Flexible Funds and Fund of Funds

Centralize operations and offer more ways to invest – without being limited by your investment management platform. From flexible funds to fund of funds, empower your team with straightforward technology to simplify sophisticated fund strategies.

Evolve your strategy over time through a platform that evolves with you.

Support complex structures inside the platform from start to finish.

Provide unparalleled transparency to bring your investors closer.

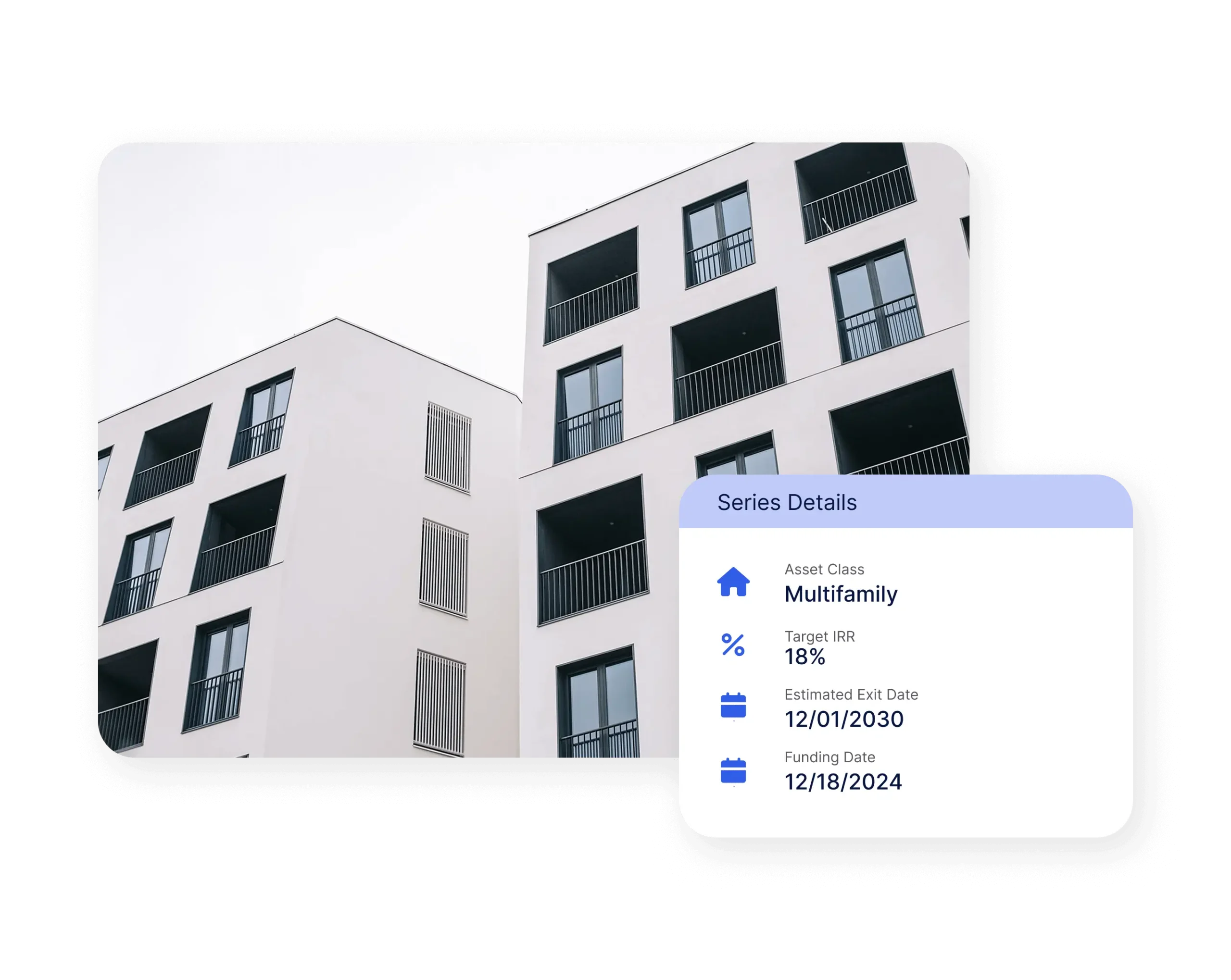

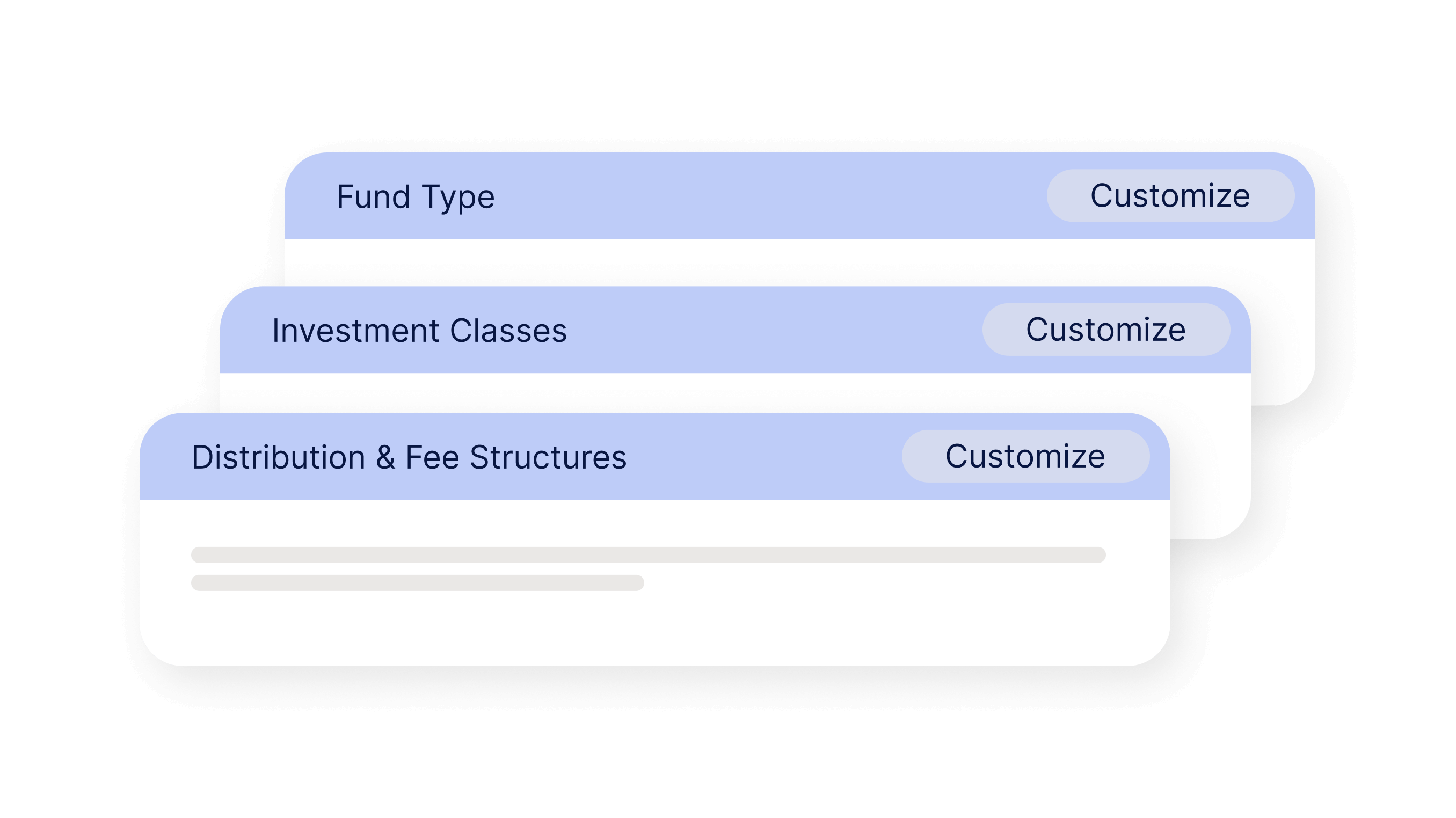

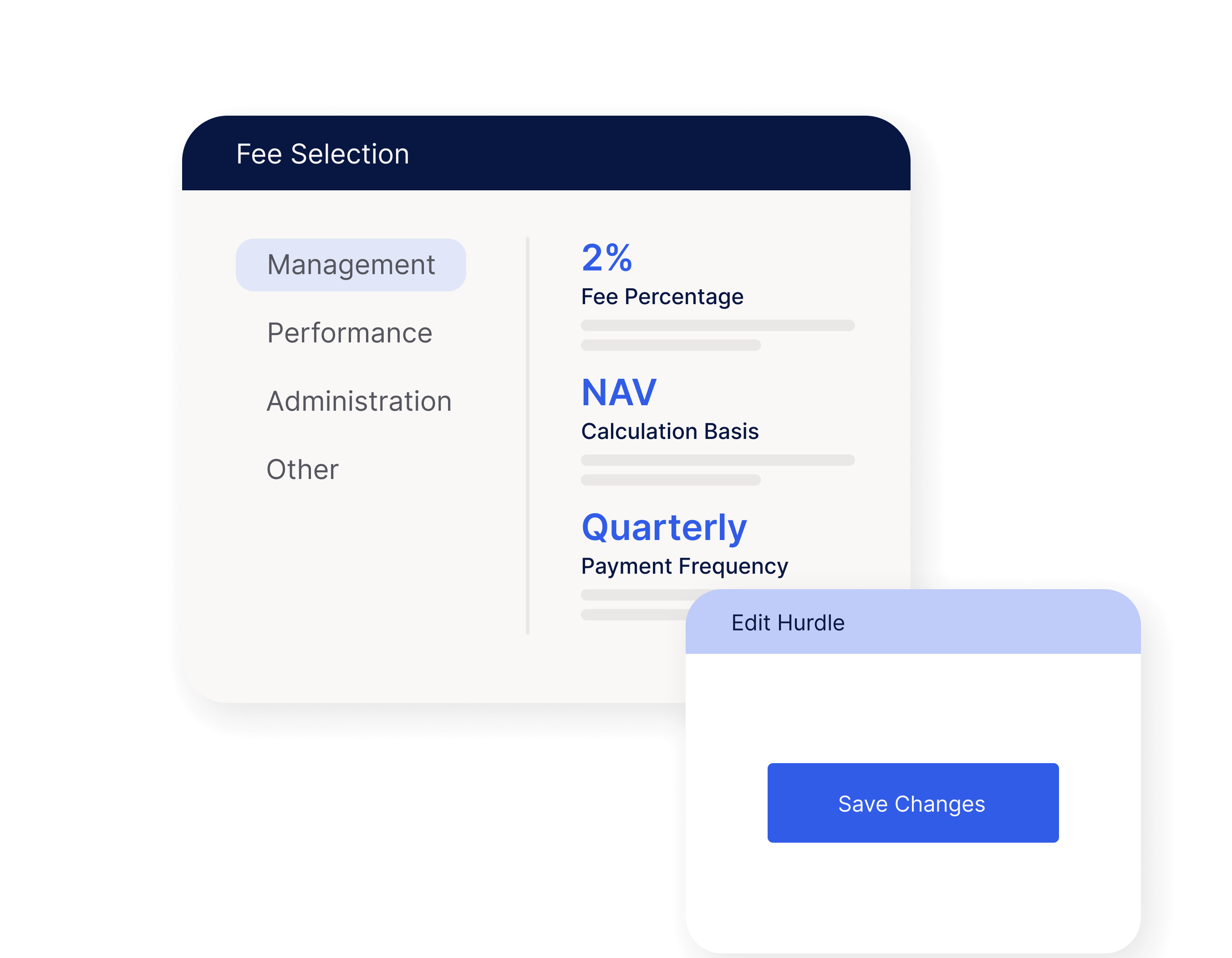

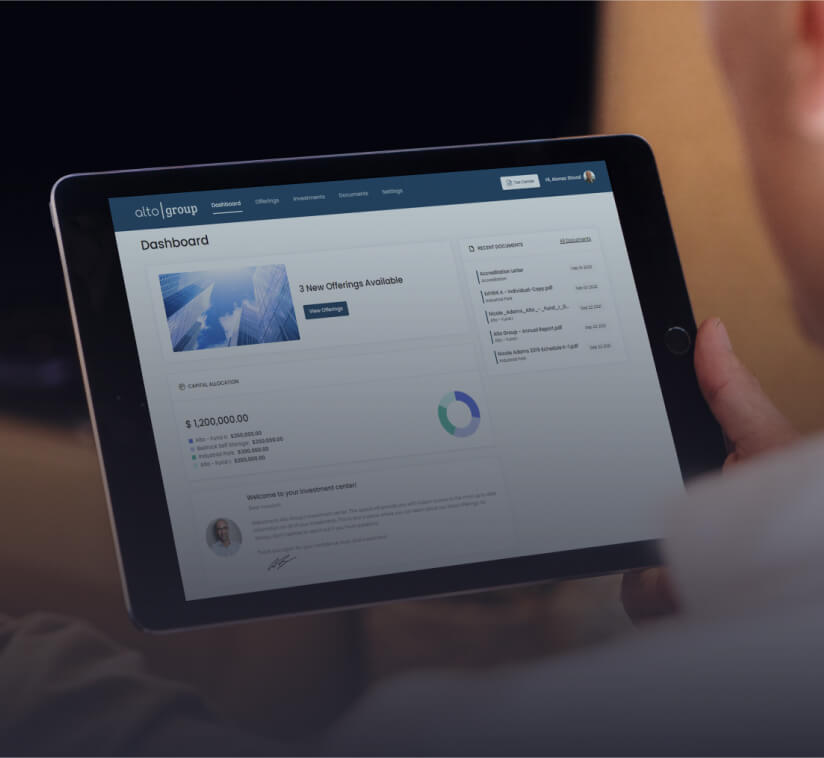

Design investment vehicles that work for you and your investors. Whether you’re building flexible funds or managing fund of funds, you can customize your investors’ experience with multiple investment types, strategies, and classes from one, centralized platform.

Centralized

Flexible Funds:

Fund of Funds:

“My positive experience with InvestNext was anchored in its user-friendly interface, robust distribution capabilities, cost-effectiveness, and exceptional support.”

Natalia Linchenko | TAG SLC

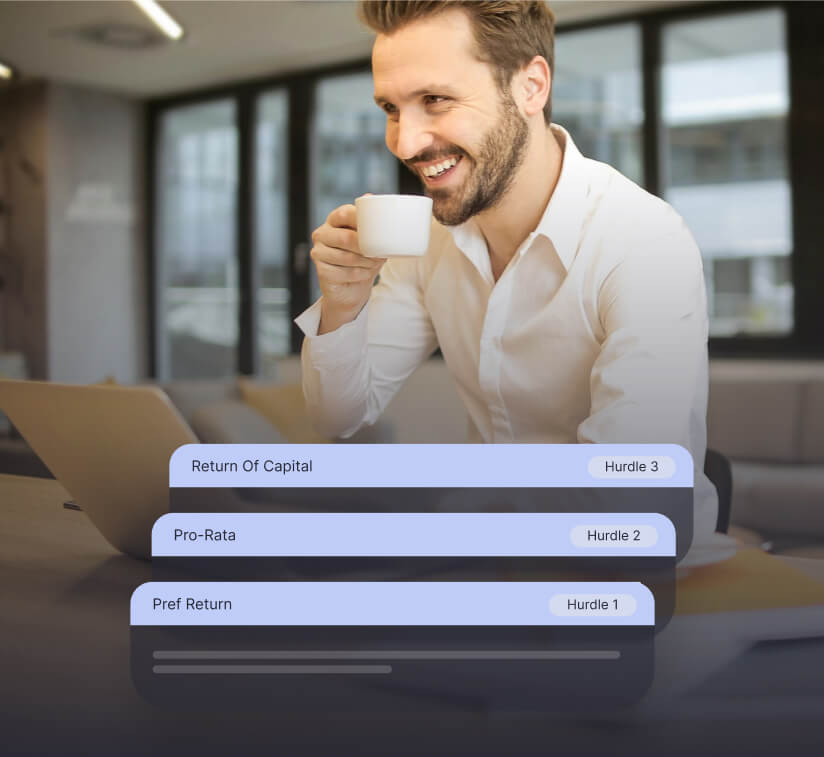

Create complex distribution waterfalls, automatically calculate distributions and send secure payments to your investors with a few clicks.

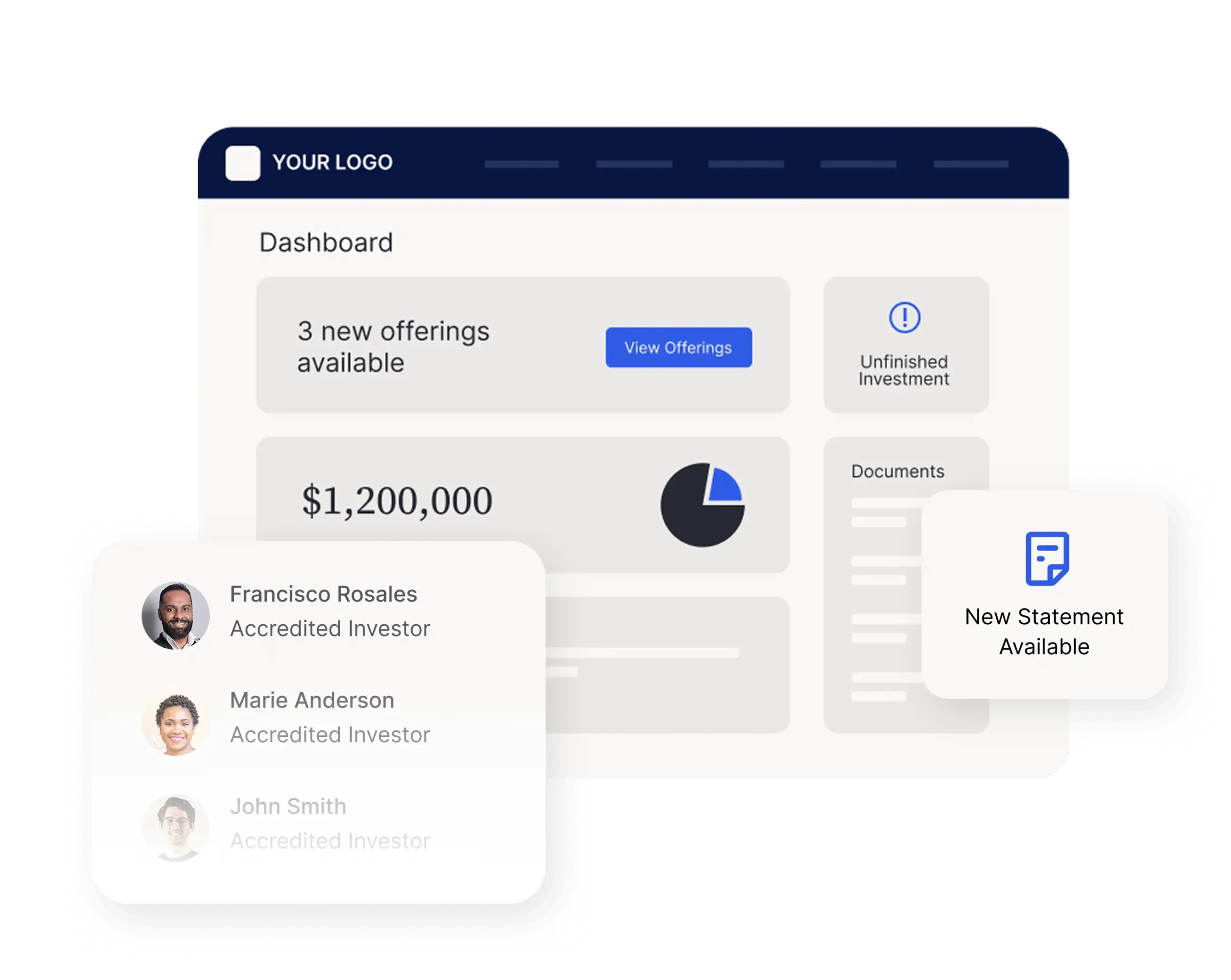

Deliver a modern, user-friendly experience to impress your investors. Share documents, send updates, and capture investment intent in a centralized hub.

Reduce administrative overhead with automated financial management.

Discover the proven strategies for accessing your share of the $7 trillion retail capital opportunity before your competitors do.

Here’s what you can expect from our guide:

Gain access to proven frameworks and retail investor acquisition strategies.

Retail investors have different expectations. Get insights into best practices on managing your retail investors.

An influx of retail capital will likely come some internal challenges. See how you can align your operational capacity with growing demand.