A significant aspect of preserving investor confidence and obtaining financial commitments is by providing additional safeguards for ACH payment transactions. Investors want reassurance that their resources will be sent directly to the recipient, and as the sponsor, you want to ensure that these transactions are locked in so the deal can be completed successfully.

However, manual methods of securing commitments often come with a serious downfall, a lack of security. Physical wire transfers offer no transparency and irreversible consequences if cash is sent to another individual. In addition to insufficient protection, fraudsters are always on the watch, trying to acquire tracking information and transaction codes to hack anonymously into accounts.

Lastly, consider the expense associated with wire transfer fees. While some banks may not charge a fee to accept wired payments, others do, ranging from $25 to $30 per transfer to bank accounts in the US.

So what’s the solution?

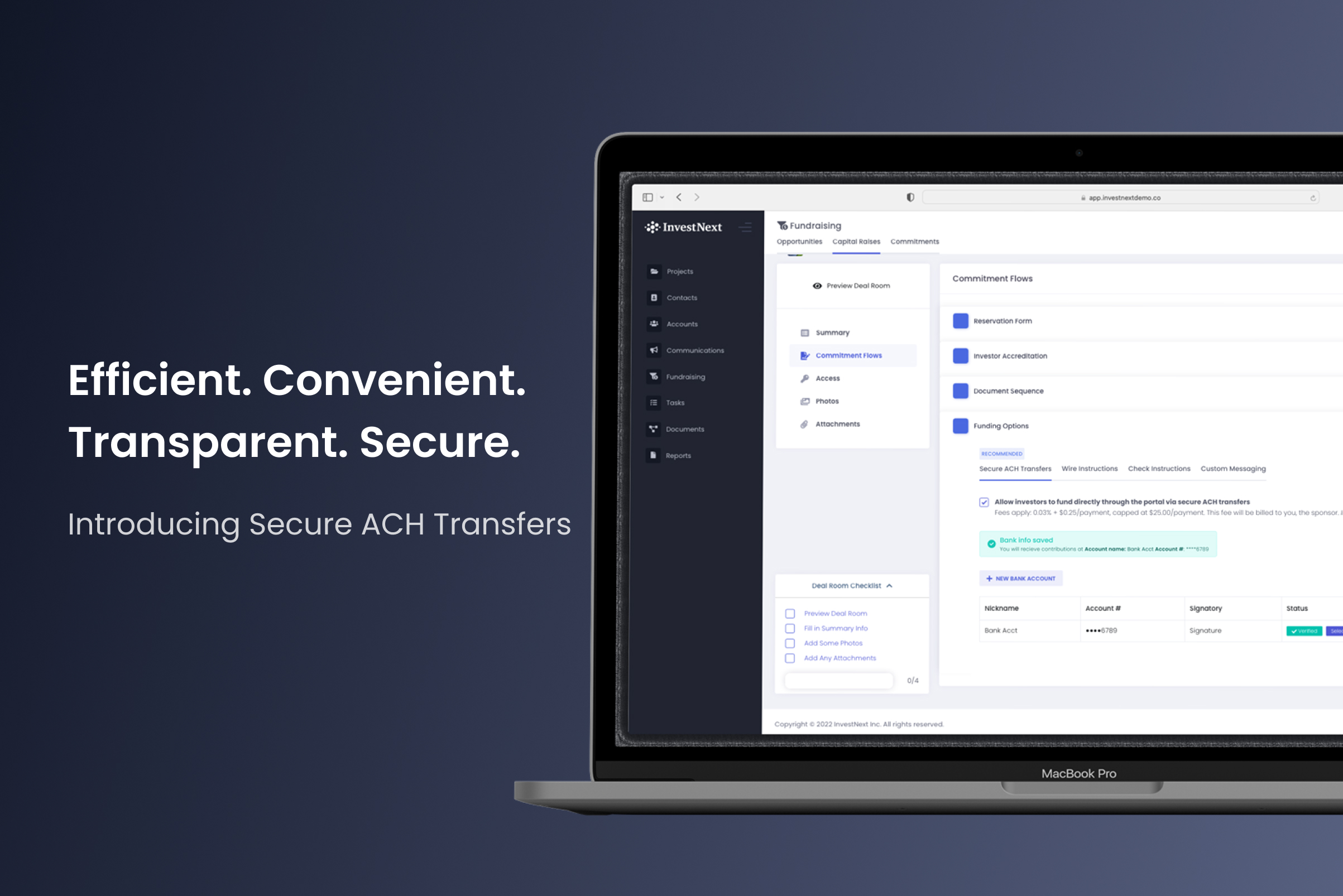

To offset these challenges between investors and sponsors and to help maintain a level of confidence between both parties, we are thrilled to introduce Secure ACH Funding, a robust financial tool designed to address the irregularities around money transfers and reduce the manual operations that would otherwise be a part of your daily workflow.

Investors can send funds safely and securely within the investor portal – through Plaid’s data protection infrastructure and Dwolla’s ACH payment API, safeguarding private bank information and sensitive financial data while reducing the possibility of fraud.

What Makes ACH Funding More Secure?

ACH (or Automated Clearing House) is governed by the National Automated Clearing House Association (Nacha), which oversees guidelines regarding electronic payments in the United States.

Nacha is responsible for developing and monitoring rules and codes of ethical practice, risk management, and quality within the ACH networking system for financial institutions. These security guidelines protect sensitive ACH data for merchants and third-party processors.

Under these strict systems, ACH provides secure transmission of funds that are always monitored and easy to be traced from person to person or entity to entity. In addition to security, ACH payments provide convenience in reconciling issues that may occur in the middle of a transaction. Through ACH payments, the direct transfer of funds is made between accounts, and account numbers are kept private. If an error occurs – ACH payments can always be retracted, while wire transfers cannot be reversed.

Lastly, ACH payments have gained traction and are widely used as the most common method of B2B electronic payments. Total dollars transferred through ACH payments topped $8.89 trillion in 2021, outperforming check and wire transfers.

More Benefits Of ACH Funding

In addition to having that extra layer of protection, ACH payments act as a convenient payment solution for managing cash flow efficiently between businesses. Common uses for ACH payments include:

- Enabling customers to move funds: This is in a form of peer-to-peer (P2P) payments for goods and services.

- Funding customer accounts: ACH payments is a reliable and cost-effective option for real estate investment management firms. Once a customer has confirmed their account info, they can quickly solidify their commitments by paying the sponsor the desired amount for the deal.

- Accepting payments: Mobile payments online or through physical storefronts.

- Moving internal funds: For various reasons, businesses often maintain a number of bank accounts, sometimes with different banks. When transferring funds between accounts, using ACH is less expensive and more effective than using wire transfers for checks.

- Lower costs: Processing costs associated with credit card and debit card transactions are relatively higher than ACH fees. Wire transfers as well are higher, averaging around $25 a transaction. ACH payments, on the other hand, run about $0.29 per transaction. The lower cost makes ACH payments excellent for organizations that handle a significant number of B2B payments, as well as for other recurring payments such as salaries.

- Convenience: ACH payments offer convenience for you and your customers for various reasons. It takes time and effort to monitor paper bills, make trips to the bank, carry a checkbook, mail payments (assuming that is still a thing), and send payments via the mail. However, all transactions made using ACH payments are electronic and accessible from any location at any time.

- Reduce Human Error: According to IBM Security’s 2020 Cost of a Data Breach Report, human errors account for 23% of data loss. The same report also estimated that data breaches caused by human errors cost businesses an average of $3.3 million per breach. With ACH payments, you eliminate the chance for human mistakes to occur. [1]

Other ACH use cases include billing/recurring payments, paying taxes, and business-to-business supplier transactions. To find out more, check out Why do businesses use choose ACH?

Bird’s Eye View on Fund Visibility

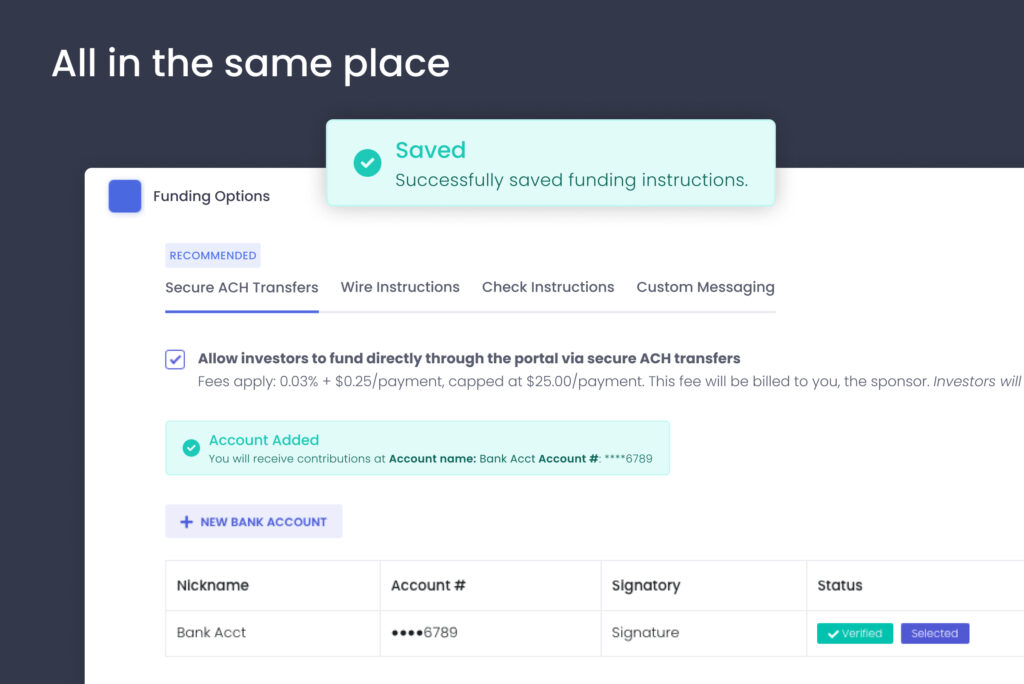

While raising capital, visibility and time are crucial when acquiring resources. This means that you need to be notified throughout the transactional cycle. Secure ACH Funding lets you and your investors view when funds are released, pending, and safely obtained into all verified accounts while you manage commitments.

As we mentioned previously, wire transfers cost. Secure ACH Funding conveniently caps ACH fees at $25, which is less than standard bank fees. Therefore, enabling you to seamlessly collect up to $500k from a single investor without worrying about exhausting fees on moving transactions.

Why Should You Use ACH Funding With Us?

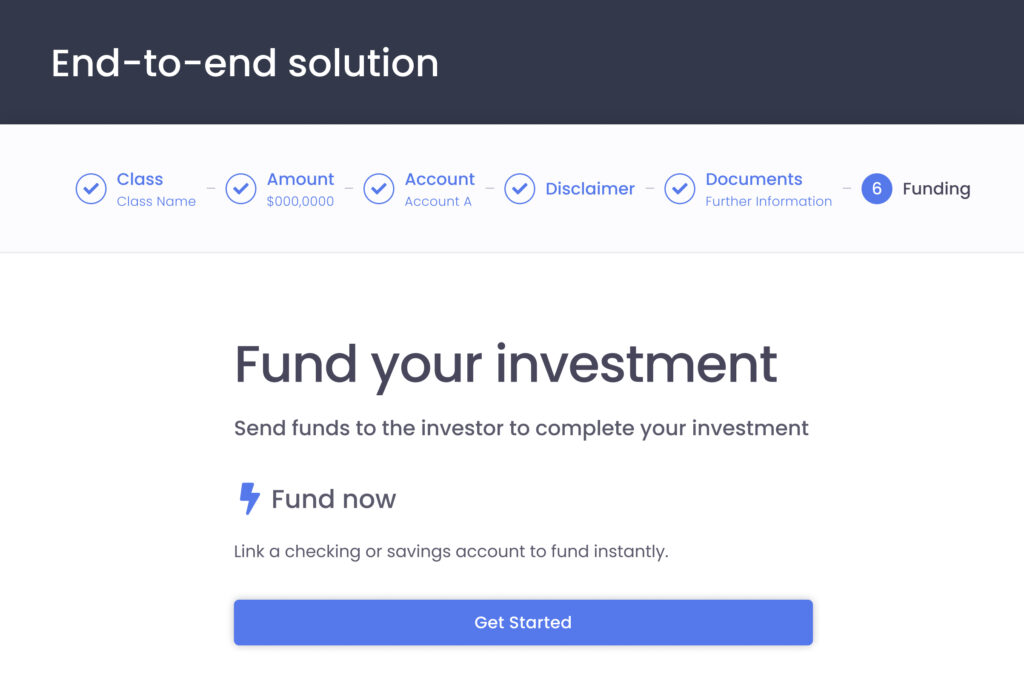

Convenience. No more paper checks, invoices, and unwanted trips to the bank. Investors can initiate contributions through the commitment process without leaving the platform, making digital payments simple and easy..

Further benefits include:

- Decreased ACH payment processing times from days to minutes

- Plaid protection from fraudulent activity – secure personal account details through 2FA.

- Receive investor funds into your bank account directly through the platform and eliminate the need to perform any reconciliations.

Get started with InvestNext

At InvestNext, we’re always creating solutions to streamline the investing process for your investors. Through our Secure ACH Inbound Funding feature, sponsors on our platform no longer have to worry about reconciliation issues, sharing sensitive wire instructions, chasing down investor funds, and other logistical issues that, in the past, have plagued the fundraising process.

InvestNext provides a comprehensive solution for investing in commercial real estate. Our full-service investment management software allows you to efficiently oversee all aspects of your capital raise in one place.

Schedule a demo today to see how our team can help you to welcome the next level of raising capital.

Resource:

[1] https://ebizcharge.com/blog/7-benefits-of-ach-payments/