At InvestNext, we’ve observed that many real estate investment firms struggle with outdated payment processes. As payment technology innovators, we’ve seen firsthand how the right payment system can dramatically impact a firm’s efficiency and investor relationships.

This article explores the shift from manual methods to automated ACH systems, highlighting the benefits and challenges of each approach.

Before we describe how these payment systems work, let’s define some key terms. Understanding this terminology is crucial to grasping the interwoven nuance of real estate investment payments:

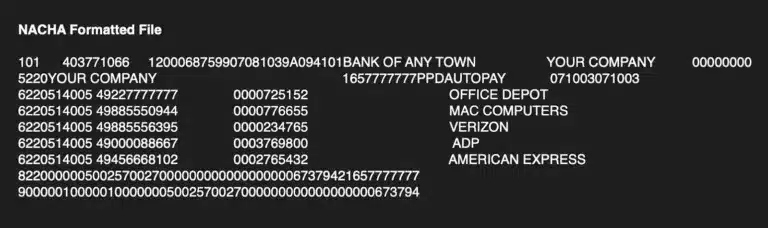

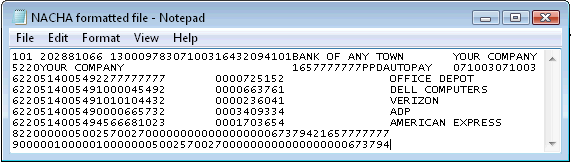

- ACH (Automated Clearing House): The electronic network for financial transactions in the United States.

- NACHA Files: Standardized formats used to initiate ACH transactions.

- Automated ACH: A system that streamlines ACH payment creation and sending.

- RTP (Real-Time Payments): A payment rail for near-instantaneous fund transfers.

Manual Payments are a Relic of the Past

Many real estate investment firms still rely on outdated payment methods—a mix of spreadsheets, wire transfers, and physical checks. While these might work for smaller operations, they quickly become problematic as a firm grows.

We’ve seen numerous firms struggle to maintain accuracy and efficiency as their investor base expands from dozens to hundreds or thousands.

We’ve even seen cases where distributions were incorrectly processed, such as “return on capital” instead of “return of capital,” requiring time-consuming manual corrections. These errors waste time and can have serious tax implications for investors.

The True Cost of Manual Payment Processes

Manual payment processes in real estate investment often involve several time-consuming and error-prone steps:

- Data is manually entered into multiple systems, increasing error risk.

- NACHA files are generated separately for each entity, eating up valuable time.

- Staff juggle between accounting software, banking portals, and spreadsheets.

- As investor and property numbers grow, these processes become increasingly unwieldy.

- Maintaining accurate records for audits and compliance becomes a massive task.

One of the biggest risks is the “all or nothing” nature of NACHA file submissions. As our Chief of Staff, Jay, points out, “If you input errors into a NACHA file, the payments all fail together.” A single error can delay payments to all investors, potentially damaging relationships and trust.

Automated ACH is a Game Changer for Real Estate Investment Firms

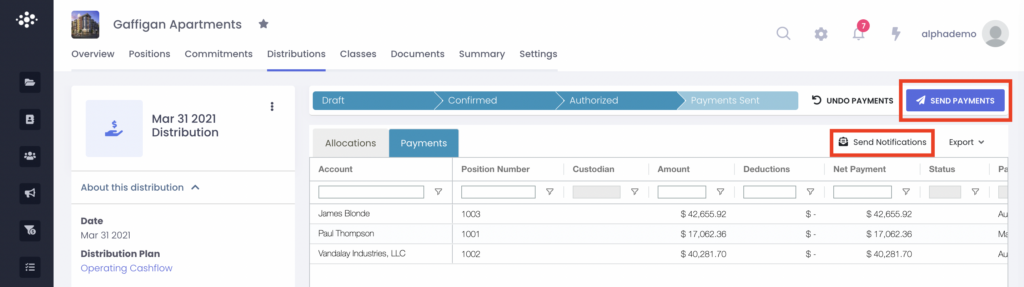

Automated ACH systems address many of the pain points associated with manual processes:

Integrated Calculations: Waterfall structures are automatically calculated within the system, reducing manual data entry and error risk.

Streamlined File Creation: Automated systems handle NACHA file generation seamlessly, saving time and reducing file-wide failure risk.

Centralized Management: All payment-related tasks are handled in a single platform, improving oversight and reducing discrepancies.

Scalability: An automated system grows with your firm, maintaining efficiency whether you’re managing 20 investors or 2,000.

Enhanced Compliance: Automated record-keeping and detailed audit trails simplify regulatory compliance.

Error Detection and Management: Automated systems can often catch and isolate errors on a per-client basis, providing granular control even when issues arise.

A Side-by-Side Comparison

Here’s how manual processes stack up against automated ACH systems:

Aspect | Manual Processes | Automated ACH |

Time Efficiency | High time investment, especially as scale increases | Significantly reduced processing time |

Error Risk | Higher due to manual data entry and calculations | Lower due to automated calculations and checks |

Scalability | Limited; becomes more complex with growth | Highly scalable; handles growth with ease |

Compliance | Challenging to maintain accurate records | Automated record-keeping and audit trails |

Investor Satisfaction | Potential delays and errors can erode trust | Timely, accurate payments enhance relationships |

Error Management | Errors often affect entire payment batches | Ability to isolate and address individual errors |

How to Implement Automated ACH Effectively

If you’re considering transitioning to an automated ACH system, keep these key steps in mind:

- Assess your current process, identifying pain points in your existing payment workflow.

- Choose an integrated solution that works seamlessly with your existing investment management platform.

- Plan carefully for data migration to ensure a smooth transition of historical payment data.

- Invest time in training your team to maximize the benefits of the new system.

- Communicate clearly with your investors about any changes to the payment process.

Remember, the goal is to enhance your overall operational efficiency and investor relations, not just replace your current system.

InvestNext is Your Partner for Payments Success

At InvestNext, we’re committed to helping real estate investment firms navigate the complexities of payment systems. Our automated ACH solution is designed specifically to address the unique challenges faced by firms in our industry.

We understand that transitioning to a new system can seem daunting, but we’ve seen time and again how it can transform operations, reduce errors, and ultimately lead to happier investors.

Looking ahead, we anticipate that increased automation will become the norm, not the exception, as firms seek to stay competitive. While not yet widespread, real-time payment systems may play a larger role, particularly for certain types of transactions. We also expect even tighter integration between payment systems and other aspects of investment management.

Whether you’re a small firm looking to scale or a large operation seeking to streamline your processes, we’re here to help. Our team of experts can guide you through the process, ensuring a smooth transition and ongoing support. Ready to explore how automated ACH can benefit your firm?

Schedule a demo with us today. Let’s work together to build a more efficient, accurate, and scalable future for your real estate investment operations.