The Schedule K-1 tax form is an important document to report investment income taxes and must be provided to each partner or shareholder by the partnership, S corporation, or trust. As a sponsor, securely issuing individual tax forms to investors is a top priority and should be done promptly and efficiently.

Whether you’re an experienced investor or just starting, this article will provide an overview of the Schedule K-1 and offer valuable insights into how our platform can effectively distribute important tax articles to your investors.

What is a Schedule K-1?

A Schedule K-1 is a federal tax document provided by the IRS and issued by entities such as Partnerships, S corporations, and Trusts and Estates to report earnings, losses, and dividends. Under the United States Internal revenue code, these institutions can utilize the “pass-through” taxation method to shift income liability from the entity to individuals that benefited from any profits gained on the investment.

Commercial real estate investments as part of a group or syndication also require that you file a Schedule K-1. The IRS bases this requirement on the equity contribution or agreements between the investor and the general partner (GP). In addition, the entity must show net operating profits or losses in its business.

There are three types of Schedule K-1’s

- Schedule K-1 Form 1065 Partnership Tax Return

- 1120 Schedule K-1, S Corporation Tax Form

- Schedule K-1 Form 1041, Beneficiary of Trusts and Estates

Partnership Schedule K-1’s

When two or more people form a partnership to conduct business for a profit, the owners must distribute all earnings to their partners. The partners are then responsible for paying taxes on the income.

Partnerships are considered “pass-through” entities, meaning the business itself does not pay taxes; the partners do. In this case, each partner receives a K-1 statement that reports their earnings, deductions, and credits.

For example: if a business generates $600,000 in taxable income under a partnership agreement involving six equal partners, each partner will receive a K-1 indicating the earnings of $100,000 (or 1/6 of the total taxable income) to report to the IRS. This tax condition is also proper for investments in limited partnerships and some ETFs.

S Corporation Schedule K-1

An S Corporation (S Corp) is a corporation taxed under Subchapter S of the Internal Revenue Code. S Corps are also considered to be pass-through entities. To report their financial information to the IRS, an S Corp must file Form 1120-S, the U.S. Corporation Income Tax Return. Along with the 1120-S, the S Corp must also distribute Schedule K-1 forms to its stockholders, showing their share of the entity’s income, deductions, credits, and other tax items.

For example, let’s say an S Corp operates a commercial real estate business. The business generates rental income and incurs expenses such as property management fees and repairs. At the end of the year, the S Corp files the Form 1120-S and distributes schedule K-1 forms to its stockholders. The stockholders then report their share of the business’s rental income and expenses on their individual tax returns.

Note: this applies to companies with fewer than 100 stockholders

Trust and Estate K-1 Forms

Compared to Partnerships and S Corporations, Trusts and Estates are unique entities when it comes to filing taxes. A trust can elect to pay the tax on its income instead of shifting the tax liability to the beneficiaries. In this scenario, the trust files a Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts. This tax form will show the trust’s income, deductions, gains, losses, and credits for the tax year and is used to report the taxable income generated by the trust.

Similar to the previous illustrations, there are also instances where a trust or estate may opt to distribute its taxable income to its beneficiaries. In this case, the beneficiaries receive a k1 tax form, which reflects their share of the taxable gain or loss, and then report their share of the trust’s income on their tax returns.

Let’s take a scenario where a trust holds a rental property that generates an annual income of $80,000. In this instance, the trust may file a Form 1041 and report the $80,000 as its taxable income. Suppose the trust chooses to allocate the payment among its beneficiaries. In that case, it will prepare and distribute schedule K-1 forms to each beneficiary, reflecting their respective share of the income and any related deductions. The beneficiaries, in turn, would then have to report their share of the gain on their tax returns.

It’s crucial to know that trusts and estates have specific guidelines when filing taxes. The regulations regarding allocating trust income to its beneficiaries can be intricate, making it imperative to consult a tax expert to guarantee adherence to tax laws and regulations.

What To Know Before You File as an Investor

Investors who are also equity holders in an entity can expect to receive a pro-rata share of the entity’s profits and losses. For example, if an LLC submits a tax return, the entity will claim all deductions and income. In this case, a form K-1 will be issued to the investor by the company, and the preparation of the investor’s tax return will reference that K-1.

Distributions listed on form K-1s are generally not taxable, but any amount distributed, on the other hand, could reduce an investor’s basis and be treated as a return of capital.

Whether you’re an experienced or inexperienced investor, you should always speak with a CPA to fully comprehend how rental real estate investments affect your tax situation.

How Schedule K-1s work on our platform

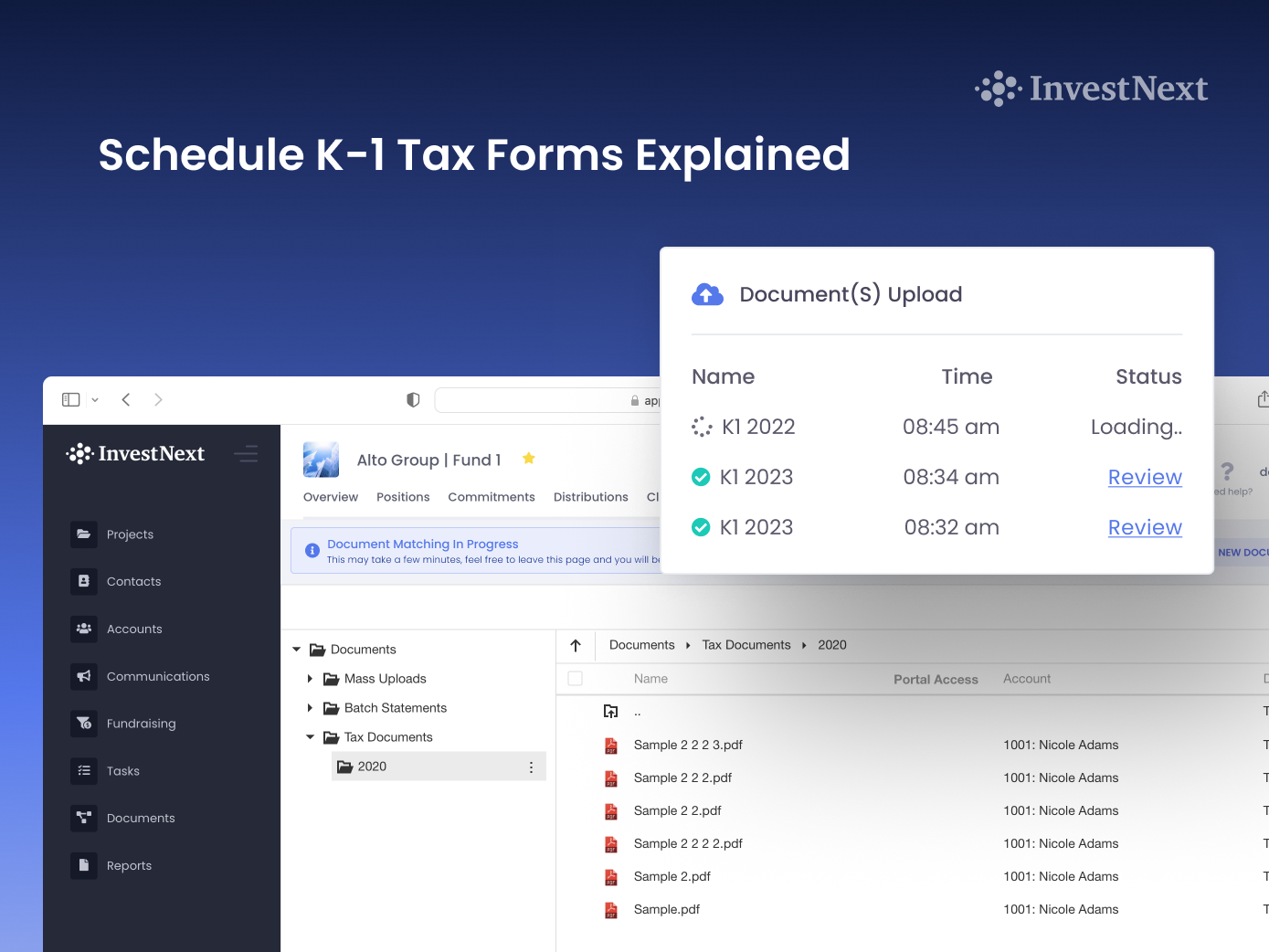

InvestNext’s enhanced sharing functionality is integrated with Optical Character Recognition (OCR) technology which reads the numerical file names from financial folders and matches each document to your investor’s account, enabling you to upload mass documents at once without having to rename investor files, reducing the risk of human error and freeing up valuable time for you.

By leveraging our mass distribution sharing tool, you can enhance investor satisfaction by providing K1s promptly and conveniently. Once your CPA provides you with a batch file of tax forms, you can import the entire zip folder into the uploader, and the system will match each file to the appropriate investor within minutes.

Additionally, investors will benefit from the convenience of having all of their investment information housed in one central location, accessible at any time. Our goal with updating our sharing application is to make it simple for you to manage and distribute K1s while also serving as a valuable resource for your investors.

Feature Benefits:

- Accelerated Workflow: Eliminates manual and labor-intensive tasks, such as renaming and individually uploading documents to each investor.

- Security: Confidential information stays protected; sensitive files are transported securely within the portal.

- Investor Satisfaction: Timelier delivery for investors to submit important tax documents before the filing deadline.

- Consolidated Filing System: A centralized filing system that allows investors to access and submit important tax documents in a timely manner.

Click here for more information on how InvestNext streamlines tax reporting and takes the hassle out of K-1 distributions.