As inflation rates rise in the US, real estate investors must understand the implications held on their investment portfolios. Commercial real estate (CRE) investing during inflation is widely considered to be a strong hedge due to its stable income and the potential to increase rents. In this article, we will discuss the impact of inflation in the CRE industry and provide guidance for investors looking to allocate capital to this asset class.

What is Inflation?

Most people have at least a basic understanding of inflation. Essentially, it is a phenomenon where prices of goods and services rise, resulting in a decline in purchasing power over time.

The rate at which purchasing power declines is measured by tracking the average price increase of a basket of selected goods and services over a specific period. This price rise is often expressed as a percentage and means that the same amount of currency buys fewer goods or services than in the past. Conversely, deflation is the opposite of inflation, where prices decrease and purchasing power increases.

Effect on Supply & Demand

Supply and demand are the fundamental forces driving economic models, impacting everything from the milk you purchase at the supermarket to CRE. Inflation, in particular, can significantly affect these principles.

As the inflation rate rises, people become less inclined to purchase goods at an increased price. This leads to a decrease in demand, causing producers to manufacture fewer goods and reducing the overall supply. As a result, inflation directly impacts both the supply and demand sides of the market.

Effect on Purchasing Power

Purchasing power is another important economic concept. This details the strength of a particular currency in terms of the amount of goods and services that can be bought with it. Since inflation increases the cost of things, it also decreases the purchasing power of a currency.

Inflation’s Impact Varies by Asset Type

From an investment standpoint, the vital thing to consider regarding inflation is that different types of assets are impacted at different rates. This can be complex; however, we will provide a basic overview.

Liquid assets tend to be more negatively impacted by inflation because they do not appreciate much over time. Additionally, holdings with long-term fixed cash flows, such as bonds, are negatively affected because their purchasing power will decrease over time. Assets with adjustable cash flows, such as rental property, tend to perform better with rising inflation as they can adjust to the market.

Commercial Real Estate and Inflation, Real Value of Cash Flows

We have noted the impact of inflation on a person’s purchasing power or their ability to buy goods. For example, higher prices for groceries mean a person can purchase fewer groceries. This is a fairly easy aspect to understand. However, dealing with major decisions such as the real estate market can get a bit more complicated. Let’s take a look.

High Inflation and the Housing Market

When it comes to significant purchases like vehicles and homes, inflation’s impact is more complex. At the national level, inflation is typically controlled through interest rate adjustments. When inflation becomes too high, the government raises interest rates to slow down the economy and keep prices from rising further.

These increased interest rates can have a direct impact on the housing market. Most home purchases are financed through mortgages, and higher interest rates can make it more expensive to purchase a home. For instance, a couple purchasing a $300,000 home with a 4% interest rate mortgage may end up paying an additional $600 per month if interest rates increase to 7%. As a result, high inflation rates can discourage individuals from buying homes and instead opt to rent.

Inflation can also affect the real estate market, including the cost of housing. As the prices of goods and services rise, construction expenses also go up, resulting in an escalation of housing prices. This trend may deter potential homebuyers and generate greater demand for rental properties. Therefore, comprehending how inflation influences mortgage rates and the real estate market is vital when contemplating investment decisions in this sector.

How Commercial Real Estate Investing Effectively Hedges Inflation

Amidst inflation, numerous individuals aim to hedge their investments to minimize the impact on their portfolios. This is where real estate investing comes into play, as it provides a major benefit in this regard.

Commercial Real Estate & Stability

Times of inflation often seem as if nothing is truly stable. After all, most assets decline in value. However, there are several types of assets that can weather inflationary periods. Commercial real estate is one of the most stable over time. Price increases tend to raise the property’s value as a tangible asset. Inflationary periods are often associated with rent increases, which help investors weather inflation by increasing their cash flows.

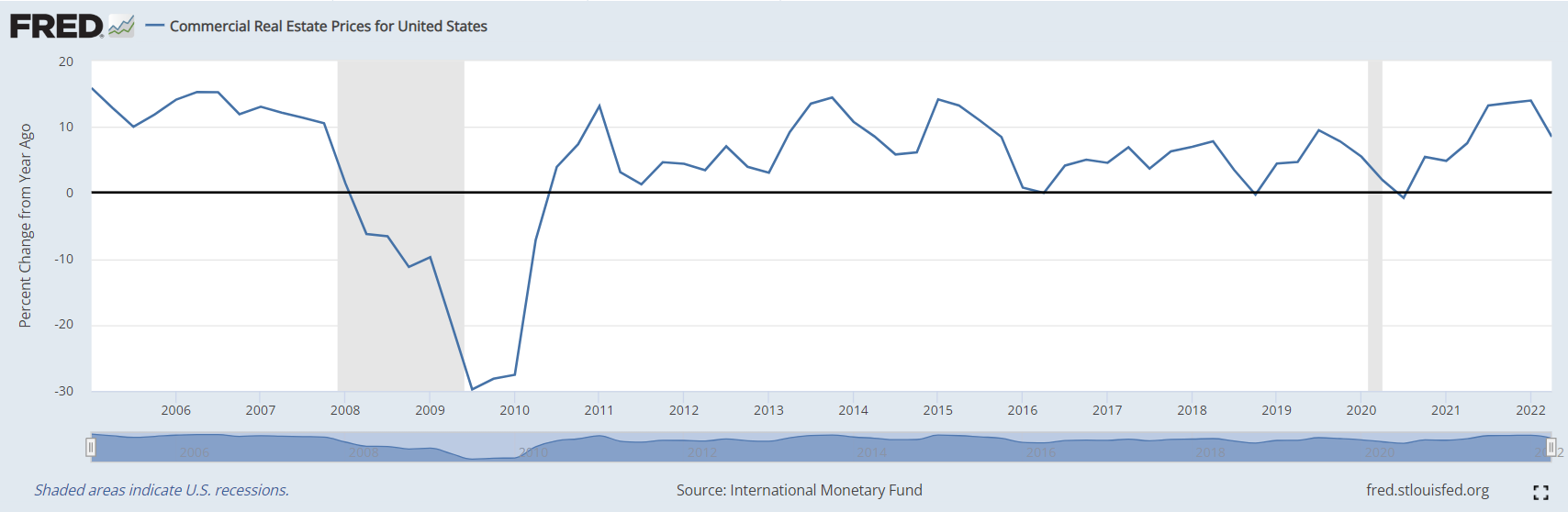

A look at the historical performance of commercial real estate illustrates its relative stability. As this graph from the Federal Reserve shows, commercial real estate has consistently appreciated, even during the COVID recession. The one exception was the 2008 market turnover, which was unique as it was driven by banks issuing bad-faith mortgage loans, directly impacting the housing market. Prices also quickly rebounded afterward.

Factors that Affect Real Estate Investing as a Hedge

While commercial real estate investing during inflation has traditionally been a favorable decision, there are a variety of factors that you need to consider when examining an asset’s ability to serve as a hedge against inflation. Below are some of the key things to keep in mind.

- Lease Duration. Long-term leases are not well positioned to serve as hedges as they tend to prevent you from increasing rent to respond to the market. Thus, shorter leases are ideal.

- Type of Debt. Fixed-rate mortgages with commercial real estate are optimal for inflationary periods as they allow you to pay off a loan with money worth less than it was when you took out the loan. Collateralized debt obligations (CDOs) are risky but tend to perform well during inflation as well. Conversely, adjustable-rate mortgages are poor financing options for inflationary periods.

- Cap Rate Movement. Cap rate is the percentage of a commercial real estate property’s value generated in revenue each year. A positive cap rate movement as rents increase illustrates stronger performance as a hedge against inflation.

Identifying the Best Commercial Real Estate Investments During High Inflation

Commercial real estate sectors perform well when it comes to inflation. Consider investing in the following types:

- Multifamily Apartments. Apartment buildings are substantial during times of inflation for numerous reasons. There tends to be increased demand for rent. Additionally, these properties tend to have high cap rates as many units generate revenue.

- Industrial Assets. Industrial assets also perform well during times of inflation. Industrial vacancy rates continue to fall despite inflation, with record capital entering the sector.

Considerations for Real Estate Investors

In addition to the types of assets to invest in, you should also spend some time thinking about other factors, including the following:

- Risk Appetite. An important thing for any investment is how much risk you are comfortable with. Even relatively stable investments like real estate carry risk. Consider your comfort before investing.

- Cap Rate Expectations. Real estate investors typically have expectations in terms of their cap rate. Consider your goals in this area and benchmark against similar properties when looking for potential investments.

- Diversification. Perhaps the most important aspect for real estate investing is diversification. Holding multiple types of assets in different markets provides the highest level of protection against inflation. Ensure that you are evaluating your real estate portfolio with an eye toward diversifying.

Weather Inflation with Commercial Real Estate Investing

Commercial real estate has long been considered a safe haven for investors looking to hedge against the effects of inflation. This is due to the stability of income potential and the ability to adjust rental rates to match rising operating costs. However, real estate investors must conduct thorough research and analysis to ensure they make informed decisions aligning with their financial goals. Factors such as lease duration, debt type, and asset class all play a crucial role in the success of a commercial real estate investment.

One of the main challenges faced by investors during times of inflation is rising interest rates. As the Federal Reserve seeks to control inflation, it may raise interest rates, making it more expensive for investors to borrow money for property purchases. This can impact the profitability of a commercial real estate investment, particularly if the property is financed through a mortgage.

As the cost of goods and services increases, construction costs also heighten, leading to higher building and maintenance costs for commercial properties. This can result in higher rental rates and potentially lower demand for commercial properties as businesses may seek to reduce overhead costs.

Therefore, in order to make informed investment decisions during times of inflation, it is important to understand the role of the Federal Reserve and rising interest rates, as well as the potential impact of inflation on the commercial real estate market. By diversifying their commercial real estate portfolios and carefully considering factors like lease duration, debt type, and asset class, investors can better navigate the challenges posed by inflation and position themselves for success in the long term.

Investment Management Software Solutions

As a sponsor, it is crucial to possess an extensive understanding of the real estate industry and the capital raise process. Additionally, utilizing a robust asset administration tool can facilitate the efficient and effective management of your fundraising efforts and increase the chances of success for your next raise.

InvestNext is a full-service investment management platform that allows you to efficiently oversee all aspects of your capital raise in one place. From same-day ACH transactions to waterfall calculations, impress your investors through an intuitive investor portal coupled with stylish deal room functionalities to captivate, attract and retain investors.

Schedule a demo today to see how our team can help you to welcome the next level of raising capital.