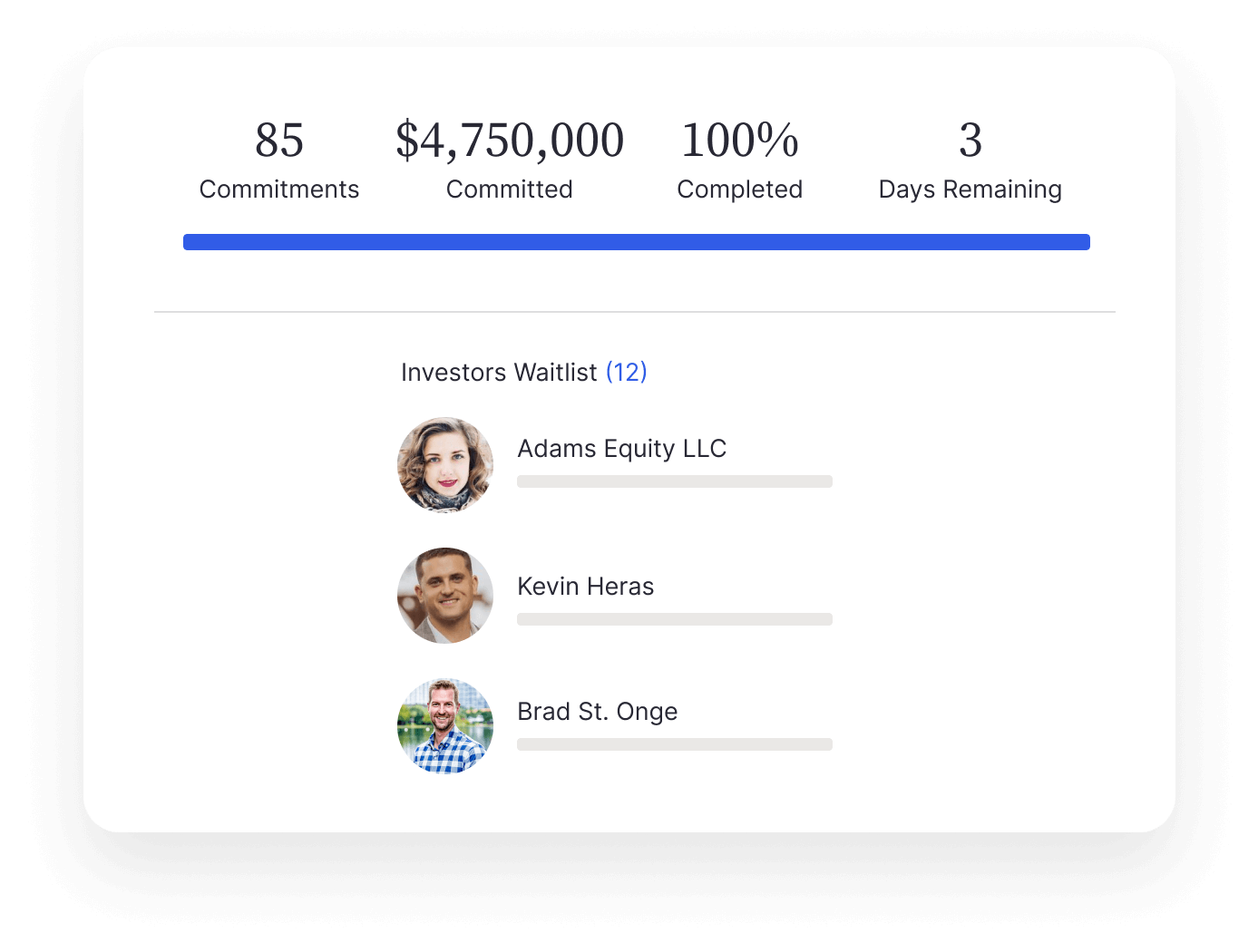

Oversubscribed Offerings

Never miss your next commitment – even when unexpected changes arise. Capture investor interest for fully subscribed deals. If funding needs change, you can secure commitments fast and keep deals moving forward.

Set thresholds during deal creation to automatically trigger a waitlist once deals are fully committed.

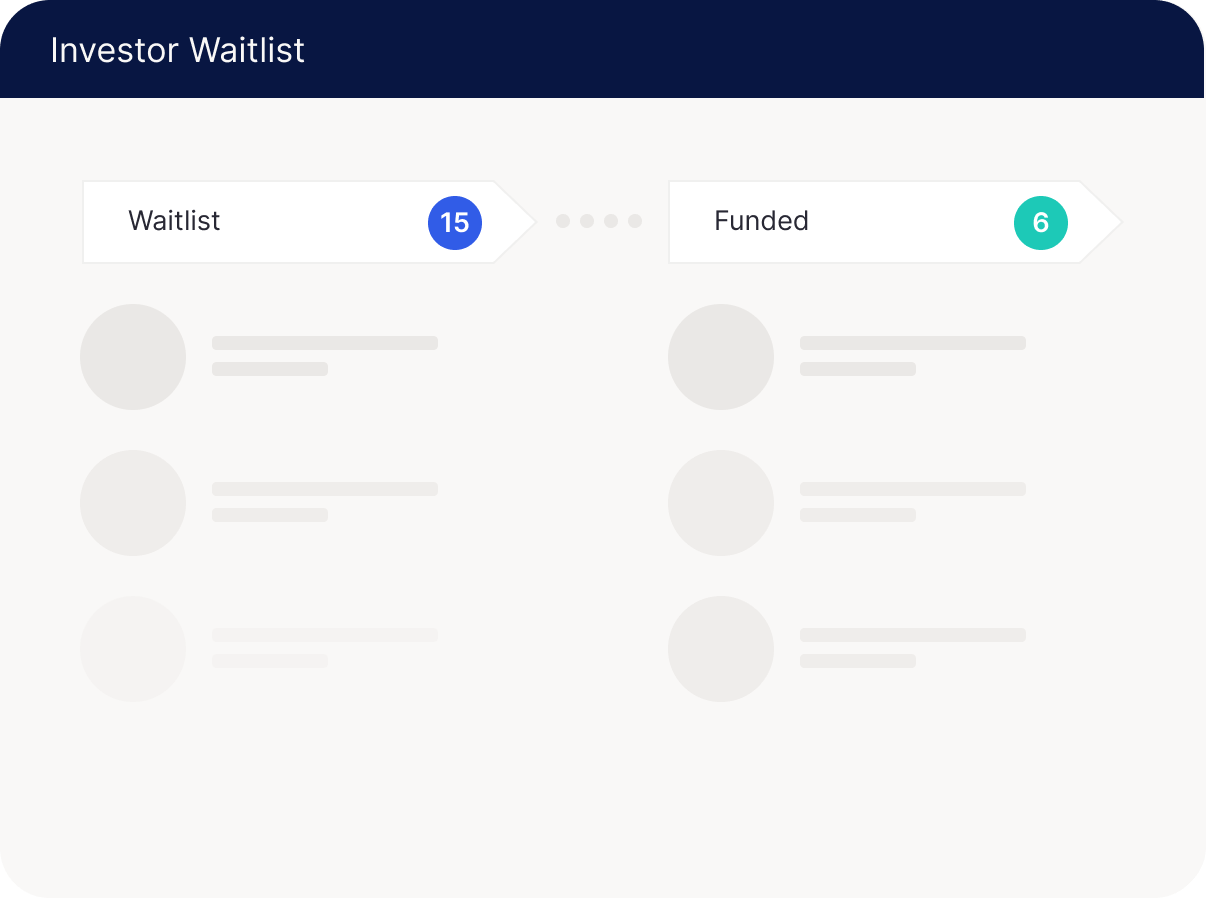

Save time by reaching out to a ready list of interested investors whenever funding needs change.

Learn what types of offerings your investors are most interested in to inform future projects.

Automated Thresholds

When creating an offering, configure your deal to automatically open a waitlist once your set commitment threshold has been reached. Investors can make soft commitments and never miss out on potential opportunities

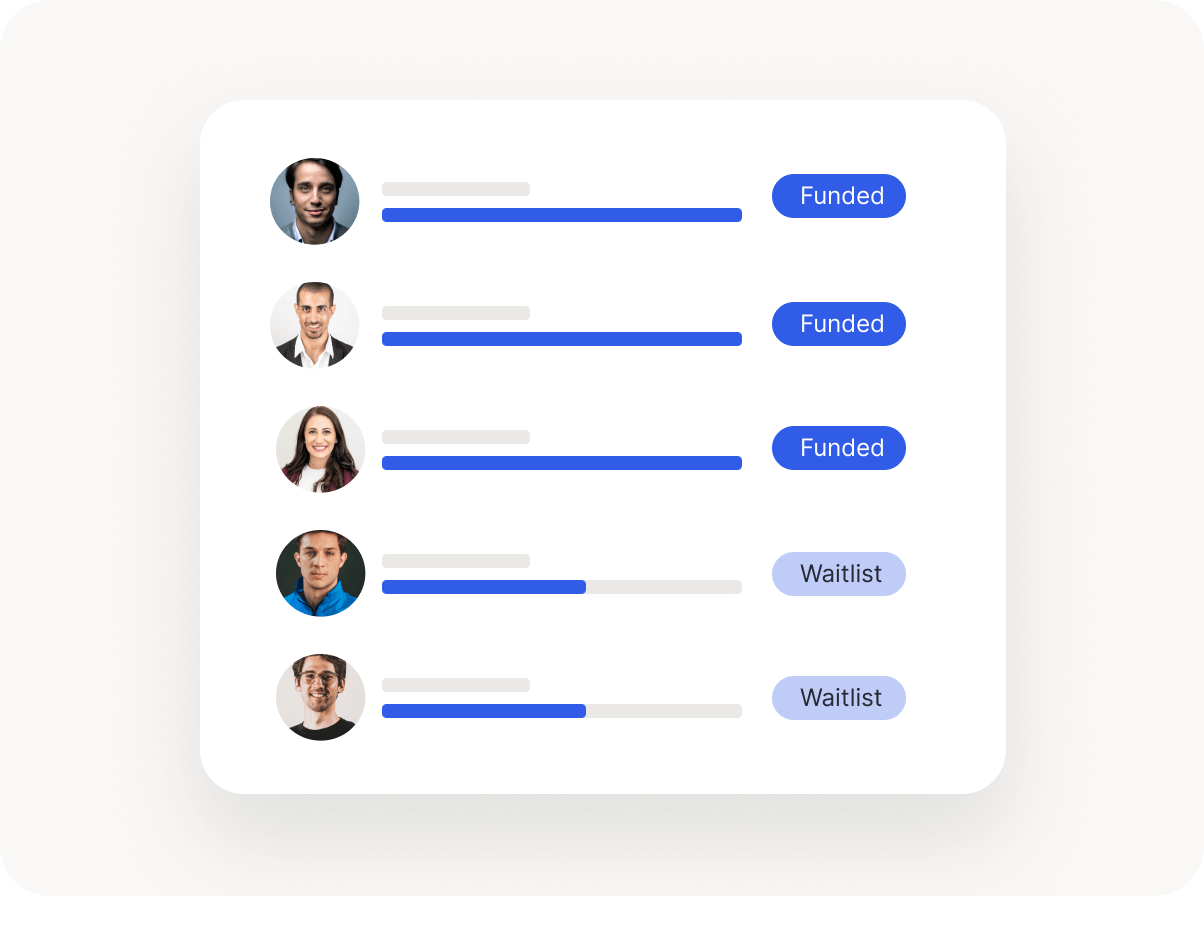

Fast Follow-Up

Ensure projects never go off track by notifying interested investors quickly if commitments fall through or funding needs change. Notify interested investors on your waitlist to secure commitments and expedite the process with fully integrated inbound funding so you keep moving forward.

Investor Insights

Track interest, relationships, and detailed investor attributes to build a holistic capital pipeline for future offerings. Increase capital raising efficiency for future offerings with an engaged audience of waitlisted investors..

“They are user friendly and provide a simple user experience for our investors. I like how you can do everything from capital raise to process distributions to manage your investors in the CRM.”

Chris Lynn | Verified G2 review

Create complex distribution waterfalls, automatically calculate distributions and send secure payments to your investors with a few clicks.

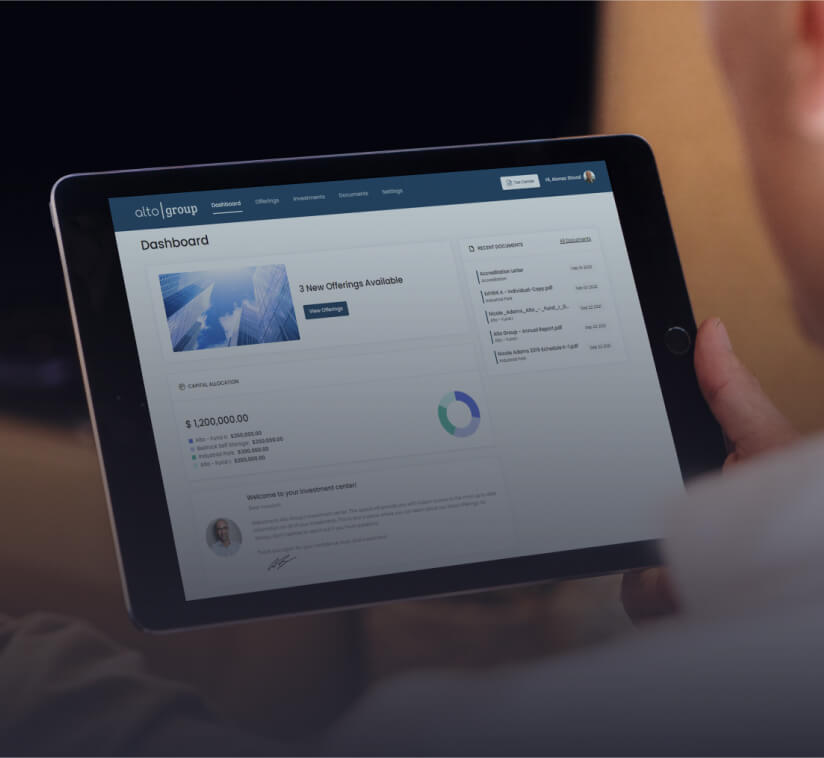

Build credibility and impress your investors with a modern, user-friendly experience. Share documents, send updates, and capture investment intent in a centralized hub.

Reduce administrative overhead with automated financial management.

Our analysis reveals the five strategies reshaping CRE capital raising.

Learn how top fund managers are rewriting the rules of engagement.

Drastically reduce the time it takes to raise and distribute capital.

Transform time-intensive processes into powerful and efficient investor relations tools