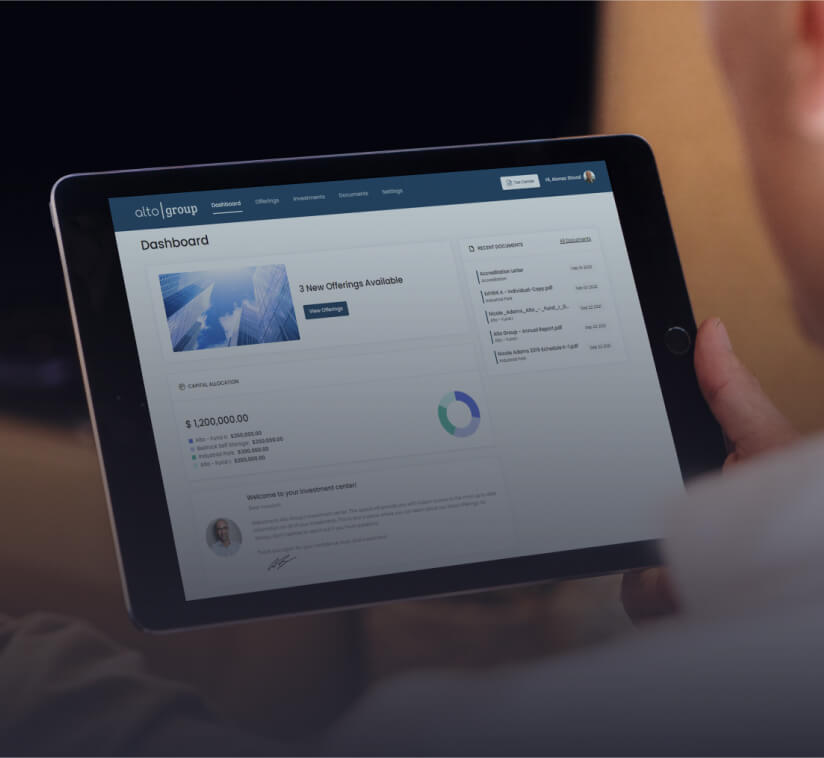

Streamline your fundraising process with engaging deal rooms, frictionless commitment flows, e-signatures, secure inbound funding, automated CRM and back-office integration.

Build credibility and impress your investors with a modern, user-friendly experience. Share documents, send updates, and capture investment intent in a centralized hub.

Upgrade to the Real Estate Investment Management Platform

Discover the proven strategies for accessing your share of the $7 trillion retail capital opportunity before your competitors do.

Here’s what you can expect from our guide:

Gain access to proven frameworks and retail investor acquisition strategies.

Retail investors have different expectations. Get insights into best practices on managing your retail investors.

An influx of retail capital will likely come some internal challenges. See how you can align your operational capacity with growing demand.