Designed for General Partners, Fund Managers, and IR professionals.

Our pricing adapts to the complexity and size of your operation from $5M firms to billion dollar funds.

$499 /month

Scale your operations, automate processes, and delight your investors. Best for firms with an existing portfolio of investors and assets – up to $10M in Investor Equity Under Management.

$699 /month

Accelerate growth and partner with a dedicated account manager to expand your team’s capacity. Best for firms managing between $10M–$500M in Investor Equity.

Everything in Core +

Contact Us

Power complex capital structures, collaborate across teams, with waived ACH fees to support high-volume transactions. Best for firms managing portfolios over $500M in Investor Equity.

Everything in Firm +

After that $99/Mo

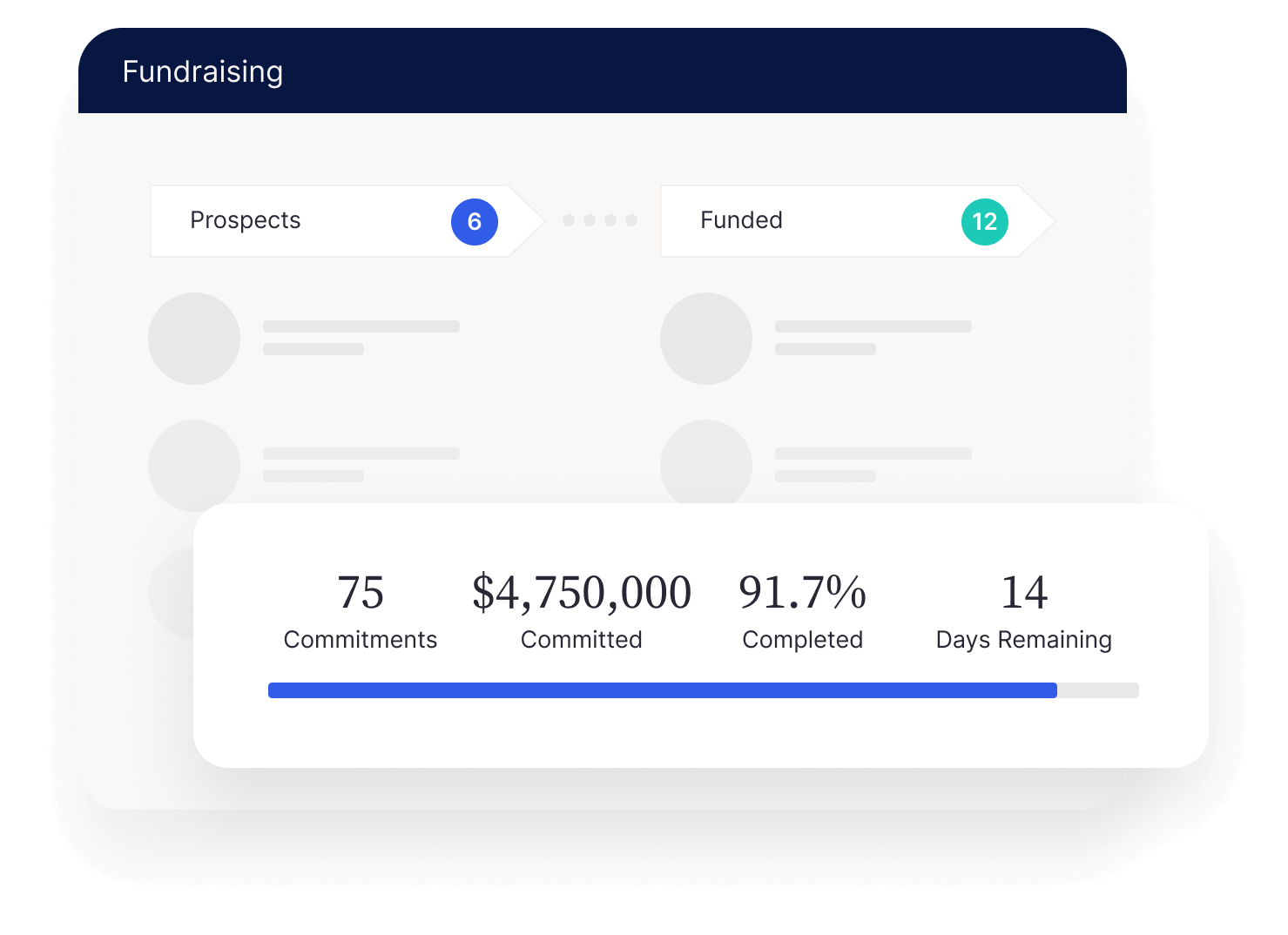

Prepare for your raise with fundraising features free for 30 days.

Core: Everything a sponsor needs to raise capital, onboard investors, automate investor reporting, distributions, and other back office operations. This plan is designed for sponsors that have an existing portfolio of investments.

Firm: Accelerate growth and partner with a dedicated account manager to expand your team’s capacity. Best for firms managing between $10M–$500M in Investor Equity.

Institution: Power complex capital structures, collaborate across teams, with waived ACH fees to support high-volume transactions. Best for firms managing portfolios over $500M in Investor Equity.

InvestNext offers flexible pricing options to suit your needs. InvestNext operates on a subscription model with a 12 month initial agreement. This ensures consistent, quality service for all your investment needs.

Core starts at $499 per month, paid annually, up to $10 million Funds Under Management. Our flexible pricing scales with you as you grow, based on your active Funds Under Management.

Firm starts at $699 per month, paid annually. Our flexible pricing scales with you as you grow, based on your active Funds Under Management.

Our subscription model is designed to provide flexibility and value, aligning with your investment journey. The pricing for our services includes an initial data migration and onboarding fee, which is determined based on your tier and the specific services you select.

Funds Under Management is defined as the capital being managed within your portfolio.

Note that if Funds Under Management increase or decrease, your monthly subscription will be updated throughout the subscription period accordingly.

We’ve developed partnerships with leading payment processors across the globe – with InvestNext, you can transact up to $1,000,000 in a single transaction.

InvestNext includes integrated payments. This feature enables you to collect and distribute funds directly within the platform. This is performed via Automated Clearing House (ACH). The Incoming & Outgoing Funds fee operates on a pay-as-needed model. We charge 0.03% + 25¢ per individual payment transacted (capped at $25). For instance, if you were to send a $5,000 distribution to an investor, you would pay $1.75 to transact that distribution directly through InvestNext. To reach the $25 cap, you would have to send a distribution to an investor in excess of $83,000. This fee enables us to maintain our direct connectivity to the ACH network, regardless of which bank you or your investors use. It also enables investors to update their banking details via the portal, without you having to manage it manually in the system. Of course, our Incoming & Outgoing Funds feature is totally optional. You can still export your distributions to the appropriate file format and run payments outside of InvestNext.

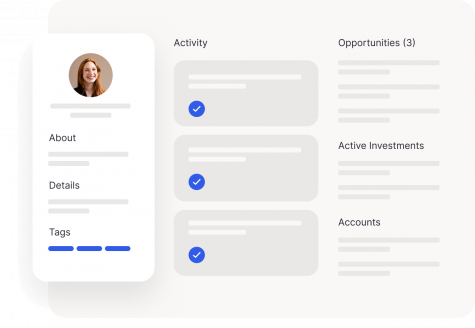

Never miss your Next Investor

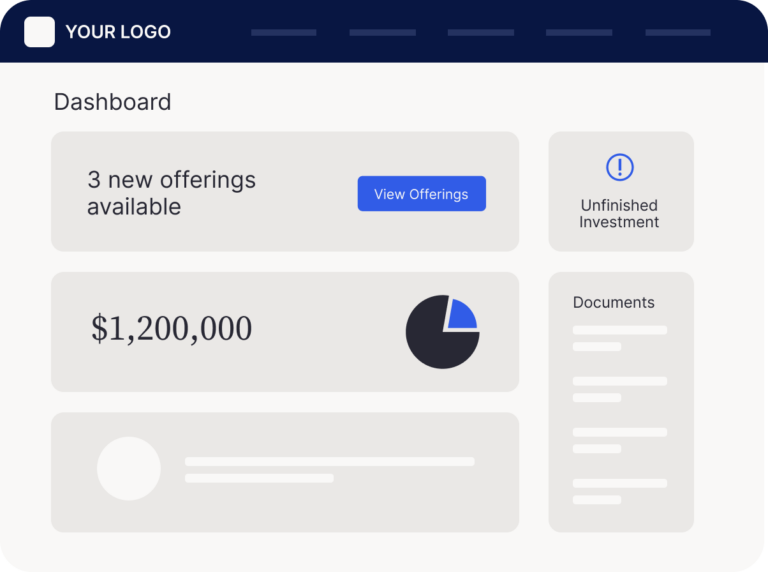

Build credibility and impress your investors with a modern white label investor portal. Accelerate capital raising with professionally customized deal rooms, frictionless commitment flows and secure inbound funding.

Build credibility and enhance investor satisfaction – all while reducing workload with easy-to-use functionality and streamlined platform integration.

Go from awareness to funded in minutes with engaging deal rooms, frictionless commitment flows, and secure inbound funding. Create seamless experiences that build lifetime investor relationships.

Access our industry-leading fund administration partner network. Efficient, accurate, and timely administration for any syndication or fund structure.